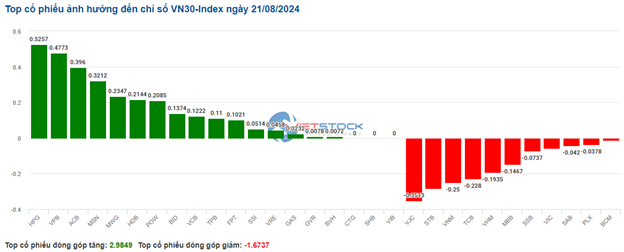

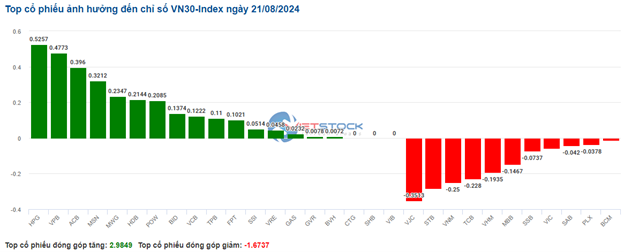

Stocks in the VN30 basket showed an interspersed pattern of increases and decreases, but buying power still dominated. Specifically, HPG, VPB, ACB, and MSN contributed 0.53, 0.48, 0.4, and 0.32 points to the overall index, respectively. In contrast, VJC, STB, VNM, and TCB faced strong selling pressure, deducting over 1 point from the VN30-Index.

Source: VietstockFinance

|

The telecommunications services sector recorded the strongest growth in the market. Notably, VGI rose by 2.95%, CTR by 0.71%, YEG by 0.3%, and ELC by 0.42%. On the other hand, a few small-cap stocks continued to trade in the red, including MFS, down 1.75%, SGT, down 0.36%, and DST, down 3.13%.

From a technical perspective, the telecommunications services index remained range-bound following a significant correction since mid-July 2024, while trading volume consistently stayed below the 20-session average, indicating investors’ cautious sentiment. Additionally, the sector index found decent support from the SMA 100-day moving average, as the MACD and Stochastic Oscillator indicators turned upward, generating buy signals. This suggests that the sector’s recovery prospects could improve in the coming period if capital inflows strengthen.

Source: https://stockchart.vietstock.vn/

|

Following this upward trajectory was the energy sector, with the majority of gains concentrated among the industry’s heavyweights, such as oil and gas companies. BSR rose by 0.83%, PVS by 1.49%, PVD by 1.27%, and PVB by 4.21%.

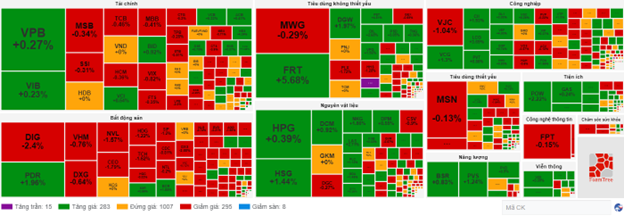

Meanwhile, the real estate industry witnessed a slight decline, with the sell-off spreading across the sector. Specifically, DIG fell by 2.4%, VHM by 0.63%, DXG by 0.32%, and NVL by 1.18%. On the upside, a few stocks managed to stay in the green, including PDR, which climbed by 2.44%, NTL by 0.2%, and KBC by 0.37%.

Compared to the opening, the market continued to witness a tug-of-war between buyers and sellers, with over 1,000 stocks trading near the reference price. The number of advancing and declining stocks was relatively balanced, with 283 gainers and 295 losers.

Source: VietstockFinance

|

Opening: A tug-of-war from the start

At the start of the August 21 session, as of 9:40 am, the VN-Index edged slightly higher, but caution prevailed as it fluctuated around the reference level. However, the index received positive contributions from the telecommunications and energy sectors.

Large-cap stocks, including BID, GAS, and HPG, led the market higher, adding nearly 1.5 points to the index. On the flip side, stocks like CTR, VCB, and VPB dragged the market lower, resulting in a net loss of over 0.5 points.

The market was predominantly green during the morning session, with several telecommunications services stocks outperforming from the get-go: VGI surged by 3.98%, CTR by 1.09%, ELC by 1.09%, FOX by 0.53%, VTK by 1.73%, and YEG by 0.55%.

The energy sector also contributed positively to the overall market performance, led by stocks such as BSR, PVD, PVS, and PVC, which rose by 2.08%, 1.81%, 2.73%, and 3.73%, respectively.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.