According to Eurominitor data, the penetration of modern retail in Vietnam is still relatively low and in the early stages of development, with a modest market share of nearly 12%. When compared to Indonesia, Vietnam is at the same stage as its Southeast Asian neighbor was in 2010. However, Indonesia’s retail giants, Indomaret and Alfamart, accelerated the modernization of their market by rapidly expanding their store chains. As a result, Indonesia’s modern trade market achieved an impressive 18% annual growth over a five-year period.

In Vietnam, while modern trade and e-commerce are experiencing robust growth, daily consumer transactions are still largely taking place in the traditional retail channel, which is expected to hold a market share of nearly 75-80% in the next five years. Monitor’s report indicates that if Vietnam’s modern trade market develops at a similar pace as Indonesia’s, its scale is predicted to more than triple in the next decade, reaching a market size of nearly $20 billion.

So, which enterprise has the financial capability, retail foundation, and operational capacity to build a “New Commerce” in Vietnam and seize the opportunity to serve the country’s 100 million consumers, just as Reliance Retail did in India and Indomaret and Alfamart did in Indonesia?

Enter WinCommerce, the company that is modernizing retail in Vietnam. With a presence in 62 provinces across the country, WinCommerce (WCM), the operator of the WinMart/WinMart+/WiN chain, boasts a network of nearly 3,700 stores. It is the largest modern retailer in Vietnam, holding over 50% of the modern retail market share. Each month, the WinMart/WinMart+/WiN chain serves over 30 million shoppers.

In 2023, WinCommerce completed its restructuring and returned to its expansion strategy, focusing on distinct models for different regions and customer segments. By the end of 2024, WinCommerce plans to have a total of approximately 4,000 stores nationwide, meaning a new store will open every day. This is the same strategy that Indomaret and Alfamart employed to successfully modernize Indonesia’s retail landscape.

However, WinCommerce’s contribution to the “New Commerce” landscape goes beyond just scale. The company also leverages the core capabilities of the Masan Group’s consumer-retail ecosystem (WinCommerce’s parent company). Specifically, WinCommerce combines the production expertise and strong brand-building capabilities of Masan Consumer, the unit behind billion-dollar brands like CHIN-SU and Omachi. Moreover, Masan Consumer operates one of the largest food and beverage distribution networks in Vietnam, providing a significant competitive advantage in efficiently supplying consumers while reducing transportation costs. This is crucial as nearly 70% of Vietnam’s population resides in rural areas, and the retail sector remains heavily reliant on traditional channels.

This combination is further enhanced by WinCommerce’s internal logistics arm, Supra. Established in 2022, Supra currently owns a distribution center system comprising 10 warehouse clusters (including dry and cold storage) across the three regions of Vietnam. Supra is responsible for delivering 60% of WinCommerce’s total cargo volume and has helped reduce logistics costs by 11%, directly contributing to lower product prices and benefiting consumers.

In essence, WinCommerce’s “New Commerce” model is a complete consumer-retail value chain, encompassing production, distribution, and logistics, and is playing a pivotal role in modernizing Vietnam’s retail market.

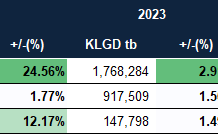

Scaling up, optimizing, and turning a profit are crucial aspects of any successful business. WinCommerce has skillfully executed this strategy and reaped the rewards in 2024. According to recent reports, in the second quarter of 2024, WCM recorded a revenue of 7,844 billion VND, a 9.2% increase compared to the same period last year. This success is attributed to the upgrading and improvement of WiN stores (catering to urban consumers) and WinMart+ Rural stores (serving rural consumers). These two store models outperformed the traditional model, achieving LFL growth of 6.3% and 10.7%, respectively, in the second quarter of 2024 compared to the previous year. Notably, WCM achieved a positive net profit in June, marking a significant milestone since its acquisition by Masan. WCM plans to accelerate store openings in the second half of 2024.

WinCommerce serves as the solid foundation for the Masan Group’s mission to serve Vietnamese consumers. The network of supermarkets and convenience stores offers a one-stop-shop for consumers, meeting all their daily needs, from essentials to financial services. As the modern trade market continues to evolve, WinCommerce will further enhance its profitability, driving up the intrinsic value of the enterprise.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.