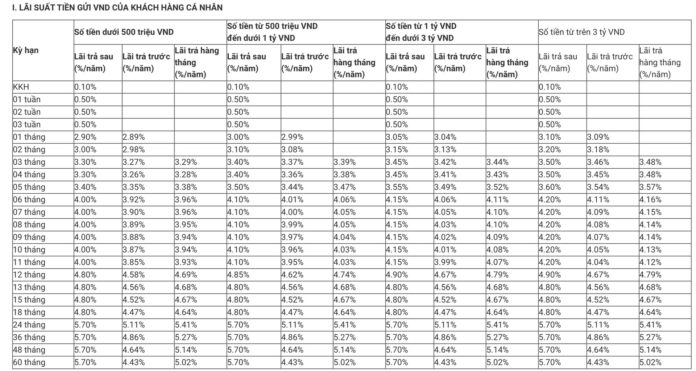

MB Bank’s Personal Savings Rates for June 2024

According to the latest survey, Military Commercial Joint Stock Bank (MB) offers a range of interest rates for personal savings accounts, currently varying from 0.5% to 5.8% per annum.

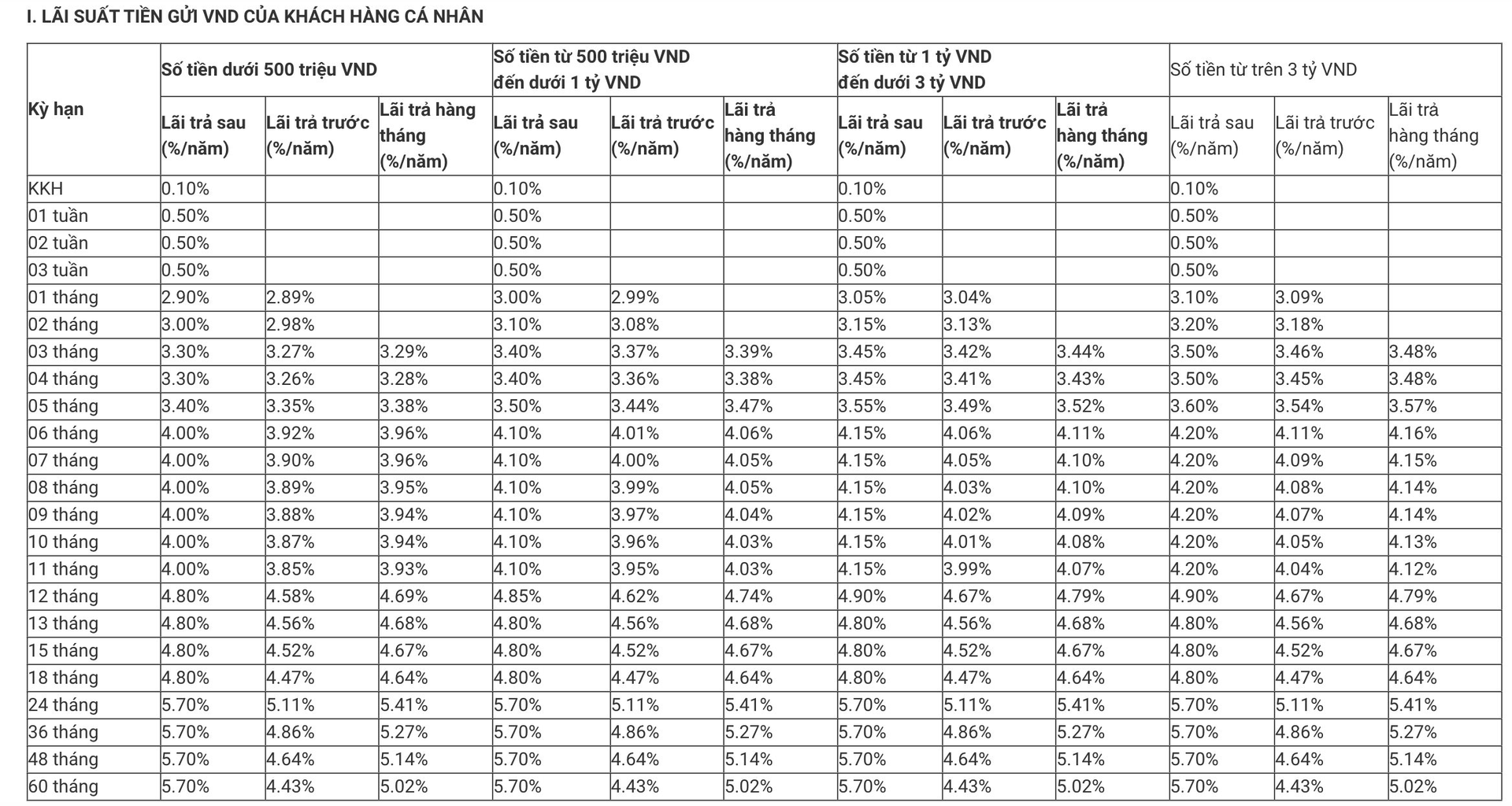

MB categorizes personal deposit interest rates into four tiers based on the amount deposited: below VND 500 million, VND 500 million to below VND 1 billion, VND 1 billion to below VND 3 billion, and VND 3 billion and above.

For deposits below VND 500 million, the interest rates are as follows: 0.5% per annum for 1-week, 2-week, and 3-week terms; 2.9% for 1-month term; 3.0% for 2-month term; 3.3% for 3-4-month term; 3.4% for 5-month term; 4.0% for 6-11-month term; 4.8% for 12-18-month term; and the highest rate of 5.7% for 24-36-month term.

Deposits ranging from VND 500 million to below VND 1 billion enjoy slightly higher interest rates, with an increase of 0.05% to 0.1% compared to the below VND 500 million tier for terms ranging from 1 to 12 months. The rates remain the same for terms longer than 12 months.

For deposits between VND 1 billion and below VND 3 billion, MB offers even more competitive rates. The interest rates are increased by 0.1% to 0.15% compared to the below VND 500 million tier for terms ranging from 1 to 12 months. Again, the rates are consistent with the previous tier for terms longer than 12 months.

Finally, for deposits of VND 3 billion and above, MB provides an even more attractive proposition. The interest rates are enhanced by 0.1% to 0.2% compared to the first tier for terms up to 12 months. As with the previous tiers, the rates remain unchanged for longer terms.

MB’s Personal Deposit Interest Rates for August 2024

Additionally, personal customers who deposit money at branches in the Central and Southern regions will enjoy higher interest rates compared to other regions, with an increase of approximately 0.1% per annum (excluding terms shorter than 1 month). The interest rate range for this option is 0.5% to 5.8% per annum for end-of-term payments. The highest rate of 5.8% per annum is offered for deposits with a term of 24 to 60 months.

