Illustrative image

|

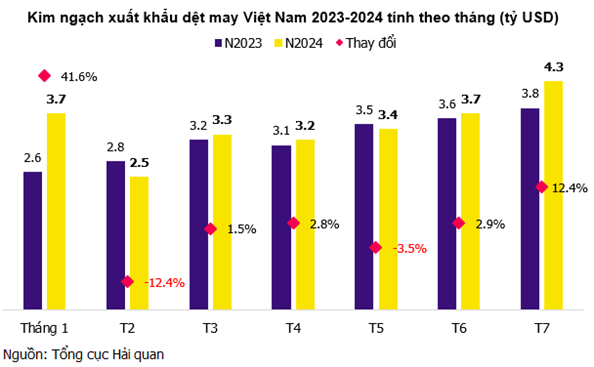

According to preliminary statistics from the General Department of Customs, the textile and garment industry’s export turnover in July 2024 reached nearly $4.3 billion, an increase of over 12% compared to the same period last year. This is the first month in 2024 that the textile and garment export turnover has surpassed the $4 billion mark, and it is also the month with the highest turnover since August 2022. In the first seven months, the industry’s total export turnover increased by nearly 6% compared to the same period last year, with a value of $23.9 billion.

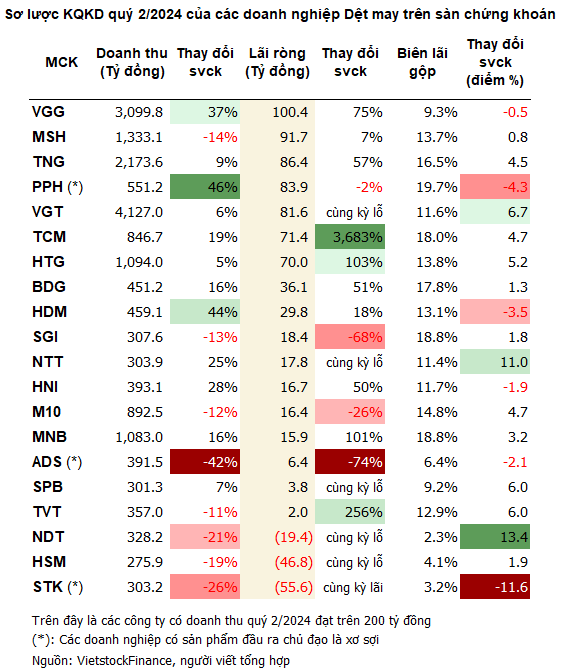

The business picture of textile and garment enterprises also has some bright spots, but the recovery is uneven. Data from VietstockFinance shows that, among the 32 textile and garment enterprises on the two stock exchanges that announced their second-quarter results for 2024, 13 enterprises increased profits, 8 enterprises decreased profits, 5 enterprises returned to profit, 4 enterprises continued to make losses, and 2 enterprises switched from profits to losses.

The total revenue and net income of the enterprises reached more than VND 20,352 billion and over VND 652 billion, respectively, up 5% and 89% compared to the same period last year, mainly due to the low base in 2023. The gross profit margin improved from 10% in the same period last year to over 13%.

A multi-colored picture, not just rosy

There were 11/32 textile and garment enterprises that achieved net profit growth in the second quarter, with increases of over 50% compared to the same period last year. Thanh Cong Textile Garment Investment Trading Joint Stock Company (TCM) achieved a profit growth of nearly 38 times compared to the same period last year, reaching over VND 71 billion. However, if the third quarter of 2021 (due to losses) is excluded, the second quarter of 2023 was the lowest profit period in more than a year, hence the high growth rate for TCM this quarter. The company said it had improved productivity, efficiency, reduced waste, and optimized revenue and profits.

| TCM has the highest quarterly profit in nearly 2 years |

|

|

Similarly, compared to the low base, triple-digit profit growth was also achieved by Mirae Joint Stock Company (KMR) with a 12.5 times increase to VND 3.4 billion; Vietnam Victory Joint Stock Company (TVT) with a 3.6 times increase to VND 2 billion; and Tien Son Thanh Hoa Joint Stock Company (AAT), X20 Joint Stock Company, Hoa Tho Garment Joint Stock Company (HTG), and May Nha Be Joint Stock Company (MNB), all of which doubled compared to the same period last year.

