Illustration

Oil Price Drops by Over $2 per Barrel

Oil prices fell by more than $2 per barrel as successful Middle East peace negotiations reduced supply risks. This, coupled with a weakening economy in the top oil-importing country, China, has curbed oil demand.

At the close of trading on August 19, Brent crude oil fell by $2.02, or 2.5%, to $77.66 per barrel, while WTI oil fell by $2.28, or 3%, to $74.37 per barrel.

In the previous session, both oils fell by nearly 2% as investors lowered expectations for China’s oil demand growth, but ended the week almost unchanged after U.S. data showed inflation falling despite strong retail spending.

China’s economic woes also put pressure on oil prices, with last week’s data showing the biggest drop in new home prices in nine years. Chinese refineries cut their crude processing rates in the previous month to match weak fuel demand.

U.S. Natural Gas Prices Hit 4-Week High

U.S. natural gas prices rose 5% to a four-week high as production declined and forecasts for hotter-than-expected weather next week increased, boosting demand for gas-fired power to keep air conditioners running.

The price of natural gas for September delivery on the New York Mercantile Exchange rose 11.2 U.S. cents, or 5.3%, to $2.235 per mmBTU, the highest since July 22, 2024.

Gold Price Falls

Gold prices fell after hitting $2,500 per ounce in the previous session as investors took profits and awaited further signals from the U.S. Federal Reserve and developments in the Middle East.

Spot gold on the LBMA fell 0.2% to $2,501.74 an ounce after hitting a record high of $2,509.65 in the previous session. Gold futures for December delivery on the New York Mercantile Exchange rose 0.1% to $2,541.30 an ounce.

Gold prices could fall to the $2,479-$2,487 range after failing to break through the $2,507 resistance level, technical analyst Wang Tao said.

Focus will shift to the minutes of the Fed’s latest policy meeting on August 21 and Chairman Jerome Powell’s speech at the economic symposium in Jackson Hole on August 23.

Copper Price Hits 2.5-Week High, Aluminum Price Highest in a Month

Copper prices rose to a 2.5-week high as buying picked up on signs of improving demand in top consumer China and a weaker U.S. dollar amid rising expectations for an interest rate cut in the U.S.

London copper prices rose 1.5% to $9,255 a ton after hitting $9,277 a ton, the highest since August 1.

Recovering Chinese copper demand pushed Shanghai inventories to their lowest level in five months (262,206 tons).

At the same time, London aluminum prices rose 2.9% to $2,434 a ton, hitting a one-month high of $2,449.50 a ton during the session due to falling London inventories and rising alumina prices.

Iron Ore and Steel Rebar Prices Rise

Iron ore prices on the Dalian Commodity Exchange reversed early losses as steel prices rose and expectations for economic stimulus measures in top consumer China supported market sentiment.

The September iron ore contract on the Dalian Commodity Exchange rose 0.71% to 712 yuan ($99.70) a ton. In early trading, iron ore fell to 688.50 yuan a ton, the lowest since August 2023.

At the same time, the September iron ore contract on the Singapore Exchange rose 3.14% to $94.90 a ton.

On the Shanghai Futures Exchange, steel rebar rose 1.5%, steel bar rose 1.4%, stainless steel rose 0.6%, and hot-rolled coil fell 1.3%.

Rubber Prices in Japan Fall

Rubber prices in Japan fell due to concerns about demand prospects in top consumer China and a stronger yen, but synthetic rubber prices limited the decline.

The January 2025 rubber contract on the Osaka Stock Exchange (OSE) fell ¥2.4, or 0.73%, to ¥326.5 ($2.25) per kg.

Meanwhile, the January 2025 rubber contract on the Shanghai Futures Exchange rose 60 yuan to ¥16,155 ($2,261.43) per ton.

The September 2024 rubber contract on the Singapore Exchange rose 0.8% to 174.3 U.S. cents per kg.

The U.S. dollar fell sharply against the yen, falling more than 1% to ¥146.01 per dollar.

The stronger yen made yen-denominated assets cheaper for foreign buyers.

Robusta Coffee Price Hits 4-Week High

Robusta coffee prices rose to a four-week high as exports from Vietnam fell, tightening global supplies.

November robusta coffee on the London International Financial Futures and Options Exchange rose 0.7% to $4,476 a ton after hitting a four-week high of $4,535 a ton.

Meanwhile, December arabica coffee on the ICE rose slightly to $2,443.50 a pound after hitting a five-week high of $2,482 a pound.

Sugar Prices Mixed

October raw sugar on ICE was unchanged at 18.02 U.S. cents a pound.

Meanwhile, October white sugar on the London International Financial Futures and Options Exchange fell 0.6% to $513.70 a ton.

Soybean and Corn Prices Rise, Wheat Falls

Chicago soybean prices rose from near four-year lows as tight supplies supported prices.

On the Chicago Board of Trade, soybeans rose 13 U.S. cents to $9.70 a bushel after touching their lowest level since September 2020. Corn rose 6-1/2 U.S. cents to $3.99 a bushel after touching its lowest level since October 2020 in the previous session. Wheat fell half a cent to $5.52 a bushel.

