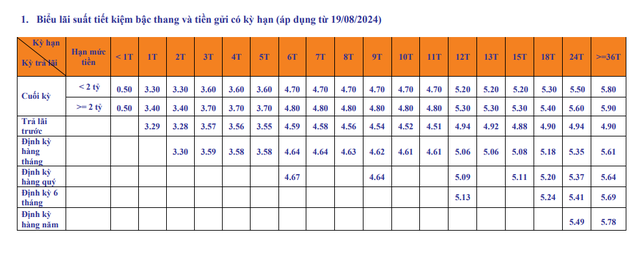

SHB’s Latest Savings Interest Rates

SHB’s latest savings interest rates have been officially adjusted upwards from August 19th. According to the tiered and fixed-term savings interest rate table, for deposits below VND 2 billion with interest payable at maturity, the interest rate has increased by 0.2% per year for terms ranging from 3 months to 36 months.

Specifically, SHB’s savings interest rates for terms of 3-5 months have climbed to 3.6% per year. The interest rate for terms of 6-8 months is listed at 4.7% per year, while the 12-month term now stands at 5.2% and the 18-month term is 5.3% per year. The interest rate for the 24-month term is currently 5.5% per year, and for terms of 36 months and above, the savings interest rate has increased to 5.8% per year.

For savings deposits over VND 2 billion, SHB adjusted the interest rate for terms ranging from 3 months to 18 months, with an average increase of 0.1-0.2% per year. The bank maintained the interest rates for other terms.

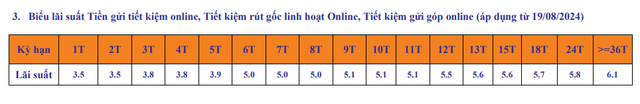

SHB’s Latest Online Savings Interest Rates.

Regarding online savings deposits, the interest rate for terms of 3-4 months has been increased to 3.8% per year, while the 5-month term has risen to 3.9% per year. The online savings interest rate for terms of 6-8 months has climbed back to 5% per year.

The interest rates for terms of 9-11 months have also increased to 5.1% per year. The new interest rate for terms of 12-15 months is 5.6% per year, and the 18-month term is listed at 5.7% per year.

The bank maintained the interest rate for 1-2-month terms at 3.5% per year. The 24-month term stands at 5.8% per year, and the interest rate for terms of 36 months and above is 6.1% per year.

Currently, SHB is one of the banks with the leading savings interest rates in the market.

Techcombank’s Latest Savings Interest Rates

Techcombank has also officially updated its latest savings interest rates from August 19th.

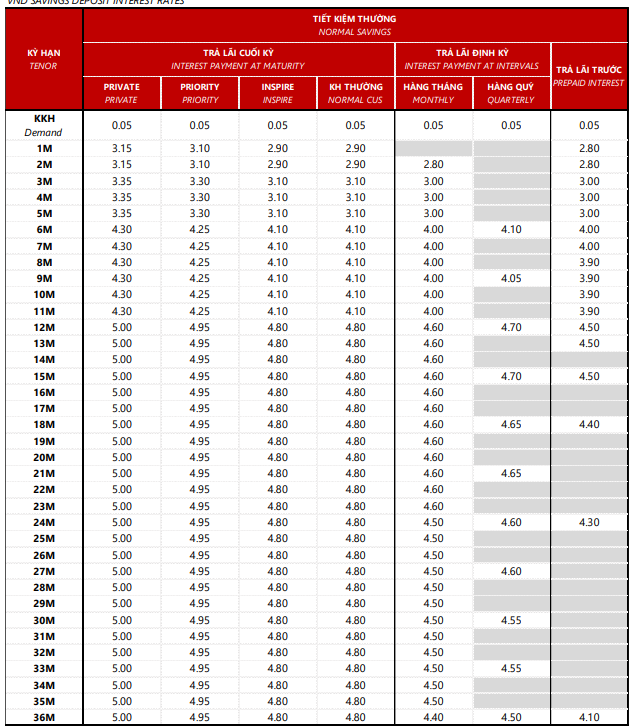

For regular savings interest rates, the 1-2-month term is listed at 3.15% per year. The interest rate for terms of 3-5 months remains at 3.35% per year. The 6-11-month term is unchanged at 4.3% per year, and the 12-36-month term is maintained at 5% per year.

