The Federal Reserve (Fed) needs to cautiously approach its interest rate reduction, a Fed official opined ahead of the central bank’s annual symposium in Jackson Hole, Wyoming, this week.

In an interview with the Financial Times, Mary Daly, President of the Federal Reserve Bank of San Francisco, shared that recent economic data gave her “greater confidence that” inflation is under control. She suggested that it’s time to consider lowering interest rates from the current 23-year high of 5.25-5.5%.

The monetary policymaker advocated for a prudent approach to allay fears among economists that the US economy is heading towards a sharp slowdown, which would require the Fed to slash interest rates aggressively.

As Fed officials gather in Jackson Hole this week, the key question they face is the pace at which they will cut interest rates.

On Friday, at the symposium, Fed Chair Jerome Powell will deliver a speech closely watched by global investors. They are eager to learn of Powell’s plan to steer the economy towards a soft landing—concluding the fight against inflation without triggering a recession.

Daly, a voter on monetary policy decisions within the Federal Open Market Committee (FOMC), dismissed the need for rapid rate cuts in response to the weakening job market. She argued that there are currently few signs of an impending recession and asserted that the world’s largest economy is “not in a state of emergency.”

“Prudence is not weakness, it’s not slow, it’s not falling behind. It’s wisdom,” Daly stated, adding that the job market—while decelerating—”is not weak.”

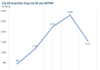

In the futures market, traders are betting on a 100% chance of the Fed cutting rates at its September meeting, which would be the first rate cut in four years. There is a 70% likelihood of a 0.25 percentage point cut on September 18, while the probability of a 0.5 percentage point cut at this reduction stands at around 30%.

Markets also predict that by the end of this year, the Fed’s federal funds rate will be a full percentage point lower than it is currently, implying that the central bank will cut rates at each of its final three meetings of the year, with at least one cut of 0.5 percentage points.

Prior to the Fed, other major central banks, including the Bank of England (BOE), the European Central Bank (ECB), and the Bank of Canada (BOC), have already lowered their interest rates. Due to inflation in the US showing signs of resurgence earlier this year, the Fed adopted a cautious stance, leading to a delay in rate cuts.

Data released last week showed that the year-over-year increase in the US consumer price index (CPI) slowed to 2.9% in July, the lowest in three years.

The core personal consumption expenditures (PCE) price index, the Fed’s preferred inflation measure, rose 2.6% in June. The overall PCE index, which the Fed uses to target 2% inflation, increased 2.5% in June.

“After the first quarter of this year, inflation has been gradually moving back towards the 2% target. We haven’t reached that goal yet, but it certainly gives me more confidence that we’re on the path to price stability,” Daly told the Financial Times. With inflation easing and the labor market becoming more balanced, the Fed must “adjust the policy rate to be consistent with the actual and expected state of the economy,” she said.

Daly noted that the Fed wants to ease up on its tight monetary policy while still maintaining some restraint to “get the job done” in reaching its inflation target.

During the interview, Daly also mentioned that the Fed doesn’t “want to overtighten in the face of an economy that’s slowing.” She added that failing to adjust policy in line with slowing inflation and growth is a “recipe for the very outcome we don’t want, which is stable prices but an unstable and collapsing labor market.”

These statements align with the views of Raphael Bostic, President of the Federal Reserve Bank of Atlanta. In a recent Financial Times interview, Bostic argued that waiting too long to cut rates “would be risky” for the economy.

A weaker-than-expected jobs report for July sparked concerns about the health of the US economy, contributing to a global stock sell-off and prompting calls from some investors and experts for the Fed to cut rates immediately. However, stronger-than-expected retail sales data released last week eased fears of an impending US recession.

According to Daly, US businesses are generally not resorting to layoffs at this time. Instead, they are cutting discretionary spending to adapt to the slower growth environment compared to earlier this year.

‘King of spenders’ Phan Minh Thong warns of ‘shocking’ changes in the US market from a $500,000 pho bowl perspective.

“In the US, a bowl of pho costs about $15-18, plus a $20 tip (around 500,000 Vietnamese dong). Compared to Vietnam, where breakfast in Saigon or Hanoi costs around 50,000 dong per meal, and a plate of banh cuon with all the toppings in Hai Phong costs 20,000 dong,” Mr. Thong recounted.

Are Central Banks Going in the Right Direction with Increasing Interest Rates?

Some economists believe that the sudden increase in prices is only temporary, inflation will eventually decrease, regardless of whether banks try to contain it through tighter monetary policies or not.