Palm Oil Price Rises

Palm oil prices in Malaysia rose after falling in the previous session on profit-taking.

The November palm oil contract on the Bursa Malaysia Exchange rose 40 ringgit, or 1.09%, to 3,721 ringgit ($849.93) a ton. Last week, palm oil prices fell 1.79% for the fourth straight week.

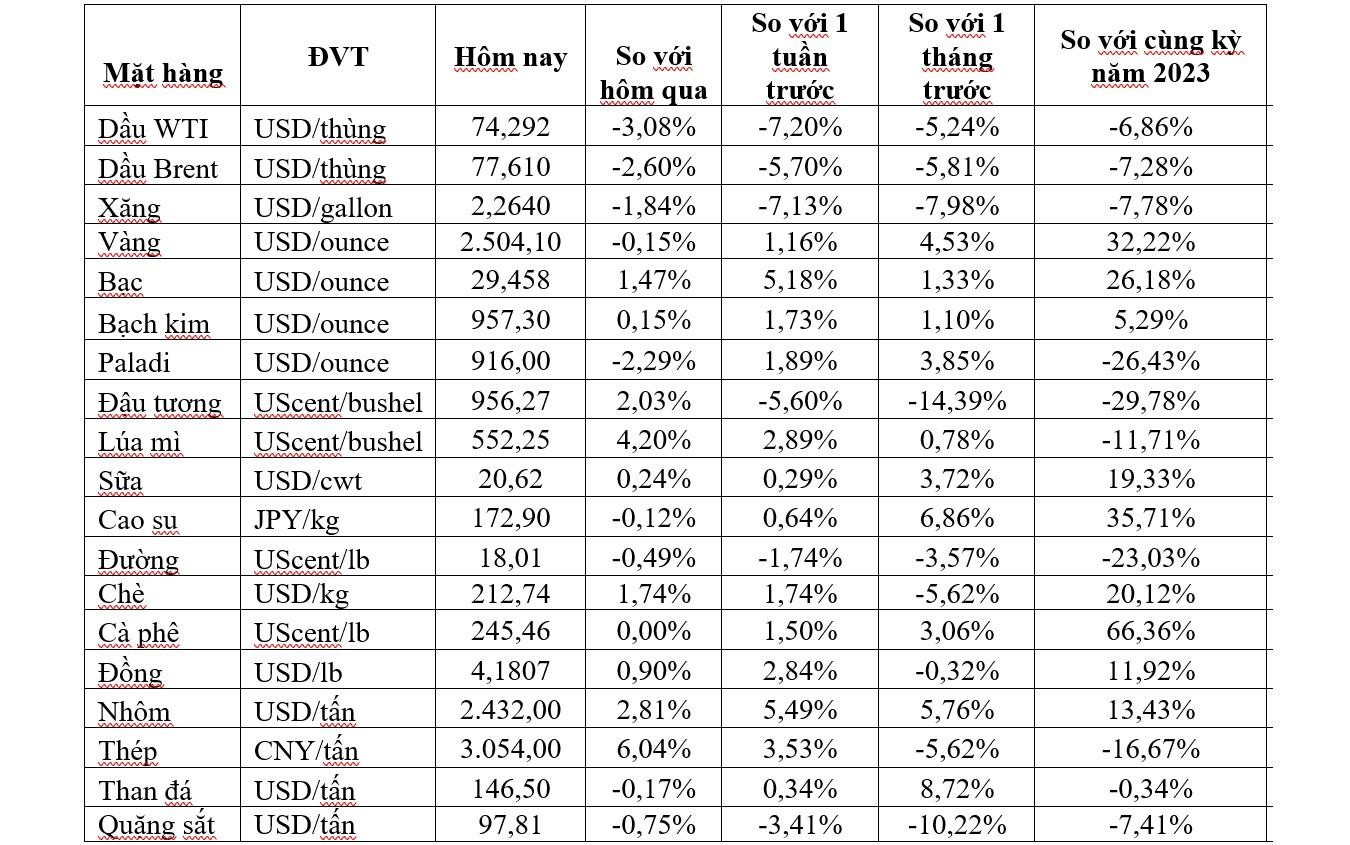

Prices of Key Commodities on August 20

Market Update on February 2nd: Oil, Copper, Iron & Steel, Rubber, and Sugar Prices Decline, Gold Surges to Almost 1-Month High.

At the end of the trading session on February 1st, the prices of oil, copper, iron and steel, rubber, and sugar all dropped, while natural gas hit a nine-month low and gold reached its highest point in nearly a month.

Market Update March 2nd: Crude Oil, Copper, and Rubber Prices Rise Simultaneously, Gold Reaches Highest Level in 2 Months

At the close of the trading session on March 1st, oil, copper, and rubber prices all rose, with gold reaching a two-month high. Meanwhile, natural gas, nickel, iron and steel, corn, and wheat all declined, with raw sugar hitting a near two-month low.