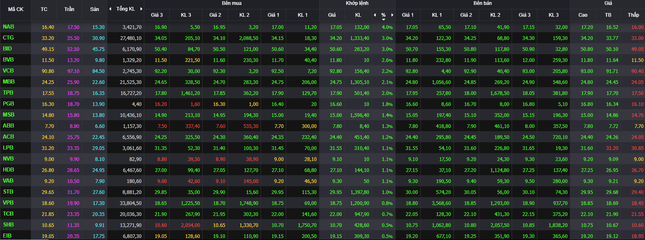

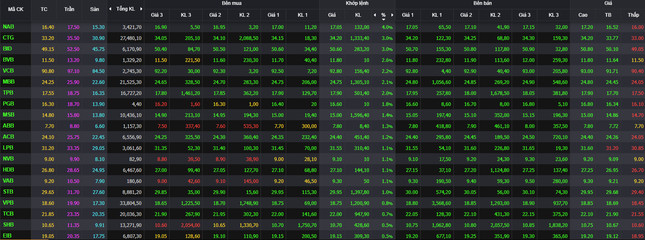

After a tug-of-war around the reference price in the morning session, the market broke out post-lunch, driven by the strong consensus among large-cap stocks. The stalemate ended as bank stocks resumed their leadership role, with significant capital inflows. CTG recorded the highest liquidity on the exchange, with a trading value of over 928 billion VND.

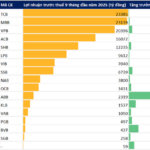

Banks played a crucial role in pushing the VN-Index towards its previous peak.

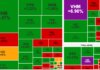

The Big4 pillars, comprising state-owned banks such as VCB, BID, and CTG, were the main contributors to the upward momentum. VCB alone contributed 2.7 points to the index, closing 2.2% higher at 92,800 VND per share. The entire banking sector was painted green, except for a slight decline of 0.2% in VIB.

Tomorrow, August 22, is the ex-dividend date for VIB, which will distribute bonus shares to its shareholders at a ratio of 17%. VIB will issue approximately 431.3 million additional shares, valued at 4,312.6 billion VND. Following this issuance, VIB’s chartered capital is expected to reach 29,681 billion VND.

Within the VN30 group, 23 out of 30 stocks posted gains, with the most significant increases observed in bank stocks such as BID, CTG, VCB, and MBB.

Meanwhile, real estate stocks witnessed a notable cool-down after a strong performance yesterday. The sector returned to differentiation, with some stocks maintaining modest gains of 1-2%, including PDR, CII, and SCR.

The broader market also exhibited differentiation, with 174 declining stocks. The VN-Index’s ascent relied mainly on a few large-cap stocks, while sectors like oil and gas, and technology witnessed high consensus. Oil and gas stocks such as OIL, PET, PVC, POW, and BSR all advanced. Notably, the Ho Chi Minh City Stock Exchange (HoSE) received an application for the listing of 3.1 billion BSR shares from Binh Son Refining and Petrochemical Joint Stock Company.

From 2020 to 2023, BSR could not list its shares on HoSE due to non-compliance with criteria regarding overdue debts related to its subsidiary, Central Petroleum Biofuel Joint Stock Company.

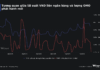

At the closing bell, the VN-Index climbed 11.5 points (0.9%) to 1,284.05 points. The HNX-Index rose 1.11 points (0.47%) to 238.42 points, while the UPCoM-Index gained 0.38 points (0.4%) to reach 94.48 points. Liquidity remained unchanged from the previous session, with a matching value of nearly 17,900 billion VND. Foreign investors net sold over 325 billion VND, focusing on HPG, MWG, MSN, and TCB.