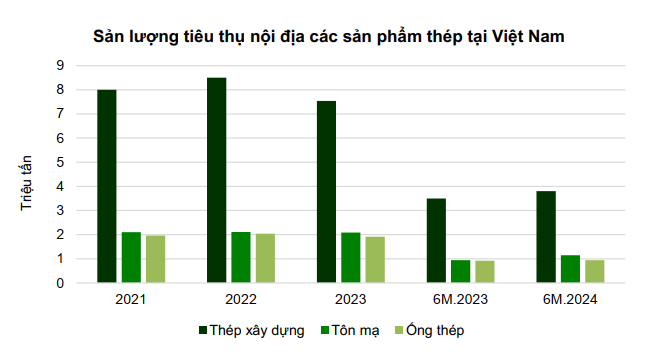

A promising start to the year. Data from the Vietnam Steel Association (VSA) shows a significant improvement in domestic steel consumption in the first six months. Construction steel increased by 4%, steel pipes by 3%, and especially galvanized steel, which surged by 22% compared to the same period last year. According to VCBS, this recovery indicates a warming up of the real estate market, particularly in the North and South regions, along with an increased demand for civil housing construction.

Exports are another notable bright spot. Statistics from the General Department of Customs show that steel exports in the first six months reached nearly 4.8 billion USD, a 12% increase compared to the same period last year.

Industry giants showcase their strength. The recovery backdrop also creates a favorable environment for steel companies to reap profits.

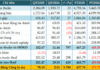

In Q2 2024, Hoa Phat Group (HPG) reaffirmed its leading position with net revenue of VND 39,556 billion, a 34% increase compared to the previous year. Notably, HPG’s net profit reached VND 3,319 billion, more than double that of the same period.

The positive results stem from a significant increase in consumption (mainly in the construction steel segment), improved profit margins, and reduced foreign exchange losses.

Not to be outdone, the giants in the galvanized steel industry also saw a sharp rise in net profits compared to the previous year. Hoa Sen Group (HSG) and Nam Kim Steel (NKG) recorded profits of VND 273 billion and VND 219 billion, respectively.

According to VCBS, HSG and NKG’s substantial profits are attributed to increased exports to the EU and the US, which recovered strongly amid signs of supply shortages in these regions. Additionally, stable HRC prices in Q1 helped these companies avoid significant inventory provisioning in Q2 (galvanized steel companies usually import stock three months in advance).

Financial Results of Steel Companies in Q2

Unit: Billion VND

Source: VietstockFinance

|

Meanwhile, some other companies in the industry also showed significant improvements. Vietnam Steel Corporation (TVN) achieved an impressive 49% revenue growth and turned losses into profits of VND 126 billion.

However, not all businesses performed well. Thep SMC (SMC) and Tien Len Steel Corporation (TLH) incurred net losses of over VND 100 billion each.

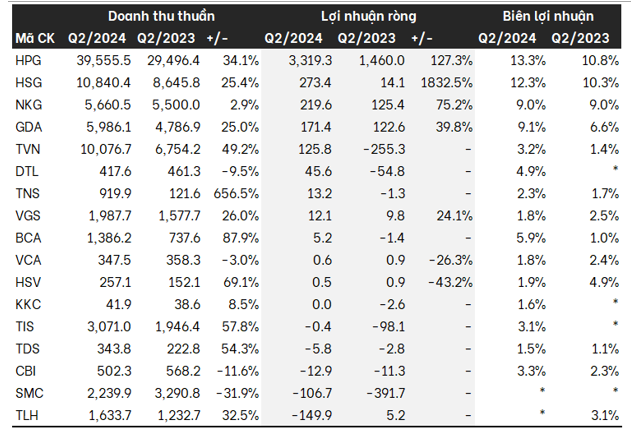

The market share landscape also underwent favorable changes for the industry leaders in the first six months. In construction steel, Hoa Phat continued to gain market share as other producers struggled to maintain business operations, leading to staff cuts and asset liquidations. In the galvanized steel segment, HSG and NKG successfully increased their market share while GDA lost ground.

Source: VCBS

|

According to a report by VCBS, the industry leaders witnessed a strong recovery thanks to their “scale, brand, and technology advantages, which helped them increase their domestic market share and seize the opportunity presented by the recovery of the domestic construction market. Additionally, the leading group was also agile in capturing export opportunities, resulting in profits that exceeded expectations, especially in the galvanized steel segment.”

A severe “winter” for the global steel industry. Despite these positive signs, the Vietnamese steel industry is facing multiple headwinds. The most notable is the warning from China Baowu Steel, the world’s largest steel producer, about a severe crisis in the Chinese steel industry that could have global repercussions.

At the semi-annual meeting, Chairman Hu Wangming likened the situation to a “severe winter” – a challenge worse than the shocks of 2008 and 2015. “This winter will be longer, colder, and more unbearable than we predicted,” he told employees. During this meeting, Chairman Baowu emphasized the risks related to steel demand and prices.

Looking at China as a whole, the world’s largest steel producer and supplier of over 54% of global steel, there are multiple warning signs. The prolonged downturn in China’s real estate sector shows no signs of ending, leading to weak demand and falling steel prices. In August, Chinese steel rebar futures plunged below 2,800 yuan per ton, the lowest in eight years. HRC futures are also hovering near four-year lows.

