As of June 30, 2024, Setra’s total assets stood at over VND 3,788 billion, a decrease of nearly 54% compared to the end of June last year. Liabilities also decreased by over 55%, reaching nearly VND 3,493 billion, with bond debt standing at VND 2,000 billion, a reduction of over 65%.

|

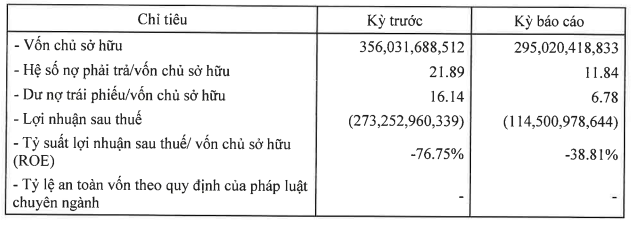

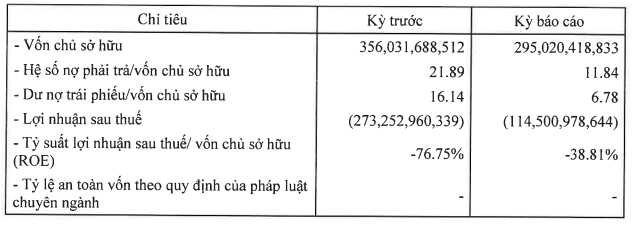

Setra’s Business Results for the First Half of 2024

Source: HNX

|

In comparison to the beginning of 2024, Setra’s total assets decreased by over VND 4 billion, while liabilities increased by more than VND 110 billion (over 3%).

Currently, Setra has 20 bond issues in circulation (with codes from SET.H2025.01 to SET.H2025.20) with a total value of VND 2,000 billion, an interest rate of 11% per annum, issued in August 2020, and expected to mature in August 2025.

During the 7th interest payment period on March 01, 2024, the Company was unable to make any interest payments, citing reasons of not being able to arrange payment sources. The total amount payable during this interest payment period amounted to more than VND 337 billion.

At the beginning of 2023, Setra held a meeting with bondholders to announce its inability to pay interest, stating that all its bank accounts and other assets were frozen by investigative authorities due to their involvement in the Van Thinh Phat case. The Company had to compile a list of assets to submit to the competent authorities, requesting permission to sell these assets to generate funds for bondholder payments.

In September 2023, the 20 bond codes of Setra were identified by the Investigation Police Agency of the Ministry of Public Security as related to the case of “Fraudulent Appropriation of Property” occurring at Van Thinh Phat Group Joint Stock Company. Along with 5 other bond codes issued by related companies, the total amount involved in the fraud reached VND 30 trillion.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.