The champion of profit in the second quarter of 2024 was May Viet Tien Joint Stock Company (VGG), with a profit of over VND 100 billion, an increase of 73%. The company attributed this to a nearly 37% increase in revenue to nearly VND 3,100 billion and a rise in profit from joint ventures and associates of nearly VND 11 billion.

The revenue champion for the second quarter was the “giant” Vinatex (VGT), with a revenue of over VND 4,100 billion, an increase of 6%. In the first six months, the company’s revenue reached nearly VND 8,100 billion, accounting for more than 21% of the total revenue of the group.

The achievement of TNG Textile Joint Stock Company was a record revenue of nearly VND 2,200 billion, an increase of 9% over the same period last year. The company attributed this to the exploitation of difficult and complex product lines. As a result, net income reached over VND 86 billion, the highest in nearly two years and an increase of 57% compared to the same period last year.

May Song Hong Joint Stock Company (MSH) had a revenue of over VND 1,300 billion, a decrease of 14% compared to the second quarter of 2023, mainly due to some orders that had been produced but were scheduled for export at the beginning of July. However, higher financial income helped improve net income by 7%, reaching nearly VND 92 billion.

In the group of fiber and yarn enterprises, Vinatex’s subsidiary, Phong Phu Corporation (PPH), was a bright spot in terms of revenue growth, achieving a revenue of over VND 551 billion, an increase of 46%, the highest growth rate in the industry. However, the faster growth in total expenses caused net income to decrease slightly by 2% to below VND 84 billion.

Damsan Joint Stock Company (ADS) had an unfavorable business period, recording a revenue of VND 391.5 billion, a decrease of 42% compared to the same period last year. Net income was only VND 6.4 billion, a plunge of 74%. This was due to a 30% decrease in cotton and yarn prices, which led the company to operate at only 80% capacity.

Century Yarn Joint Stock Company (STK) surprised the market with a record loss of VND 55.5 billion in the second quarter, far worse than the profit of over VND 37 billion in the same period last year. This was due to low sales and the occurrence of shutdown costs included in the cost of goods sold. During the period, the company shut down many machines to limit the increase in finished product inventory as market demand was weak.

The other enterprises that did not make a profit in the second quarter were Hanoi Textile Garment Joint Stock Company (HSM), which lost nearly VND 47 billion; Nam Dinh Textile One Member Limited Company (NDT), which lost more than VND 19 billion; FORTEX Joint Stock Company (FTM) and Everpia Vietnam Joint Stock Company (EVE), which both lost VND 9 billion. Garmex Saigon Joint Stock Company (GMC) reduced its loss from VND 12.5 billion to less than VND 500 million, supported by income from the liquidation of unused assets.

