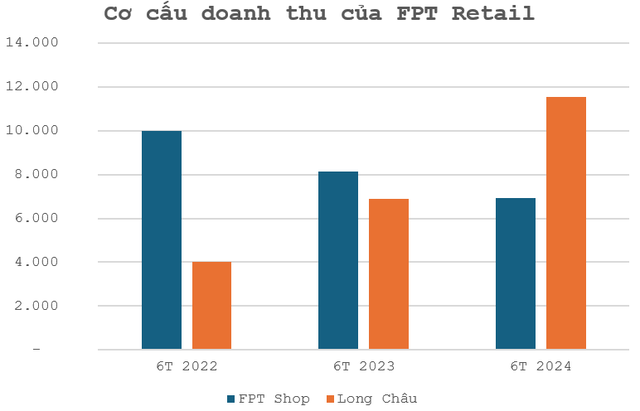

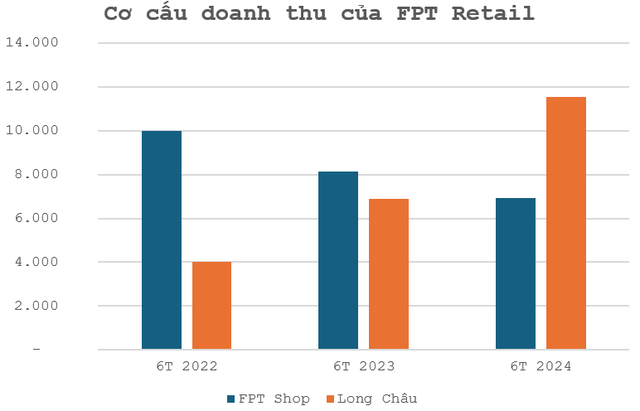

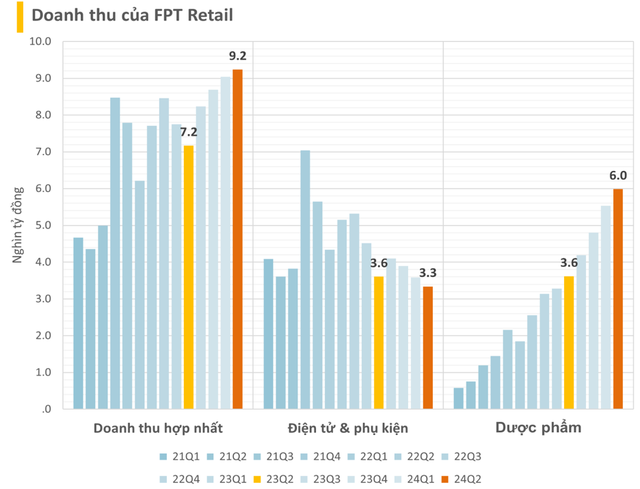

According to FPT Retail’s (ticker: FRT) reviewed consolidated financial statements for the first half of 2024, the pharmaceutical segment, led by Long Chau, contributed 11,521 billion VND in revenue, a 67% increase compared to the same period last year. The pharmaceutical segment currently accounts for 63% of FPT Retail’s revenue.

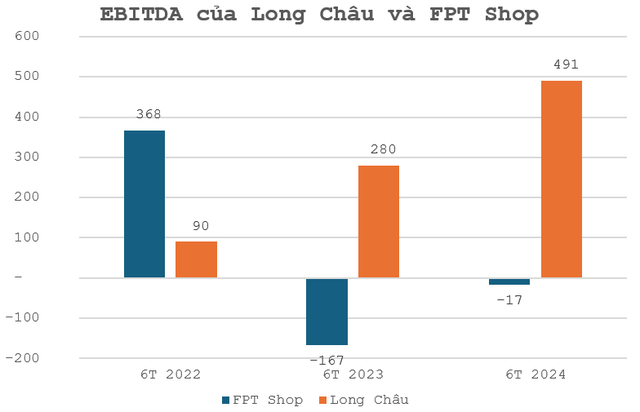

Long Chau achieved an impressive EBTDA (earnings before taxes, interest, depreciation, and amortization) of 491 billion VND. This demonstrates the strong performance and profitability of the pharmaceutical business.

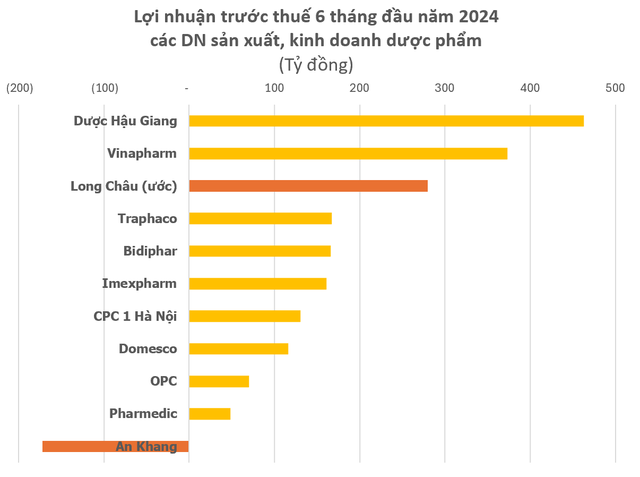

As FPT Retail does not disclose detailed figures, the ICT segment’s performance, managed by the parent company, is reflected in the parent company’s financial statements. However, based on the available data, we estimate that the pre-tax profit for FPT Retail is over 270 billion VND, while the consolidated net profit for the entire system is reported at 160.5 billion VND.

