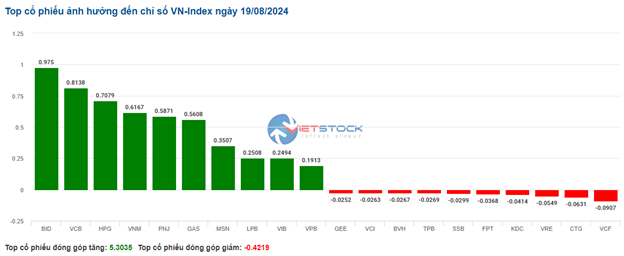

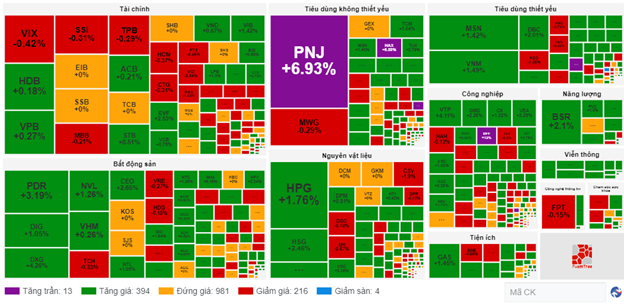

The stocks in the VN30 group were relatively balanced, but the green trend had a slightly more positive impact. Specifically, BID, VCB, HPG, and VNM contributed 0.97, 0.81, 0.71, and 0.62 points to the VN30-Index, respectively. Meanwhile, VCF, CTG, VRE, and KDC continued to face selling pressure, but the decline was not significant.

Source: VietstockFinance

|

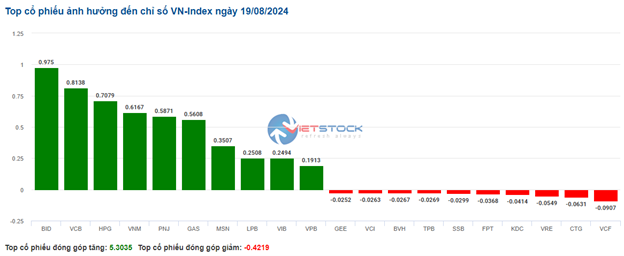

Financial and real estate stocks remained the two main groups supporting the recovery of the overall index. However, the financial group is currently experiencing strong internal divergence, with the upward trend prevailing, albeit with modest gains. For instance, VIX rose by 0.42%, VPB by 0.27%, EIB by 0.27%, and STB by 0.51%. On the other hand, SSI decreased by 0.31%, TPB by 0.29%, MBB by 0.42%, and SSB by 0.23%, indicating a slight dominance of red stocks, but the decline was not substantial.

Additionally, the real estate group exhibited a similar trend, with a mild divergence in breadth. Some stocks, such as PDR, DIG, DXG, and NVL, were in the green, with increases of 2.93%, 1.05%, 4.26%, and 1.26%, respectively. In contrast, VRE decreased by 0.27%, HDG by 0.18%, KDH by 0.4%, and SIP by 0.14%. The buying pressure slightly outweighed the selling pressure in this sector.

Furthermore, the non-essential consumer group also performed well, with a 0.82% increase. The focus of this group was on two stocks, PNJ and HAX, which turned purple right at the opening bell. From a technical perspective, during the morning session of August 19, 2024, PNJ stock witnessed a strong surge, forming a Rising Window candlestick pattern accompanied by a breakthrough in trading volume, surpassing the 20-session average. This indicates the return of large capital to this stock. Moreover, PNJ reached a new 52-week high, with the MACD continuing its upward trajectory and remaining above the zero line, providing a buy signal and suggesting a positive mid-term outlook.

Source: VietstockFinance

|

Compared to the opening, the choppy price action resulted in a high proportion of reference stocks, with over 980 stocks trading near the flatline. However, the green trend slightly prevailed, with 394 stocks advancing and 216 declining.

Source: VietstockFinance

|

Open: Real Estate Group Continues Uptrend

On August 19, as of 9:40 am local time, the VN-Index rose over 5 points to reach 1,259.78 points, while the HNX-Index slightly increased to 236.19 points.

At 9:27 am local time on August 18, the General Secretary of the Central Committee of the Communist Party of Vietnam and President of the Socialist Republic of Vietnam, To Lam, and his spouse, along with a high-ranking Vietnamese delegation, arrived in Guangzhou, Guangdong Province, China, commencing a state visit to the People’s Republic of China at the invitation of the General Secretary of the Central Committee of the Communist Party of China and President of the People’s Republic of China, Xi Jinping, and his spouse.

As of 9:40 am, the telecommunications services group led the market with a 2.17% gain in the morning session. Notable performers in this group included VGI, up 2.55%; CTR, up 0.86%; FOX, up 1.07%; and ELC, up 0.64%.

Moreover, energy stocks also turned green early on, with several stocks in the sector witnessing upward momentum. These included BSR, up 2.1%; PVD, up 0.55%; PVC, up 0.75%; AAH, up 5%; and PSB, up 8%.

Following closely was the real estate group, which continued its growth trajectory with a 1.33% increase. Standout performers in this sector were NHA, up 5.75%; PDR, up 3.46%; DXG, up 4.61%; NVL, up 2.51%; NLG, up 1.52%; and VRE, up 0.27%.

Ly Hoa

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.