Only one enterprise achieved its profit plan ahead of schedule

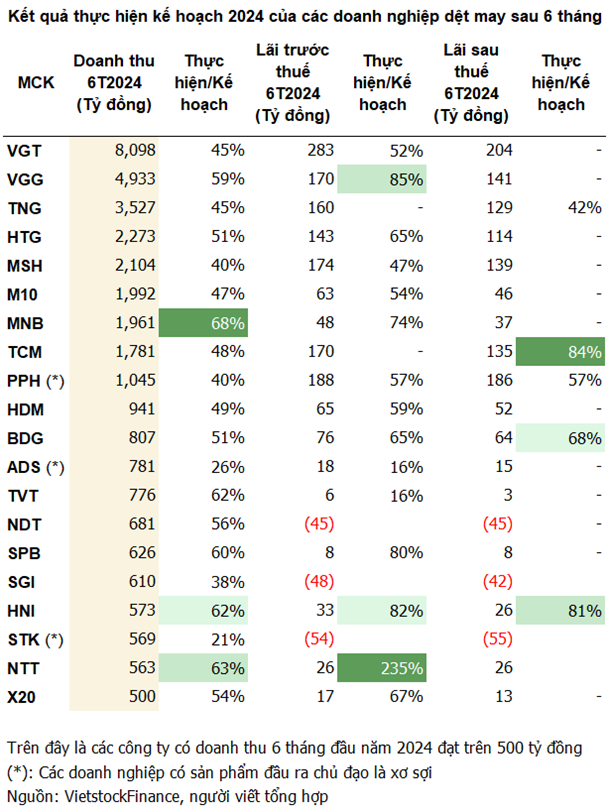

In 2024, textile and garment enterprises had bright expectations, with business plans for revenue and profit mostly increasing based on the context of exports returning to growth in the first months of the year, in contrast to the gloomy situation in 2023.

After six months, only Nha Trang Textile and Garment Joint Stock Company (NTT) announced that it had exceeded its annual profit plan by 135%. Meanwhile, 12 textile and garment enterprises have achieved more than half of their 2024 profit targets, and 4 units have completed four-fifths of their plans, including VGG, TCM, May Huu Nghi Joint Stock Company (HNI), and Phu Bai Fiber Joint Stock Company (SPB).

So far, no textile and garment enterprise has achieved its 2024 revenue plan. Leading the “race” to the finish line are MNB, NTT, and HNI, which have achieved 62-68% of their annual revenue plans.

Opportunities for order diversion

Commenting on the picture of the textile and garment industry in the first six months, Mr. Tran Nhu Tung, Chairman of the Board of Directors of TCM, said that the growth in textile and garment exports was partly due to the low base in 2023. “Last year was the bottom, and we are recovering, but we have not reached the level of 2022, so we cannot be too optimistic about the textile and garment industry,” said Mr. Tung.

In a recent sharing, Mr. Vu Duc Giang, Chairman of the Vietnam Textile and Apparel Association (VITAS), said that although the Vietnamese textile and garment industry has shown positive signs, the growth is due to the shift of orders from other countries to the Vietnamese market, rather than an increase in global consumption.

Mr. Giang also said that enterprises have had orders until the end of November 2024, and domestic manufacturing enterprises expect stronger growth towards the end of the year, with the goal of exporting $44 billion worth of goods in 2024.

On the other hand, analysts believe that Vietnamese textile and garment enterprises may benefit from the difficulties faced by Bangladesh, the world’s garment capital, as the unstable situation in this country continues.

According to SSI Securities Corporation’s research center (SSI Research), many factories in Bangladesh have closed, so customers will consider transferring orders to other countries, including Vietnam.

Agribank Securities Company’s analysis team (Agriseco Research) also holds the same view, stating that export garment enterprises in Vietnam can expect to receive orders diverted from Bangladesh. Currently, it is also the peak season for garment exports to serve the year-end holiday season.

In the long run, FDI enterprises will definitely consider finding a country to replace Bangladesh in the textile and garment supply chain due to the unstable situation and potential risks of disruption. Meanwhile, Vietnam has many advantages, such as cheap and skilled labor, preferential policies to attract FDI enterprises, and improving infrastructure.

With this positive information, many stocks of textile and garment enterprises have surged, with some even reaching historical peaks, such as the share price of May Mac Binh Duong Joint Stock Company (BDG) on August 12, which reached VND 37,500 per share, an increase of more than 20% since the beginning of July.

Similarly, the share price of TNG is on an upward trend and approaching the historical peak of VND 29,500 per share set in April 2022. Some other textile and garment stocks have also recorded good increases, such as HTG, M10, VGT, and TCM.

|

Performance of some textile and garment stocks since the beginning of 2024

Source: VietstockFinance

|

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.