Shares of PNJ have been on an impressive upward trajectory, surprising the market with a sudden acceleration to reach new highs. Just minutes into the trading session, PNJ soared to the maximum allowed limit-up price, with a buying queue of millions of units and no sellers. With a market price of 104,900 VND per share, PNJ’s market capitalization also hit a record high of over 35 trillion VND, a 23% increase since the beginning of the year.

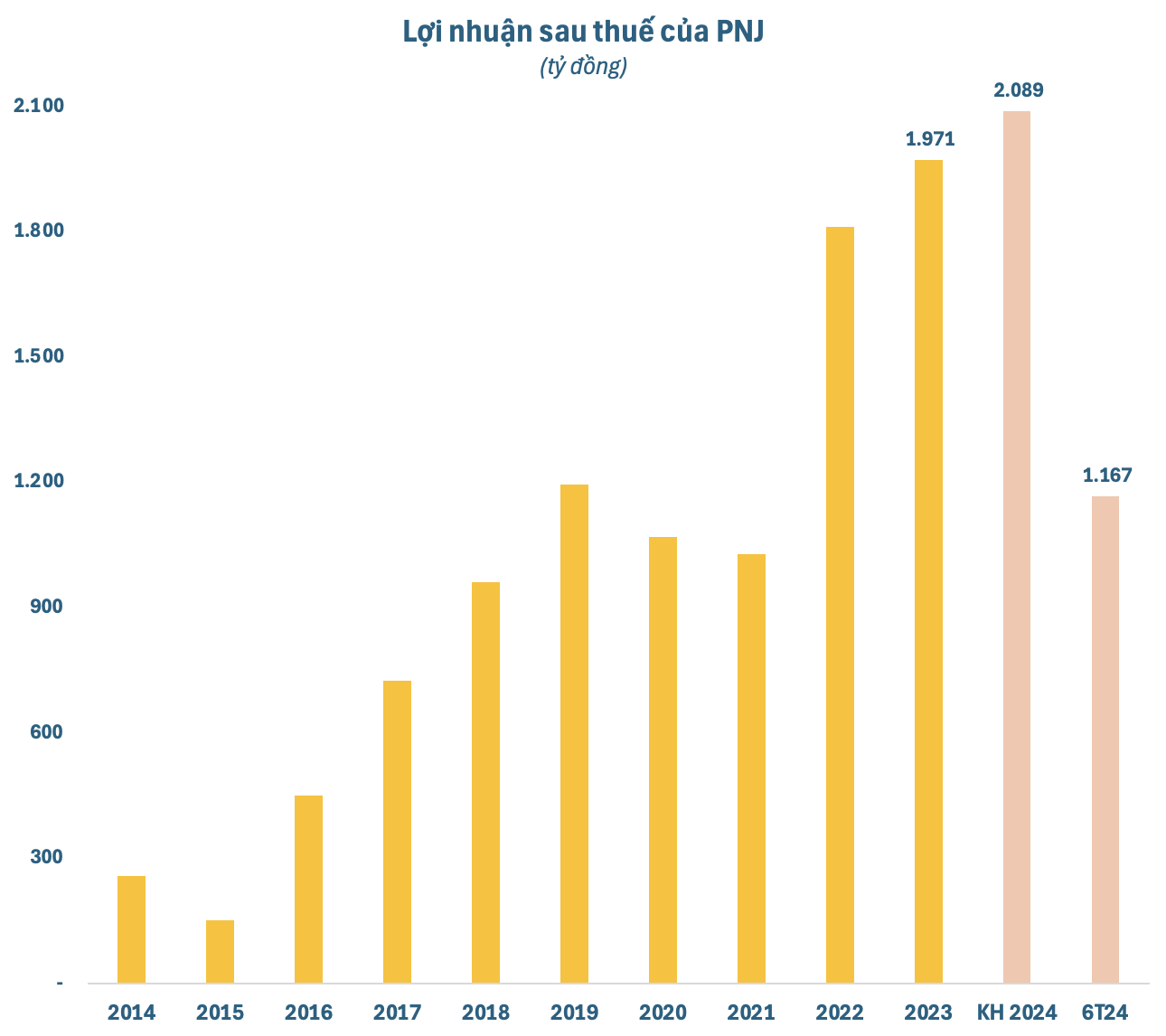

This surge in PNJ’s stock price comes just ahead of the company’s scheduled release of its July business results. For the first six months of the year, PNJ reported net revenue of 21,113 billion VND and net profit of 1,167 billion VND, representing increases of 34% and 7%, respectively, compared to the same period in 2023. These are the highest half-year results the company has achieved since its inception.