In response to this situation, Chinese producers are ramping up steel exports to other countries, creating significant pressure on competitors across Asia, Europe, and North America.

Vietnam is among the popular destinations for Chinese steel. According to the General Department of Customs, in the first six months of 2024, Vietnam imported nearly 6 million tons of HRC, a 32% increase compared to the same period in 2023. Notably, steel from China accounted for 74% of these imports.

With their low selling prices, Chinese steel products are undoubtedly causing headaches for many Vietnamese businesses. The competition from cheap Chinese steel is evident in the declining consumption of HRC by Hoa Phat. “Low-priced imported steel is putting pressure on Hoa Phat’s HRC consumption in the domestic market,” the company stated.

Moreover, according to VCBS, the importation of cheap steel from China is also believed to be a factor contributing to the stagnant domestic steel prices.

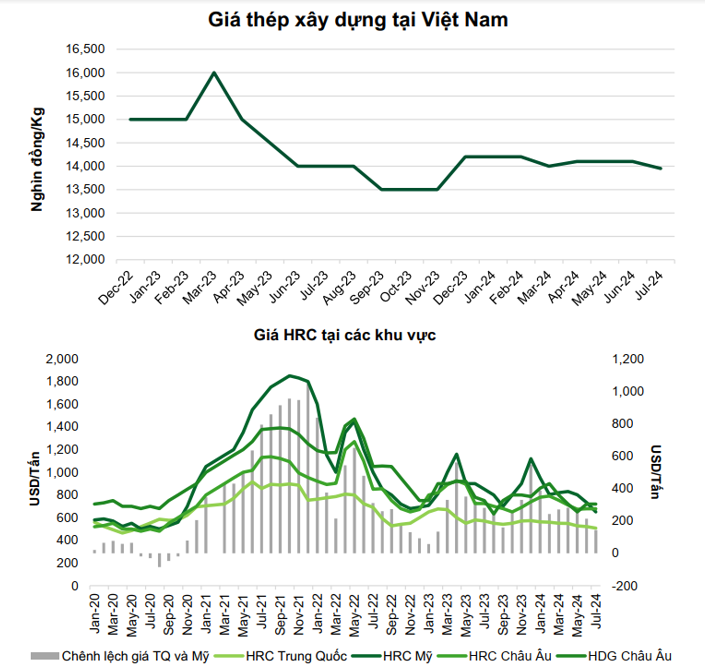

In Vietnam, domestic construction steel prices are hovering around VND 14 million per ton, the lowest in many years. Similarly, HRC prices are on a downward trend and show no signs of recovery, currently fluctuating between USD 460 and USD 480 per ton.

Source: VCBS

|

According to VCBS analysts, steel prices could continue to fall under pressure from China, and Q3 is typically a low season for the steel industry due to the rainy season.

Another concern is the risk of facing trade remedies in export markets. A recent example is the EU’s initiation of an anti-dumping investigation into Vietnam’s HRC exports in late July. Looking ahead, the EU is expected to implement the Carbon Border Adjustment Mechanism (CBAM) from 2026, requiring steel producers to invest heavily in clean technology to maintain competitiveness in this market.

The wildcard: “Donald Trump”. Let’s not forget another potential risk that could emerge in late 2024 when Americans elect their president for the 2025-2028 term.

A Trump victory is expected to significantly impact trade relations between Vietnam and the US. In his first term, Trump demonstrated his unpredictability in trade matters, often erecting tariff barriers to reduce the trade deficit with trading partners, including Vietnam. Currently, the US is Vietnam’s largest export market.

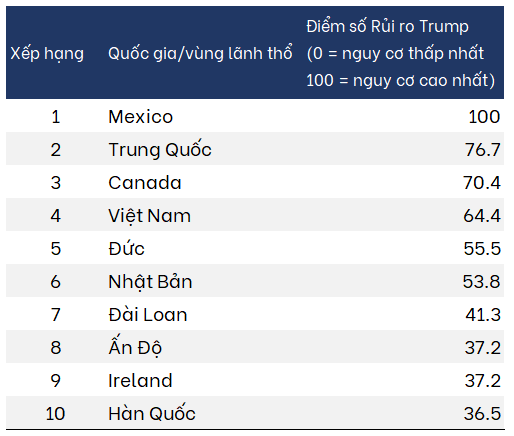

According to The Economist’s Trump Risk Index, Vietnam is among the top four countries most vulnerable to changes in US trade policies if Trump is re-elected.

Source: The Economist

|

|

The Trump Risk Index is calculated based on an assessment of trade vulnerability, taking into account various indicators such as bilateral trade balance; bilateral trade trends; current account balance; export sensitivity to the US; dependence on the US for goods and trade; and free trade agreements with the US. |

Vu Hao

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.

The Power of Lizen: Consistently Winning Massive Bids

Lizen has achieved a significant milestone by successfully deploying and implementing major high-speed construction projects in 2023. The company’s revenue has reached 2,030.5 billion VND, which is twice the amount compared to 2022. However, the post-tax profit has reached its lowest point in the past 6 years, dropping down to only 118.3 billion VND.