In recent quarters, Long Chau’s revenue has consistently grown due to its expansion strategy. On the other hand, the ICT segment’s revenue has been declining amid challenges in the retail industry. As of Q3 2023, the pharmaceutical segment’s revenue officially surpassed that of the ICT segment. Additionally, Long Chau is carrying the weight of FPT Retail’s profitability as FPT Shop reported losses (with the parent company reporting a loss of 112 billion VND in the first half of the year).

With our estimated figure of over 270 billion VND in profits for the first half of 2024, Long Chau has outperformed many established names in the pharmaceutical and healthcare industries, including Traphaco, Bidiphar, and Imexpharm.

Other large pharmacy chains are struggling to turn a profit. The Gioi Di Dong’s financial statements reveal that the An Khang pharmacy system incurred a loss of over 170 billion VND in the first half of this year, with cumulative losses now exceeding 800 billion VND.

FPT Long Chau was established in 2017 with four pharmacies on Hai Ba Trung Street, Ho Chi Minh City. Today, the chain boasts over 1,700 pharmacies across all 63 provinces and cities in Vietnam.

In early August 2024, FPT Retail established FPT Long Chau Investment Company to manage the group’s investment in the Long Chau pharmacy chain. When asked about the new entity, FRT replied, “FRT is currently restructuring the ownership of Long Chau through an investment company to facilitate future capital mobilization. In terms of consolidated financials, there is no profit or loss impact.”

LONG CHAU’S POTENTIAL IN THE NEXT TWO YEARS

In a recent report, SSI Research expressed optimism about Long Chau’s prospects, attributing it to their expansion strategy and improving profit margins. They forecast that Long Chau will open 400 new pharmacies each year in 2024 and 2025, as modern commercial pharmacies still have room to capture market share from small and hospital pharmacies (which currently hold over 85% of the market). This expansion will be accelerated in rural areas, where public healthcare facilities are limited, driving patients to seek reputable private pharmacists.

As a result, Long Chau is projected to operate 1,900 and 2,300 pharmacies by the end of 2024 and 2025, respectively.

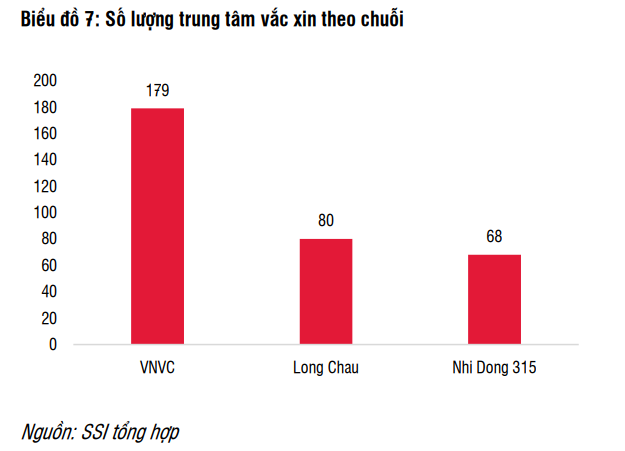

In the vaccine segment, Long Chau aims to have 100 vaccine centers by the end of 2024 and plans to open 150 more in 2025 to capture the growing demand. SSI Research anticipates this segment to operate at a loss in 2024 and 2025, with vaccine revenue expected to contribute 4% and 9% to Long Chau’s total revenue in 2024 and 2025, respectively.

The vaccine market is significantly smaller than the pharmaceutical market (approximately $666 million compared to $8.5 billion in 2023). Therefore, vaccine revenue is likely to remain a small portion of Long Chau’s total revenue until 2025.

Long Chau began opening vaccine centers in Q4 2023, and this segment is currently loss-making due to initial setup costs. However, FPT Retail believes that there is potential for long-term growth in vaccination demand and has decided to expand this model starting in 2024.

The vaccine centers will be strategically located next to Long Chau pharmacies to attract existing customers. As of May 2024, FPT Retail operated 80 vaccine centers across 37 provinces and cities nationwide.

As a late entrant into the vaccine market, Long Chau may take time to establish expertise and build trust with customers. However, they possess several key strengths:

First, Long Chau has a customer base of 16 million and a nationwide network of pharmacies, allowing them to cross-sell vaccine services. While the three leading vaccine chains focus on services for mothers and infants, Long Chau’s vaccine centers can potentially attract a larger customer base by leveraging their existing pharmacy customers.

Long Chau’s current customers are primarily adults with chronic illnesses and compromised immune systems. As a result, these customers are encouraged to get vaccinated against preventable diseases, such as pneumonia and influenza, to avoid further weakening their immune systems.

Second, FPT Retail brings valuable management experience. With their proven ability to manage a large number of stores across Vietnam, FPT Retail can rapidly scale up Long Chau’s vaccine business to compete with VNVC.

According to SSI Research, Vietnam’s vaccine market size reached VND 16,000 billion in 2023, a 14% increase from the previous year. They attribute the sustained demand for vaccines to the growing need for key vaccines such as HPV, pneumococcal, and influenza vaccines (accounting for 33%, 22%, and 10% of the total vaccine market in Vietnam, respectively). This demand is driven by the low vaccination rate in Vietnam (below 5%) as these vaccines are not included in the government’s free vaccination program.

Therefore, SSI Research expects private vaccination centers to benefit from the increasing demand for vaccinations (projected to grow at 10-15% in the next few years) and the trend toward choosing private vaccination services over public ones. Long Chau is well-positioned to be one of the major beneficiaries of this shift.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.