For 2024, PNJ has set ambitious business targets, aiming for a 12% increase in revenue to 37,147 billion VND compared to 2023. The company also forecasts a 6% year-on-year increase in net profit, reaching 2,089 billion VND. These figures represent record highs for the company. The planned dividend for 2024 remains at 20% in cash. As of now, PNJ has accomplished 60% of its revenue plan and 56% of its profit target for the full year.

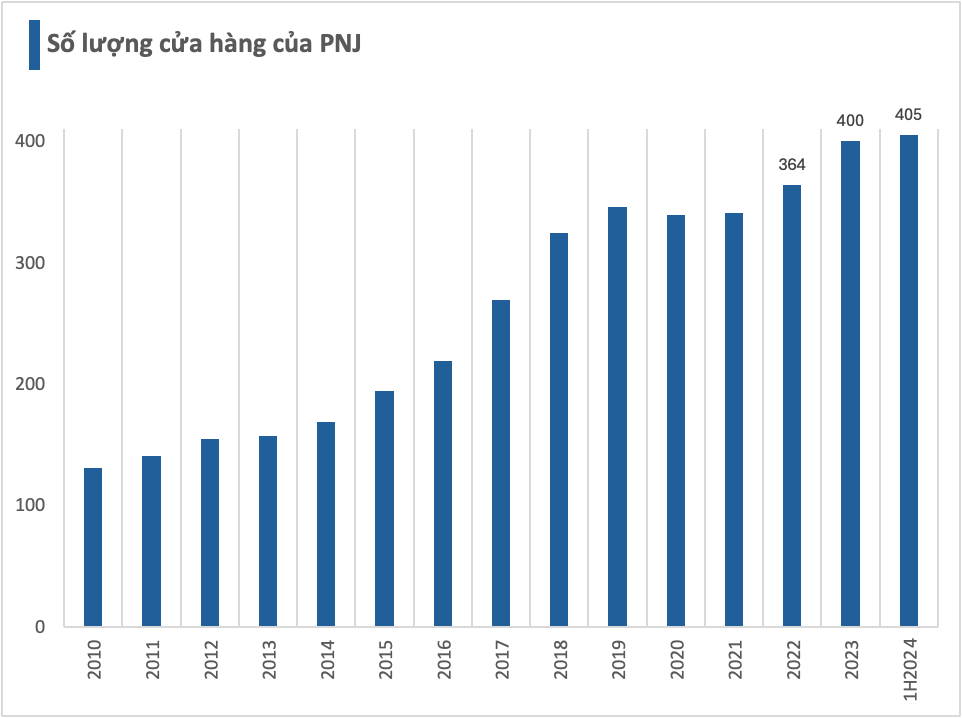

As of the end of June, PNJ had a total of 405 stores across 57 out of 63 provinces in Vietnam, including 396 PNJ stores, 5 Style by PNJ stores, 3 CAO Fine Jewellery stores, and 1 wholesale business center. The company has opened 13 new PNJ stores and closed 8 others since the beginning of the year. Notably, while PNJ continues to expand its store network, its debt has dropped to a record low.

