According to the Ho Chi Minh City Stock Exchange (HoSE), Liva Holdings Limited, a fund managed by VinaCapital Investment Management JSC, purchased 8.6 million KDC shares of KIDO Group JSC during the August 14 trading session. As a result, the fund’s holdings increased from 8.62 million shares (2.97%) to 17.24 million shares (5.95%).

With this new ownership percentage, Liva Holdings Limited has become a major shareholder in KIDO. Following the transaction, the total holdings of the VinaCapital group of funds rose from 11.67 million shares (4.02%) to 20.29 million shares (7%).

On August 14, KDC shares witnessed matching transactions totaling the exact amount purchased by Liva Holdings Limited, valued at VND 500 billion (averaging VND 58,000 per share).

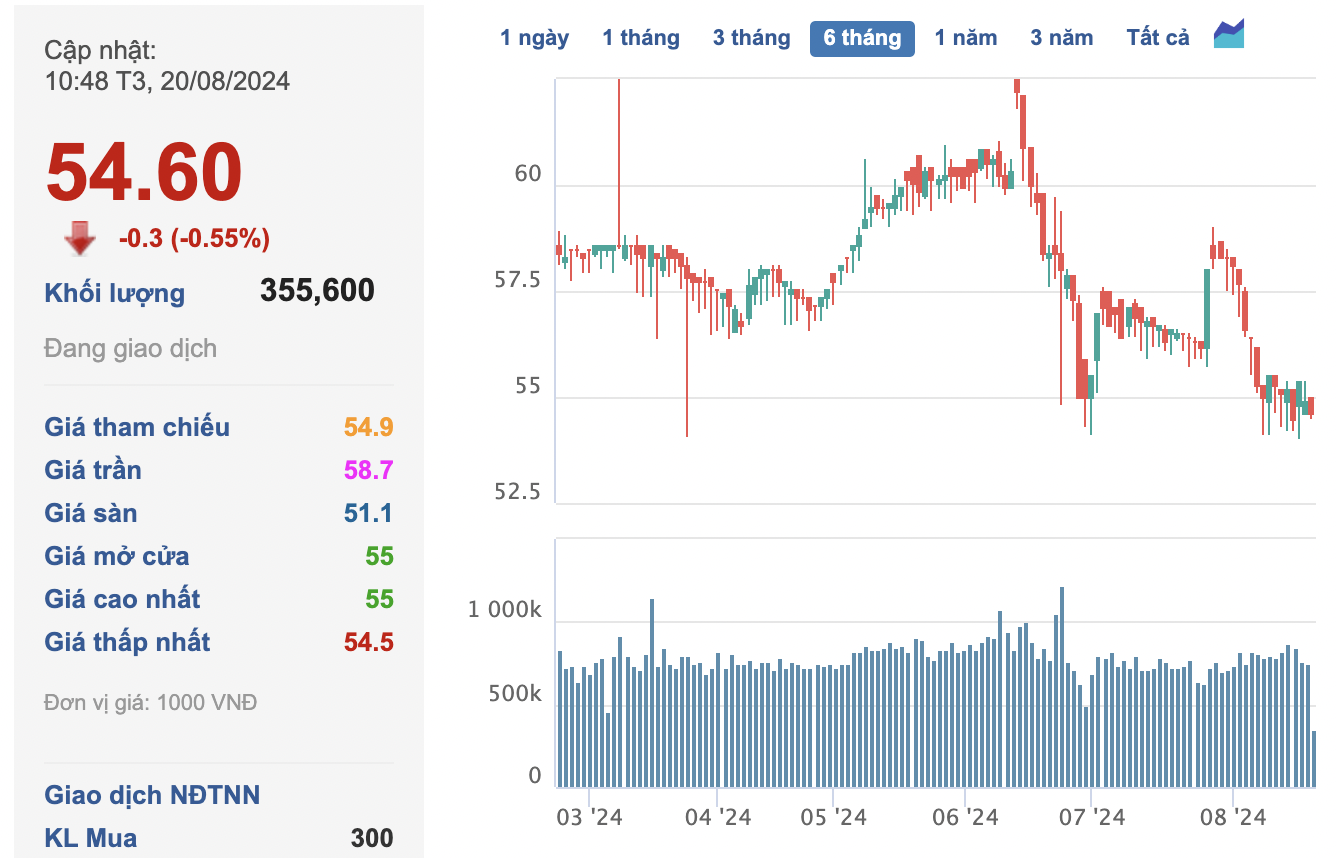

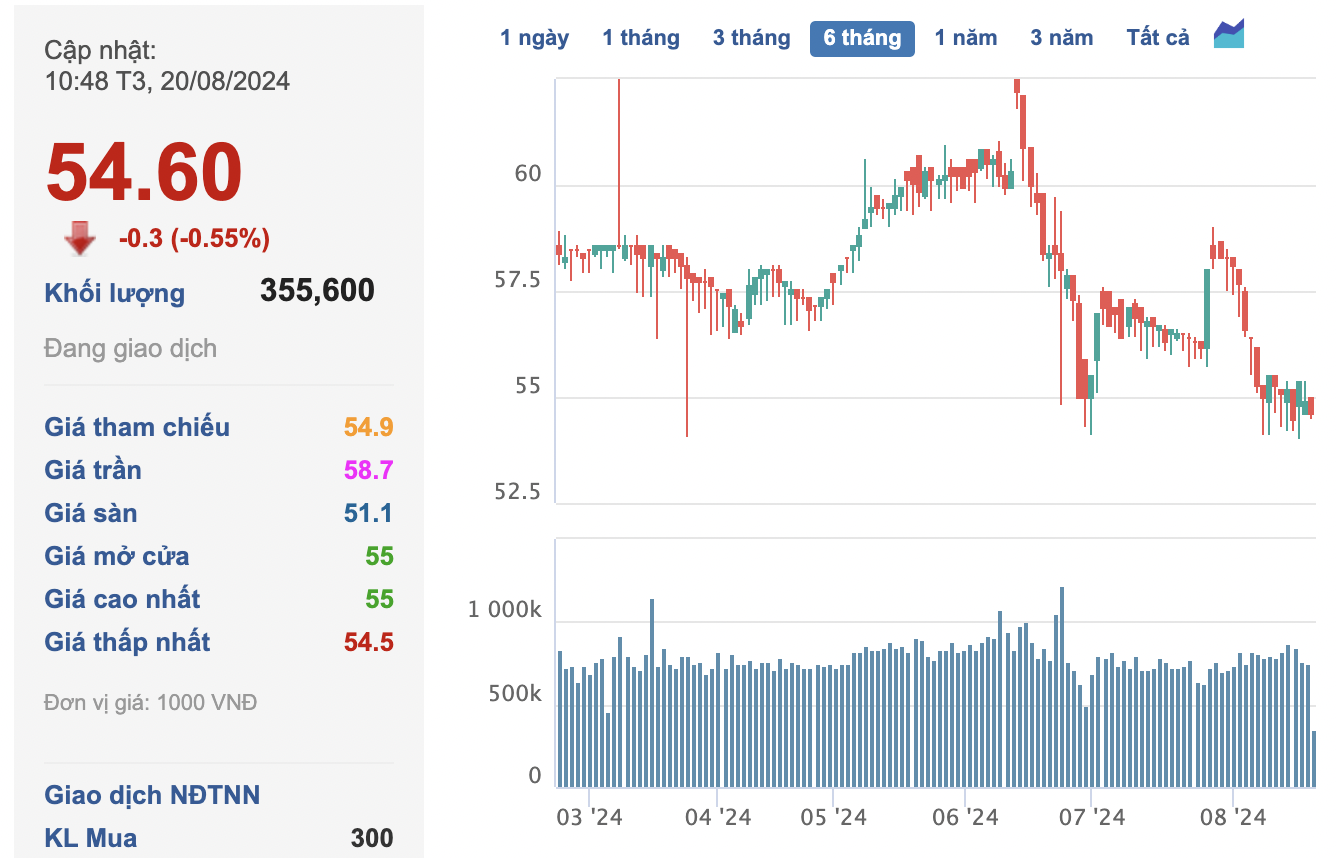

The transaction by the VinaCapital-affiliated fund took place as KDC’s share price hovered near its 52-week low, trading at VND 54,600 per share.

Image: KDC Share Trading.

Regarding KIDO, 2024 is considered a pivotal year for the Group’s transformation and deeper penetration into essential industries. According to KIDO, focusing on only a few sectors can lead to volatility in business. Hence, the company is expanding its portfolio and targeting essential goods, which also provides a strategic advantage in market-making. The company’s goal for 2024 is to transition into the essential goods sector, with a particular focus on spices and condiments. Successfully penetrating and establishing a strong presence in this market is a key objective for the year.

Mr. Tran Kim Thanh, Chairman of the Board of Directors, added: “Since 2008, KIDO has aimed to enter the essential goods sector, but it wasn’t until 2014 that we found a partner to acquire our bakery business. It was then that we ventured into the oil industry.”

For 2024, KIDO has set a pre-tax profit target of VND 800 billion, 2.5 times higher than the previous year’s performance. As of the first half of the year, the company has achieved only about 7% of this target. Cumulative results for the first six months of the year showed a net profit of VND 32.6 billion, a decrease of 94% compared to the same period last year.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.