In a recent move, NVL has decided to reduce its capital contribution in two of its subsidiaries, namely Nova Princess Residence and Nova Rivergate. At Nova Princess Residence, NVL will decrease its capital contribution from 229.7 billion VND to 79.92 billion VND while maintaining a 99% ownership stake. This reduction in capital will also lower the subsidiary’s chartered capital from 300 billion VND to 80 billion VND.

A similar strategy is being employed at Nova Rivergate, where NVL is reducing its capital contribution from 799.2 billion VND to nearly 776.3 billion VND, again retaining a significant 99.77% ownership. Consequently, Nova Rivergate’s chartered capital will decrease from 801.1 billion VND to 778 billion VND.

According to NVL, there are three primary reasons behind these capital reductions. Firstly, the subsidiaries have already completed and delivered their respective real estate projects to customers. Secondly, these companies have no immediate plans to initiate new projects. And thirdly, the reduction in capital will not alter NVL’s ownership stakes or impact the subsidiaries’ operational cash flow and debt repayment capabilities.

Nova Princess Residence, as per NVL’s 2023 annual report, is the developer of the Kingston Residence complex, which includes apartments, office-tel spaces, and offices in Phu Nhuan District, Ho Chi Minh City. Spanning an area of 4,604 square meters, the project was delivered in Q4 of 2017.

On the other hand, Nova Rivergate is the developer of the similarly named Rivergate Residence, a mixed-use complex located in District 4, Ho Chi Minh City. With an area of 7,069 square meters, this project also commenced delivery in Q3 of 2017.

Rivergate Residence (left) and Kingston Residence (right) projects

|

In addition to the capital reductions, NVL’s Board of Directors also approved borrowings from two other subsidiaries: Joint Stock Company for Real Estate Investment and Development – Thuan Phat and Binh An Tourism Company Limited. NVL plans to borrow 111.1 billion VND from Thuan Phat and 40.2 billion VND from Binh An, with both loans carrying a 4.7% interest rate. The loan tenure for Thuan Phat is 5 months, while it is 12 months for Binh An.

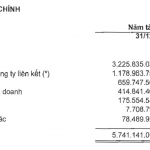

As of June 30, 2024, NVL’s related-party loan balance remained unchanged from the beginning of the year at 58.5 billion VND, and neither Thuan Phat nor Binh An was included in this figure. Binh An has a chartered capital of 297 billion VND, while Thuan Phat’s chartered capital stands at 2,516 billion VND. Thuan Phat is not currently associated with any specific project development, but according to NVL’s annual report, Binh An is the developer of the Morito subdivision within the massive NovaWorld Ho Tram project, spanning over 21 hectares.

“How does Novaland strive to make billions of profits?”

Currently, the NVL stock is experiencing margin cuts, which greatly limits its liquidity attraction. The return of positive profits is a necessary condition for the company’s stock to be granted margin again.