MB Bank’s Business Savings Rates for August 2024

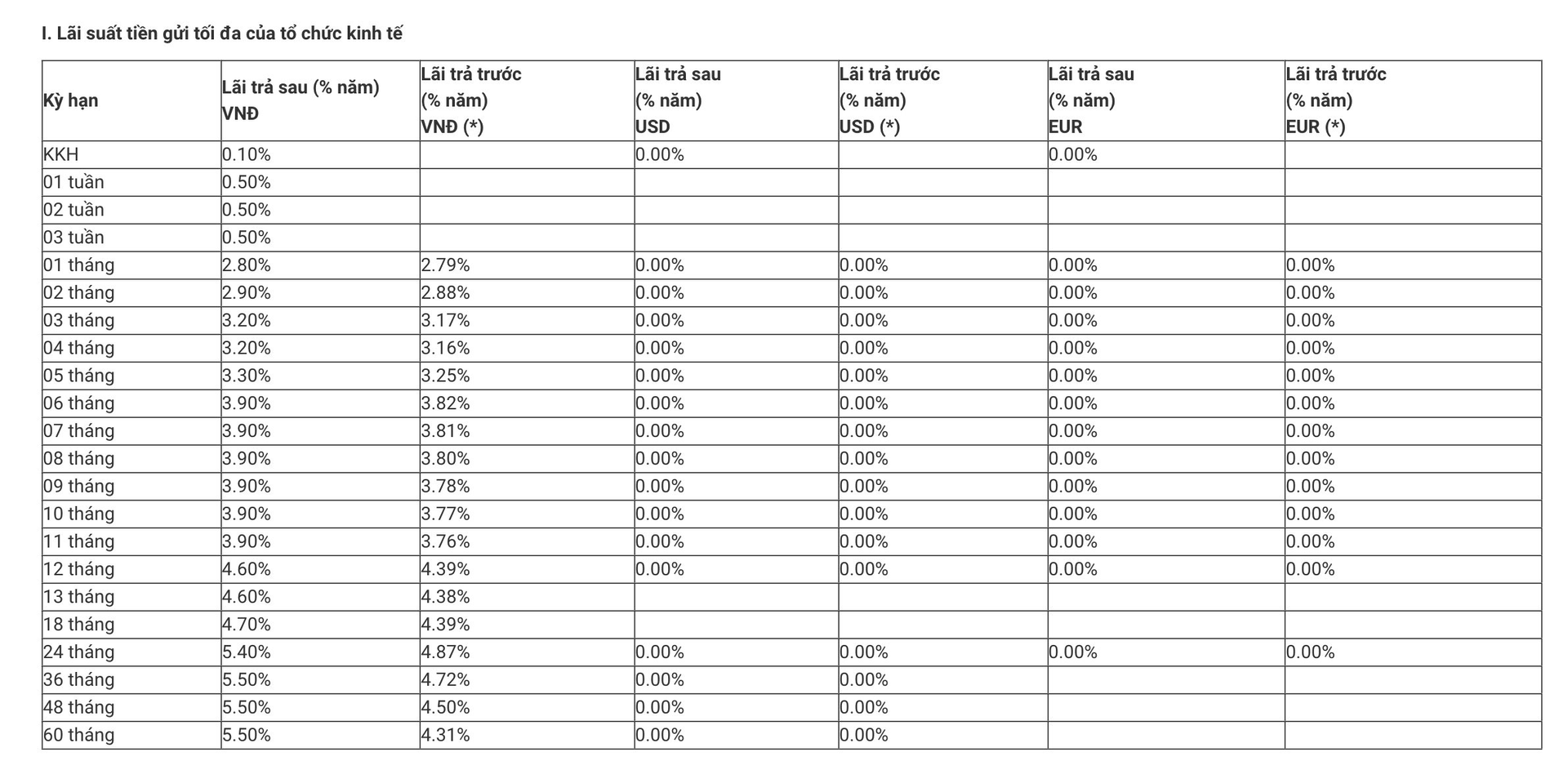

During August 2024, MB offers business customers a range of interest rates on their deposits, varying from 0.5% to 5.5% per annum for end-of-term payments.

For short-term deposits, the interest rates are as follows: 0.5% per annum for 1-week, 2-week, and 3-week terms; 2.8% for 1-month term; 2.9% for 2-month term; 3.2% for 3-4-month term; 3.3% for 5-month term; 3.9% for 6-11-month term; 4.6% for 12-13-month term; 4.7% for 18-month term; and 5.4% for 24-month term.

The highest interest rate of 5.5% per annum is offered for long-term deposits with a term of 36 to 60 months.

MB’s Maximum Deposit Interest Rates for Organizations for August 2024

MB also offers a separate interest rate framework for organizations in the Central and Southern regions (excluding Ho Chi Minh City). The rates are 0.1% higher than those for regular customers for terms of 6 months and longer. The highest interest rate of 5.6% per annum is offered for deposits with a term of 36 to 60 months.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Latest Interest Rates from VietinBank in February 2024: Up to 5% per annum

According to the latest survey in February 2024, VietinBank offers the highest deposit interest rate of 5% per annum for personal deposits of 24 months or more with interest paid at maturity.