DX Group Joint Stock Company (coded XG on HoSE) has recently announced a resolution by its Board of Directors regarding adjustments to the detailed plan for utilizing capital raised from the issuance of shares to existing shareholders in 2024.

Based on the actual capital usage situation, the leadership of Dat Xanh Group has decided to increase the capital contribution to its subsidiary by VND 201 billion and decrease the corresponding amount intended for the company’s working capital.

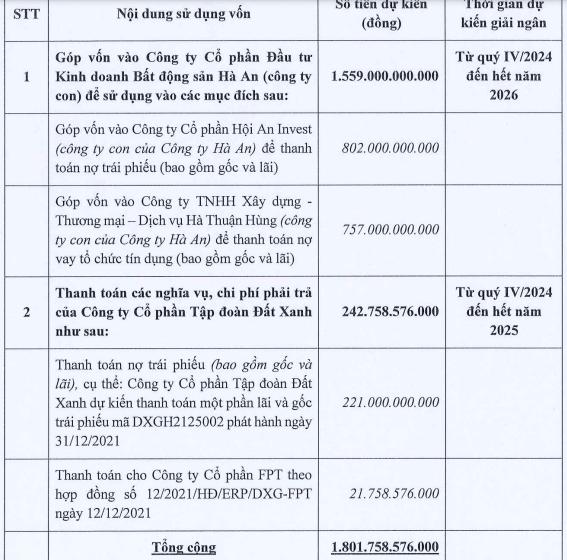

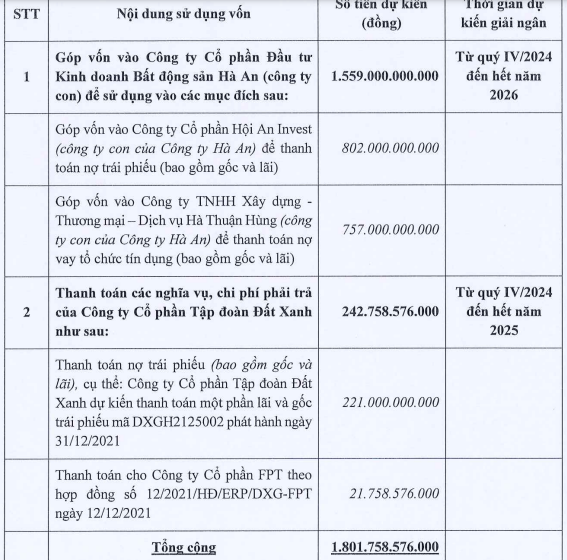

Specifically, Dat Xanh prioritizes investing VND 1,559 billion in Ha An Real Estate, an increase from the previous amount of VND 1,358 billion. Of this, VND 802 billion will be injected into Hoi An Invest to repay principal and interest on bonds, and VND 757 billion will be contributed to Construction – Commerce – Service Ha Thuan Hung to repay principal and interest on loans from credit institutions. The disbursement is expected to take place from Q4 2024 to the end of 2026 (the previous deadline was the end of 2025). The ownership ratio in the subsidiary will remain unchanged at 99.99% of the charter capital.

The remaining amount of nearly VND 243 billion will be used to pay obligations and expenses incurred from Q4 2024 to the end of 2025, including VND 221 billion for repayment of bond debt with the code DXGH2125002 issued on December 31, 2021, and VND 21.7 billion to be paid to FPT Joint Stock Company (HOSE: FPT) according to a contract from 2021.

Source: DXG

In the event that the proceeds from the share issuance are insufficient to cover all the intended purposes as outlined in the plan, the Company will allocate capital according to the priority levels mentioned. The Board of Directors may decide to adjust the disbursement depending on the needs of each purpose as they arise.

For the shortfall in capital, DXG will balance and supplement it with other sources such as using its own capital, bond capital, loans from credit institutions, and capital from other organizations/individuals.

Previously, on May 31, Dat Xanh approved the implementation of the plan to issue more than 150.1 million shares (equivalent to 20.83% of the total outstanding shares) at a price of VND 12,000 per share to existing shareholders, expecting to raise over VND 1,800 billion.

Additionally, at the 2024 Annual General Meeting of Shareholders, DXG also approved a plan to offer 93.5 million shares privately at a minimum price of VND 18,600 per share to supplement capital and increase ownership in the subsidiary. Upon completion of both plans, the real estate enterprise will increase its charter capital from over VND 7,200 billion to over VND 9,600 billion.

Ha An Real Estate is known as the investor of the Gem Sky World project. In addition, Ha An is also the investor of several important projects of DXG, including Opal Skyline, Opal Boulevard, Opal Luxury, and Datxanhhomes Riverside (formerly known as Gem Riverside)…

In 2023, Ha An Real Estate achieved impressive business results with a profit after tax of nearly VND 378 billion, 5.5 times higher than in 2022.

As of December 31, 2023, Ha An had owner’s equity of VND 9,954 billion, up 4% from the beginning of the year. Its liabilities amounted to approximately VND 12,940 billion, including VND 1,194 billion in bond debt.

Cash Coming to Bank Shareholders

Many banks’ shareholders are set to receive cash dividends in addition to stock dividends in the early days of the Lunar New Year 2024, the Year of the Mouse.