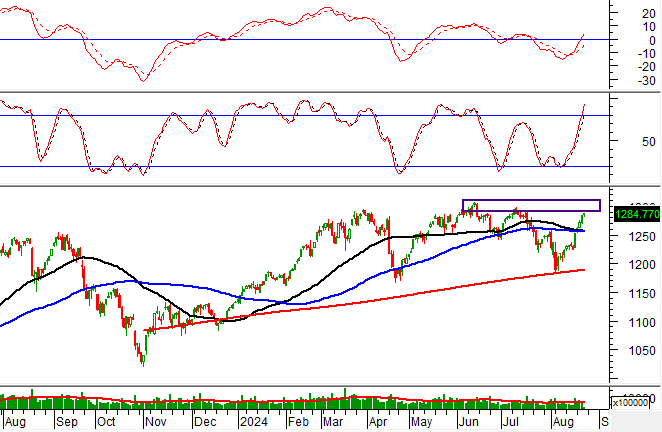

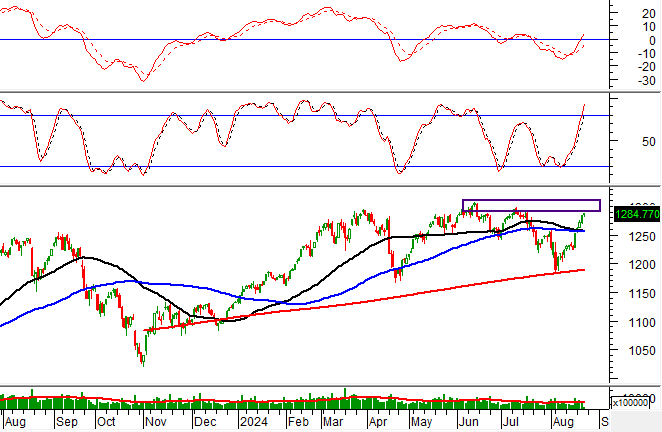

Technical Signals for the VN-Index

During the morning trading session of August 22, 2024, the VN-Index witnessed a rise in points, while trading volume declined, indicating investors’ cautious sentiment.

Currently, the VN-Index is retesting the old peak from June 2024 (around 1,290-1,310 points) as the Stochastic Oscillator indicator delves deeper into overbought territory. If sell signals reappear and the index fails to breach this resistance level successfully, the risk of a downward correction increases in upcoming sessions.

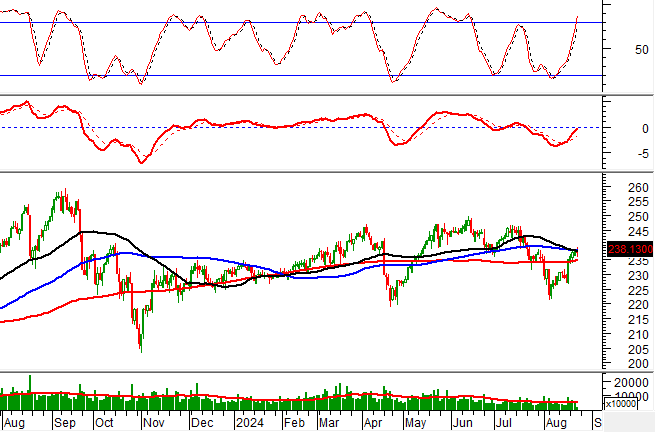

Technical Signals for the HNX-Index

On August 22, 2024, the HNX-Index witnessed a decline in points and formed a candle pattern resembling a High Wave Candle, accompanied by a significant drop in trading volume during the morning session, reflecting investors’ uncertainty.

Additionally, the index is retesting the group of SMA 50 and SMA 100 day lines, while the MACD indicator continues its upward trajectory after previously giving a buy signal. Should the buy signal be sustained and the index successfully breaches this resistance level, the medium-term optimistic outlook will be further reinforced.

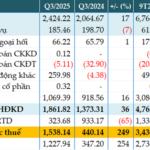

CMG – CMC Technology Group Joint Stock Company

On the morning of August 22, 2024, CMG witnessed a surge in price, accompanied by trading volume surpassing the 20-session average, indicating investors’ optimistic sentiment.

Furthermore, the stock price rose above the Middle line of the Bollinger Bands, and the Stochastic Oscillator indicator maintained its upward trajectory after previously signaling a buy, reinforcing the stock’s current bullish trend.

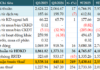

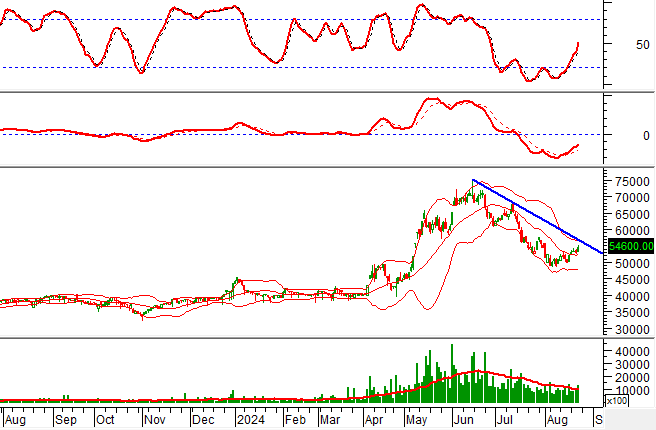

VRE – Vincom Retail Joint Stock Company

On August 22, 2024, VRE witnessed a substantial price increase and formed a White Marubozu candle pattern, accompanied by above-average trading volume, indicating active participation from investors.

Additionally, the stock price broke out of its short-term downward trendline, and the MACD indicator continued to widen the gap with the Signal line after previously giving a buy signal, suggesting that the short-term recovery scenario is gradually materializing.

Technical Analysis Team, Vietstock Consulting Department