The VN-Index trading volume reached over 355 million units, equivalent to a value of more than 8.5 trillion VND. The HNX-Index recorded a trading volume of nearly 32 million units, with a value of over 682 billion VND.

VCB, BID, and FRT are currently the main contributors to the VN-Index, adding more than 2.2 points to help the index stay in the green. On the other hand, VHM, TCB, and PLX are the restraining factors, but their impact is not too significant.

The market is tending to differentiate by industry group, with more than half of the groups increasing and nearly half decreasing. Among them, the telecommunications services group is temporarily leading with a 2.34% increase, mainly contributed by VGI (+3.24%), FOX (+0.11%), and CTR (+0.47%).

The non-essential consumer group is also being traded positively, but the upward momentum is narrowing compared to the strong breakthrough at the beginning of the session. Typically, FRT and PET touched the ceiling and near the ceiling at one point, but by the end of the morning session, they had only increased by 4.6% and 4.3%, respectively, while DGW, which had risen by almost 4%, had fallen to just over 2%.

On the contrary, the real estate group is taking a step back after shining in the previous session, falling by 0.4% at the end of the morning session. Most of the codes in the industry are being adjusted: VHM (-0.63%), VIC (-0.12%), BCM (-0.83%), KDH (-1.19%), NLG (-0.86%), DIG (-2.2%)… A few remaining codes are still maintaining a positive green color, such as PDR (+3.91%), KBC (+0.37%), DXG (+0.32%), and CEO (+0.6%)…

Foreign investors are also a negative factor, with net selling of more than 740 billion VND on the 3 exchanges. The largest net selling volume was in MWG and HPG, with respective values of 100 billion VND and 92 billion VND. On the other hand, FPT was the most net bought stock by foreign investors in the morning session, with a value of nearly 67 billion VND.

| Top 10 stocks with the strongest net buying and selling in the morning session of August 21, 2024 |

10:40 am: Real estate “loses steam,” market tug-of-war intensifies

Investors’ indecision caused the main indices to fluctuate strongly around the reference level. As of 10:40 am, the VN-Index fell 2.79 points, trading around 1,269 points. The HNX-Index decreased by 0.24 points, trading around 236 points.

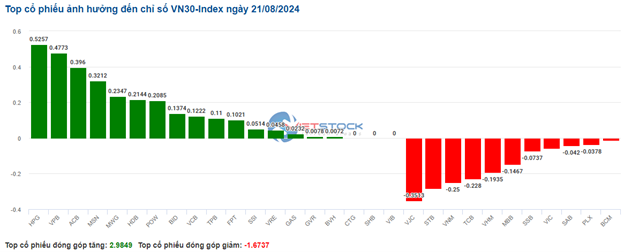

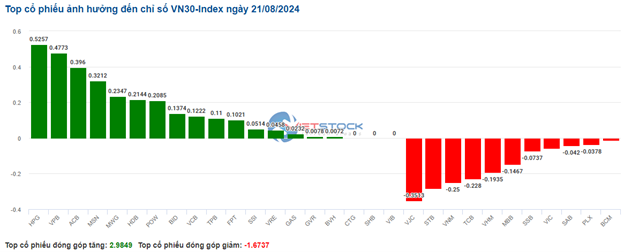

Stocks in the VN30 basket showed a mixed performance, but buying pressure slightly dominated. Specifically, HPG, VPB, ACB, and MSN contributed 0.53 points, 0.48 points, 0.4 points, and 0.32 points to the overall index, respectively. Conversely, VJC, STB, VNM, and TCB faced strong selling pressure, dragging down the VN30-Index by more than 1 point.

Source: VietstockFinance

|

The telecommunications services sector recorded the strongest gain in the market. Notably, VGI rose by 2.95%, CTR increased by 0.71%, YEG went up by 0.3%, and ELC climbed by 0.42%… Meanwhile, red still prevailed in a few small-cap stocks, such as MFS, which fell by 1.75%, SGT, down by 0.36%, and DST, declining by 3.13%…

From a technical perspective, the telecommunications services sector index continued to move sideways after a significant correction from mid-July 2024, while volume consistently remained below the 20-session average, indicating investors’ cautious sentiment. Additionally, the sector is finding decent support from the SMA 100-day moving average, while the MACD and Stochastic Oscillator indicators are trending upward, generating buy signals. Hence, the recovery prospects for this sector could resurface in the upcoming period if capital inflows show improvement.

Source: https://stockchart.vietstock.vn/

|

Following this upward trajectory was the energy sector, with the green predominantly concentrated in the oil and gas “heavyweights.” For instance, BSR rose by 0.83%, PVS climbed by 1.49%, PVD advanced by 1.27%, and PVB surged by 4.21%…

In contrast, the real estate sector witnessed a slight decline, and red prevailed in this group. Specifically, DIG fell by 2.4%, VHM dropped by 0.63%, DXG slipped by 0.32%, and NVL decreased by 1.18%… On the upside, the green persisted in select stocks, including PDR, which rose by 2.44%, NTL, up by 0.2%, and KBC, climbing by 0.37%…

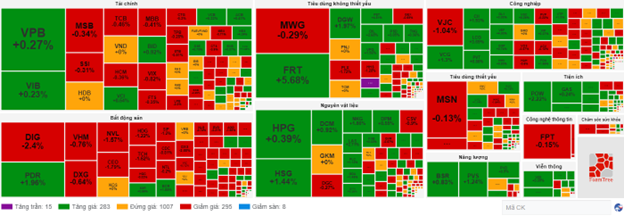

Compared to the opening, the market continued to fluctuate and differentiate strongly, with more than 1,000 reference stocks. The number of advancing and declining stocks was relatively balanced, with 283 gainers and 295 losers.

Source: VietstockFinance

|

Opening: Fluctuations from the Start

At the start of the August 21 session, as of 9:40 am, the VN-Index edged slightly higher, but investors remained cautious, as the index fluctuated around the reference level. However, the telecommunications services and energy sectors provided positive contributions.

Large-cap stocks like BID, GAS, and HPG led the market’s advance, adding nearly 1.5 points to the index. Conversely, stocks like CTR, VCB, and VPB weighed on the market, dragging the index down by more than 0.5 points.

Green prevailed in the morning session, with telecommunications services stocks outperforming from the beginning. Notably, VGI surged by 3.98%, CTR climbed by 1.09%, ELC rose by 1.09%, FOX advanced by 0.53%, VTK increased by 1.73%, and YEG went up by 0.55%.

Following suit, the energy sector also contributed positively to the overall market performance, with stocks like BSR, PVD, PVS, and PVC rising by 2.08%, 1.81%, 2.73%, and 3.73%, respectively.