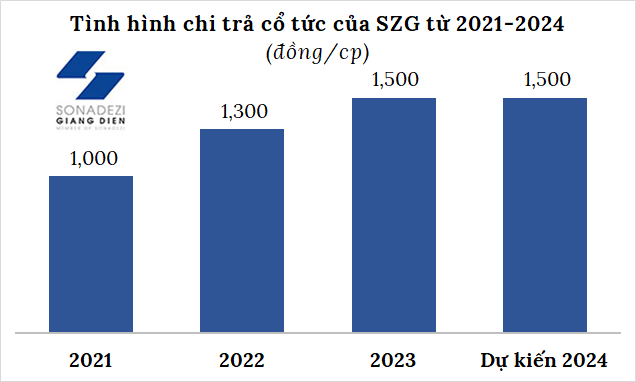

Sonadezi Giang Dien has announced a dividend payout ratio of 11%, equivalent to VND 1,100 per share. With approximately 54.9 million shares in circulation, the company is expected to distribute over VND 60 billion. The payment is scheduled for September 16, 2024.

Previously, in late 2023, SZG paid out nearly VND 22 billion (4% dividend ratio) as an advance on the first dividend payment. Thus, the company’s total dividend ratio for 2023 stands at 15%, amounting to over VND 82 billion.

Currently, the Industrial Park Development Joint-Stock Company (Sonadezi, UPCoM: SNZ) is the largest shareholder, holding 25.5 million SZG shares, representing a 46.45% stake. SNZ is expected to receive more than VND 38 billion in dividends from SZG.

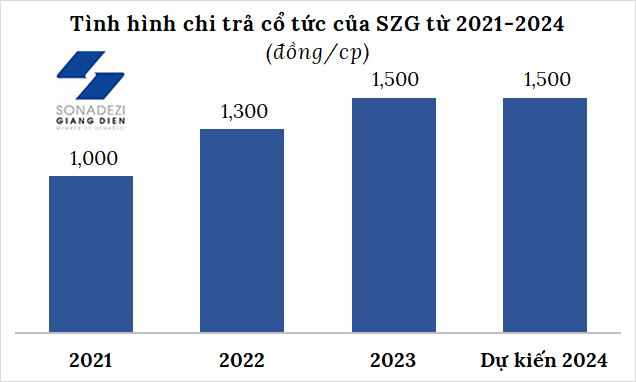

2023 marked the year with the highest dividend payout by SZG since its listing on the UPCoM in late 2021. For 2024, the company plans to continue distributing dividends at a ratio of 15%.

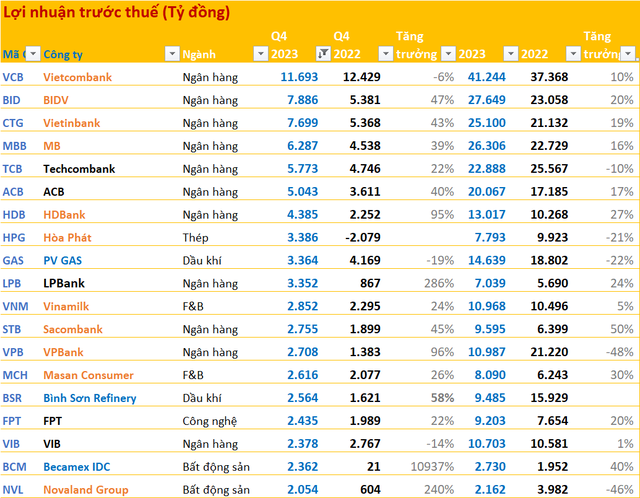

Source: VietstockFinance

|

In terms of business performance, SZG’s second-quarter 2024 revenue decreased by 39% year-on-year to over VND 101 billion due to the absence of rental income recognized as the total amount received in advance during the same period last year (VND 78 billion). The company’s net profit for the quarter was VND 30 billion, a decrease of 57% year-on-year.

For the first half of 2024, SZG’s revenue and net profit stood at VND 193 billion and VND 66 billion, respectively, representing a decrease of 23% and 36% compared to the previous year.

| SZG’s Semi-Annual Financial Results |

For the full year 2024, Sonadezi Giang Dien has set a cautious target, with total revenue expected to exceed VND 417 billion and net profit projected at over VND 122 billion. These figures represent a 5% and 35% decrease, respectively, compared to the company’s performance in 2023. SZG plans to maintain a dividend ratio of 15% for this year and aims to lease 9 hectares of industrial land and rent/transfer 3 factories (depending on the actual progress of basic construction) in 2024.

As of the first half of 2024, SZG has achieved 62% of its annual revenue target and 55% of its net profit target.

First industrial park to report a nearly 60% drop in Q2 net profit, zero debt

In contrast, SNZ reported a 15% increase in revenue for the second quarter, reaching nearly VND 1,565 billion, while its net profit surged by almost 60% to VND 325 billion. For the first six months of 2024, SNZ’s revenue and net profit exceeded VND 2,856 billion and VND 545 billion, respectively, marking an 18% and 54% increase year-on-year.

With full-year targets of over VND 6,366 billion in total revenue and more than VND 1,370 billion in net profit, this industrial park giant in Dong Nai province has accomplished 47% and 64% of its goals, respectively.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.