Services

According to BSR, as of August 21, 2024, BSR has submitted a listing registration dossier for 3.1 billion BSR shares to the HOSE of Binh Son Petroleum Refinery Joint Stock Company, corresponding to a current charter capital of over 31,004 billion VND.

BSR is the operator of the Dung Quat Oil Refinery – an important project related to national security, with a total investment of over $3 billion, contributing to ensuring the country’s energy security. BSR successfully conducted its IPO in January 2018, and its shares were listed on the UPCoM of the Hanoi Stock Exchange from March 2018.

Dung Quat Oil Refinery – An important project related to national security

|

From 2020 to 2023, BSR was unable to list its shares on the HOSE as it only met 8 out of 9 criteria (Charter Capital; Approved by the General Meeting of Shareholders; Minimum 2 years of listing on the UpCom exchange; Profitable business results for the last 2 years and ROE of the latest year above 5%; Minimum 15% of voting shares held by at least 100 shareholders (excluding major shareholders); Commitment of internal shareholders on shareholding; No violations handled in the last 2 years up to the time of listing registration; Having a securities company advising on listing registration). BSR only had 01 unmet criterion, which was related to overdue debts of its subsidiary, Central Petroleum Biofuel Joint Stock Company (BSR-BF). According to its financial statements, BSR has made full provisions for these debts to completely eliminate financial risks. At the 2024 General Meeting of Shareholders, BSR affirmed that it is expediting the completion of procedures to file for bankruptcy of BSR-BF at the People’s Court of Quang Ngai province, while actively working with the State Securities Commission to finalize the necessary procedures for listing its shares on the HOSE as soon as possible.

A significant milestone for BSR was marked on August 15, 2024, when the company published its reviewed semi-annual financial statements. The conclusion of the auditor in this report stated that on May 27, 2024, the Court issued Decision No. 01/2024/QD-MTTPS to open bankruptcy proceedings for BSR-BF, thereby terminating the control rights of Binh Son Petroleum Refinery Joint Stock Company at BSR-BF. As a result, the financial statements of BSR-BF were discontinued from consolidation into the consolidated mid-year financial statements of the Company from this date. This meant that BSR had addressed the criterion related to overdue debts and was eligible for listing on the HOSE.

The efforts to move from UPCoM to HOSE demonstrate the determination of BSR‘s leadership in fulfilling their commitments to shareholders. This move is also expected to enhance transparency and liquidity for BSR shares, thereby facilitating the company’s access to domestic and foreign capital. Additionally, the “change of venue” is anticipated to make BSR shares more attractive and increase their value for investors.

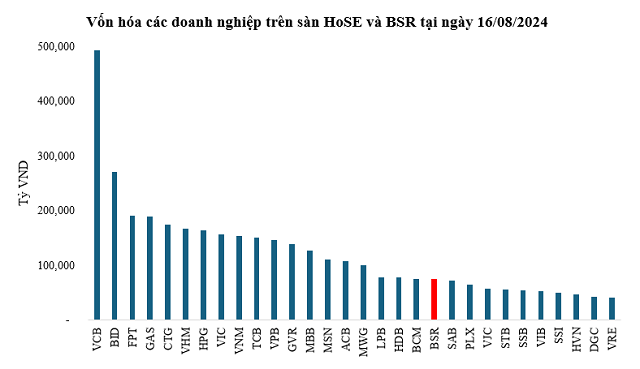

With a market capitalization of up to 74,700 billion VND (ranked 21st among companies on HSX as of August 16, 2024), once approved for the transfer to HOSE, BSR will become a Blue-chip stock and is expected to be included in the VN30 basket in the near future. The appearance of this high-quality “blockbuster” is expected to attract additional investment capital into the stock market from individual and institutional investors, both domestic and foreign.

Source: Bloomberg, PSI Consolidated

|

According to an analysis by PSI, BSR is forecasted to increase its output in the last six months to make up for the lost production during the plant’s overall maintenance period. Therefore, revenue in the second half is expected to grow strongly compared to the first six months. In addition, BSR plans to increase its charter capital to 50,000 billion VND to balance the capital source for the Dung Quat Oil Refinery Upgrade and Expansion Project. The capital increase plan is being reported to the major shareholder, Vietnam Oil and Gas Group, and competent authorities.

Moreover, BSR is actively coordinating with Quang Ngai province, the Ministry of Industry and Trade, and the Central Economic Commission to finalize the outline for the National Refinery and Energy Center project in Dung Quat Economic Zone, aiming to complete the proposal and submit it to the Prime Minister for consideration in 2024. According to the proposal, the Dung Quat Oil Refinery will be the nucleus of the National Refinery and Energy Center in Dung Quat Economic Zone.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.