With a dividend payout ratio of 10% (1 cp receives VND 1,000) and nearly 112.9 million cp in circulation, the Company is estimated to spend nearly VND 113 billion on this dividend payout. The ex-dividend date is 04/09/2024 and payment is expected on 25/09/2024.

This dividend level is in line with the plan approved at the 2024 AGM. LAS stated that it would use the source from undistributed post-tax profits as of 31/12/2023 according to the 2023 audited financial statements.

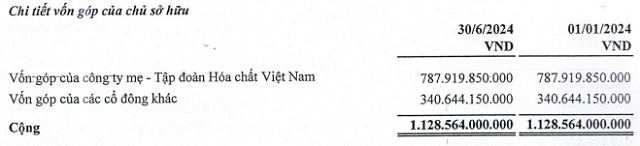

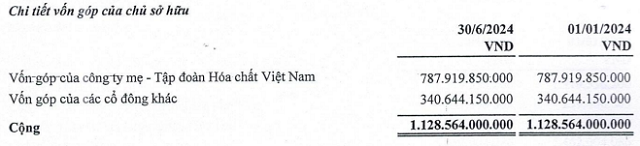

As of 30/06/2024, Vietnam National Chemical Group (VINACHEM) is the parent company and directly owns 69.82% of LAS‘s capital. Thus, it can receive nearly VND 79 billion in dividends from LAS.

Source: LAS’ reviewed financial statements for the first 6 months of 2024

|

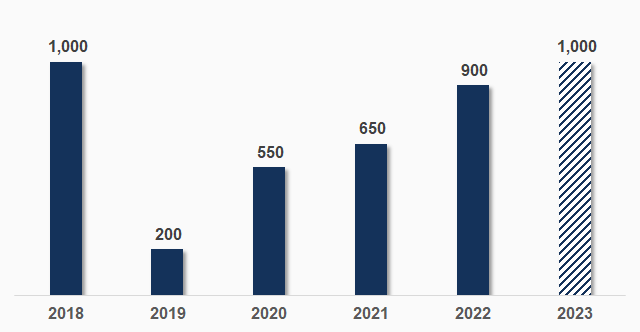

In Q2, LAS witnessed a 30% year-on-year decline in revenue to VND 605 billion. Ultimately, LAS posted a post-tax profit of VND 67 billion, up 108%. This was also the quarter with the highest profit for LAS in the past 8 years, since Q1/2016.

LAS stated that product consumption in Q2 decreased due to fluctuations in the domestic and global fertilizer market. However, thanks to the anticipation of raw material price movements and the purchase of reasonable lots for items such as sulfur, potassium, etc., the proportion of cost of goods sold to revenue decreased sharply, leading to a significant increase in gross profit.

In addition, the Company successfully auctioned off its acid production line, bringing in an additional VND 6.5 billion in profit. As a result, Q2 performance showed remarkable growth.

On a cumulative basis, LAS achieved semi-annual revenue of over VND 2,000 billion, slightly lower than the same period last year, and a post-tax profit of VND 120 billion, up 83%. Based on the results approved at the 2024 AGM, the Company has achieved over 60% of its revenue target and exceeded the full-year post-tax profit plan by more than 10% in just the first 6 months.

| LAS’ quarterly financial results in recent years |

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.