Illustrative image

DongA Bank, a joint-stock commercial bank in Vietnam, has announced a new interest rate for savings accounts, effective today (August 21). The bank has increased interest rates for most maturities.

Specifically, for the term savings account with an annual interest rate of 365 days, DongA Bank has raised the interest rate for 1-2 month terms by 0.3% per year, to 3.6% per year. The interest rate for 3-5 month terms has also been increased by 0.1% per year, now standing at 3.6% per year.

For terms ranging from 6 to 11 months, the bank offers an interest rate of 4.9% per year, reflecting an increase of 0.4% per year for 6-8 month terms and 0.2% per year for 9-11 month terms.

DongA Bank maintains the interest rates for 12 and 13-month terms at 5.3% and 5.6% per year, respectively. These are the highest interest rates currently offered by the bank.

In addition, DongA Bank continues to offer a “special interest rate” of up to 7.5% per year for customers who deposit a minimum of VND 200 billion for 13 months or more.

Meanwhile, the interest rate for 18-36 month terms has been significantly increased by 0.5% per year, now standing at 5.2% per year.

Source: DongA Bank

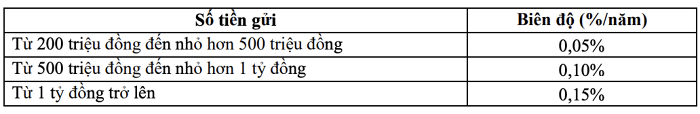

Furthermore, DongA Bank is still offering additional interest rates based on the amount deposited. For deposits ranging from VND 200 million to less than VND 500 million, the bank offers an additional 0.05% per year. Deposits ranging from VND 500 million to less than VND 1 billion will receive an additional 0.1% per year, while deposits of VND 1 billion or more will enjoy an additional 0.15% per year.

With these additional interest rates, customers who deposit VND 1 billion or more at DongA Bank can earn an interest rate of up to 5.75% for a 13-month term.

Source: DongA Bank

This is the second time in August that DongA Bank has increased its savings interest rates. Previously, on August 8, the bank had raised interest rates for terms ranging from 1 to 11 months, with adjustments of up to 0.5% per year.

Since the beginning of August, 13 banks have increased their savings interest rates, including Agribank, Eximbank, HDBank, Sacombank, Saigonbank, TPBank, CB, VIB, DongA Bank, VPBank, Techcombank, VietBank, and SHB. On the other hand, three banks, namely Bac A Bank, SeABank, and OCB, have lowered their savings interest rates.

Compared to previous months, the pace of interest rate hikes has slowed down in terms of both the number of banks and the frequency of adjustments. However, deposit interest rates are still expected to face upward pressure in the last few months of 2024.

In a recent analysis report, MBS Securities predicted that, amidst the rapid credit growth, which is three times faster than the growth of capital mobilization, banks are aggressively increasing deposit interest rates to enhance the competitiveness of savings accounts compared to other investment channels in the market.

The analysts believe that the interest rates on deposits will continue to rise in the second half of 2024 due to the increasing demand for credit. They expect the 12-month deposit interest rate of large joint-stock commercial banks to increase by another 0.5 percentage points, reaching 5.2-5.5% per year by the end of 2024.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Latest ACB Bank Interest Rates for February 2024: Highest Yields for Online Deposits 12 Months

The highest deposit interest rate currently offered by ACB is 5% per year, for a 12-month term with a minimum deposit amount of 5 billion VND, earning interest at the end of the term.