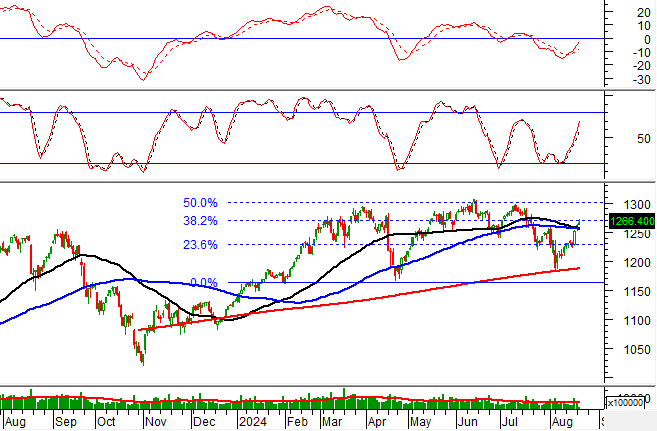

Technical Signals for VN-Index

In the trading session on the morning of August 20, 2024, the VN-Index gained points, while trading volume slightly dipped in the morning session, indicating investors’ dilemma.

Currently, the VN-Index is retesting the Fibonacci Projection 38.2% threshold (equivalent to the 1,265-1,275 point range) as the MACD indicator continues its upward trajectory after previously signaling a buy. If the buy signal is sustained and the index successfully surpasses this resistance level, the recovery scenario may persist in subsequent sessions.

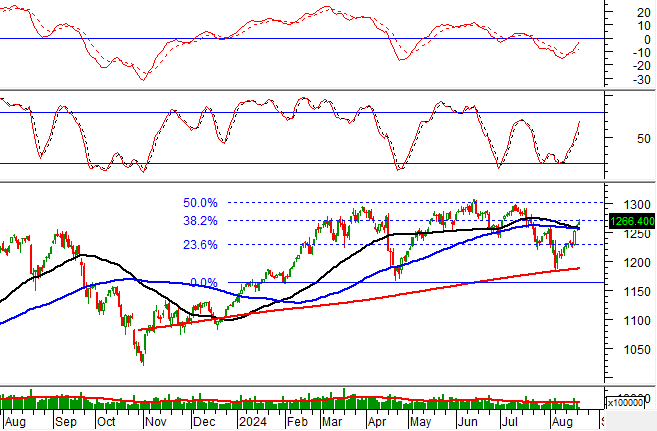

Technical Signals for HNX-Index

On August 20, 2024, the HNX-Index declined, forming a High Wave Candle pattern, while trading volume significantly dropped in the morning session, reflecting investors’ cautious sentiment.

Additionally, the index is retesting the 200-day SMA as the Stochastic Oscillator indicator maintains its upward trajectory after previously signaling a buy. Should the buy signal be sustained and the index surpasses this resistance level successfully, the long-term optimistic outlook will be further reinforced.

BID – Joint Stock Commercial Bank for Investment and Development of Vietnam

On the morning of August 20, 2024, BID witnessed a price increase, accompanied by a substantial surge in trading volume, indicating investors’ optimism.

Moreover, the stock price broke out of its short-term downward trendline as the MACD indicator continues to widen the gap with the signal line after previously signaling a buy, suggesting that the short-term recovery scenario is materializing.

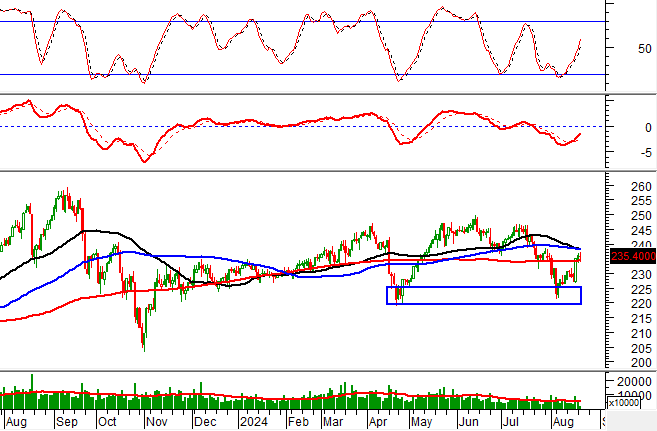

BSR – Binh Son Refinery JSC

During the morning session of August 20, 2024, BSR witnessed a price decline, coupled with a significant drop in trading volume, indicating investors’ cautious approach.

Additionally, the stock price is retesting its June 2024 high (equivalent to the 24,000-25,000 range) as the Stochastic Oscillator indicator heads towards the overbought region after previously signaling a buy. Should a sell signal emerge, the risk of a downward adjustment in subsequent sessions will heighten.

Technical Analysis Team, Vietstock Consulting Department