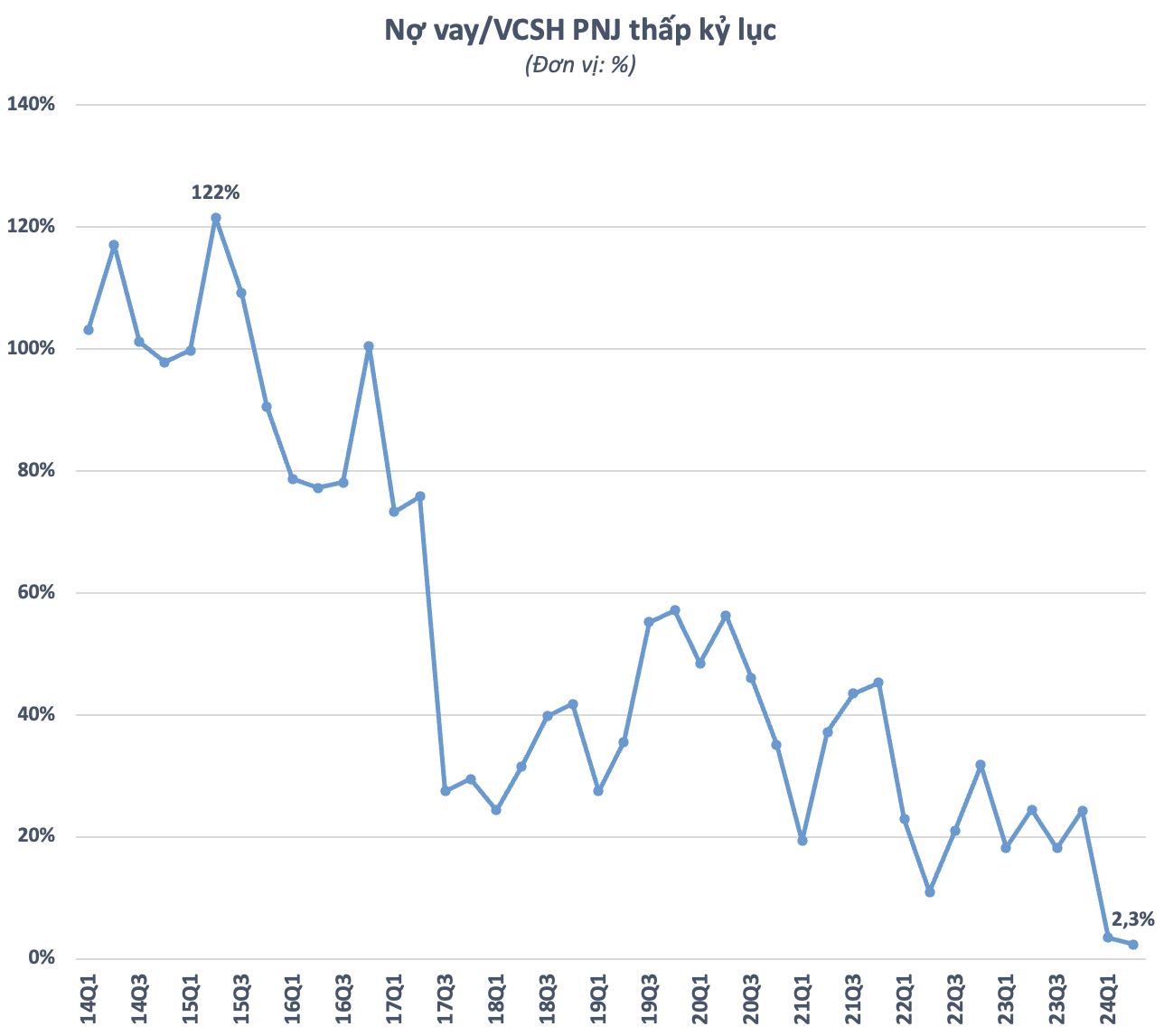

As of Q2 2024, the company’s financial debt stood at a mere 250 billion VND, a significant reduction of over 2,100 billion VND compared to the beginning of the year and the lowest level since its listing in 2009. Among the billion-dollar enterprises listed on Vietnam’s stock exchange, it is rare to find a company with such low debt levels as PNJ at present.

As of June 30, PNJ’s debt-to-equity ratio plunged to an all-time low of approximately 2.3%. Historically, this ratio exceeded 100% during 2014-2015 but has since declined sharply. From mid-2017 onwards, PNJ consistently maintained this ratio within the range of 20-40% before witnessing another significant drop in the first half of 2024.

PNJ’s management had previously shared plans to expand its store network to over 500 outlets by 2025. However, the company is taking a cautious approach to new openings. The gradual and prudent expansion, along with limited investment in fixed assets and strong cash flow, may be contributing factors to the company’s remarkable reduction in debt to a record low.

Building Giants: Profitability Continues in Q4/2023 – Is the Light at the End of the Tunnel Finally Visible?

In the final quarter of 2023, Hòa Bình Construction reported a post-tax profit of over 100 billion VND, breaking the streak of four consecutive quarters of losses. Similarly, Vinaconex, Coteccons, and Hưng Thịnh Incons also reported post-tax profits of 132 billion VND, 69 billion VND, and 33 billion VND respectively.

January 2024: HOSE Welcomes 2 Companies with Market Capitalization over $10 Billion

The Ho Chi Minh City Stock Exchange (HOSE) has recently released the market information for January 2023.