Techcombank’s Latest Savings Interest Rates for Regular Deposits.

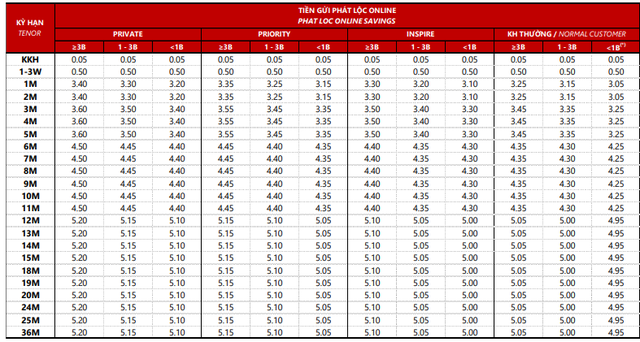

According to the ‘Loc Phat’ online savings interest rate table, for deposits below VND 1 billion and regular customers, the 1-2-month term is currently at 3.05% per year. The 3-5-month term stands at 3.25% per year, while the 6-11-month term is 4.25% per year. The interest rate for terms of 12 months and above is 4.95% per year.

VPBank’s Latest Savings Interest Rates

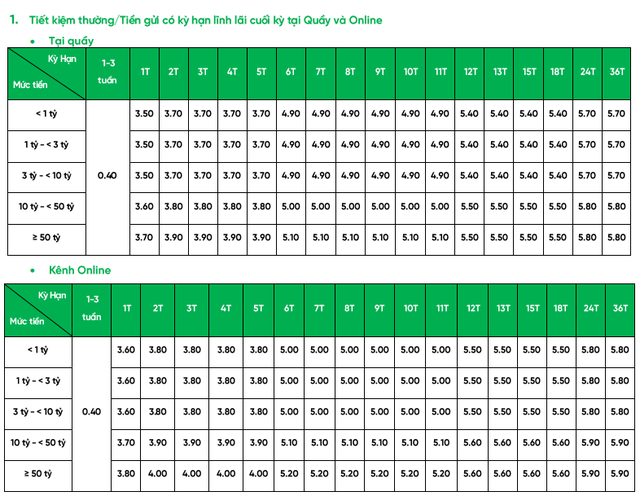

VPBank officially increased its savings interest rates from August 8th. For over-the-counter deposits, the 1-month term has an interest rate ranging from 3.5% to 3.7% per year, depending on the amount deposited.

The interest rate for terms of 2-5 months is 3.75% to 3.9% per year. The 6-11-month term currently falls within the range of 4.9% to 5.1% per year. The 12-18-month term is 5.4% to 5.5% per year, and the 24-36-month term is within the range of 5.7% to 5.8% per year.

For online savings deposits, the interest rate is 0.1% per year higher than that of over-the-counter deposits. Specifically, the 1-month term has an interest rate ranging from 3.6% to 3.9% per year. The 2-5-month term has a range of 3.8% to 4.0% per year, while the 6-11-month term is 5.0% to 5.2% per year. The 12-18-month term stands at 5.5% to 5.6% per year, and the 24-36-month term is within the range of 5.8% to 5.9% per year.

VPBank’s Latest Savings Interest Rates.

Latest ACB Bank Interest Rates for February 2024: Highest Yields for Online Deposits 12 Months

The highest deposit interest rate currently offered by ACB is 5% per year, for a 12-month term with a minimum deposit amount of 5 billion VND, earning interest at the end of the term.

International visitors “invade” New Year’s celebration; nearly 3,000 employees of The Gioi Di Dong quit their jobs

Móng Cái border gate welcomes nearly 1,000 entrants on the first day of the year; Feng Shui experts predict the economy in the Year of the Wooden Horse; Over 10,000 tons of rice distributed to residents in 17 provinces for Tet; Approximately 3,000 employees of Thế giới Di động resign… are notable news from the past week.