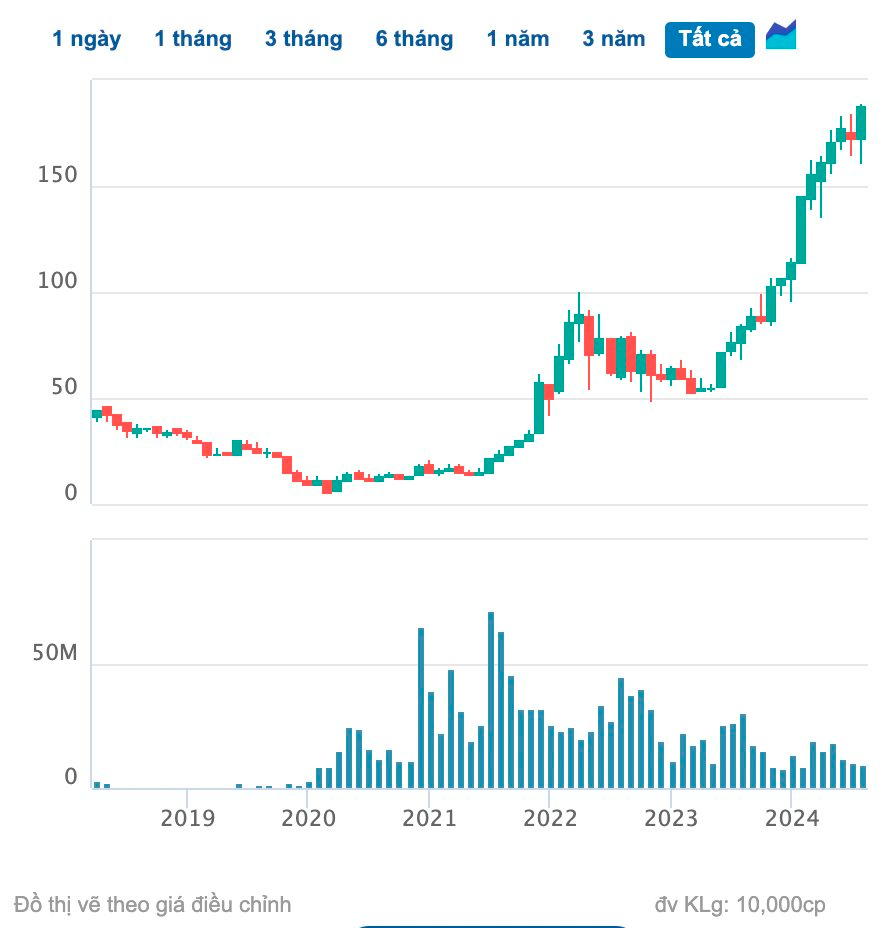

FPT Retail’s share price (ticker: FRT) soared to a new high of VND 188,000 per share on August 21, a 6.82% increase from the previous session, with a trading volume of nearly 2.2 million, more than quadrupling the previous day’s volume.

This marks a new peak for the company in its listing history.

The company’s market capitalization has now surpassed VND 25,600 billion.

FRT has been attracting substantial investor interest lately, driven by positive macroeconomic factors and the strong growth trajectory of the retail sector.

Additionally, investors are optimistic about FPT Retail’s pharmaceutical business.

In its 2024 semi-annual audited financial statements, FPT Retail disclosed impressive results for its Long Chau chain.

FRT soars to new heights. (Source: FRT)

Long Chau contributed VND 11,521 billion to FPT Retail’s revenue, a 67% year-over-year increase. The pharmaceutical segment now accounts for 63% of the company’s total revenue. Long Chau’s earnings before interest, taxes, depreciation, and amortization (EBTDA) stood at VND 491 billion.

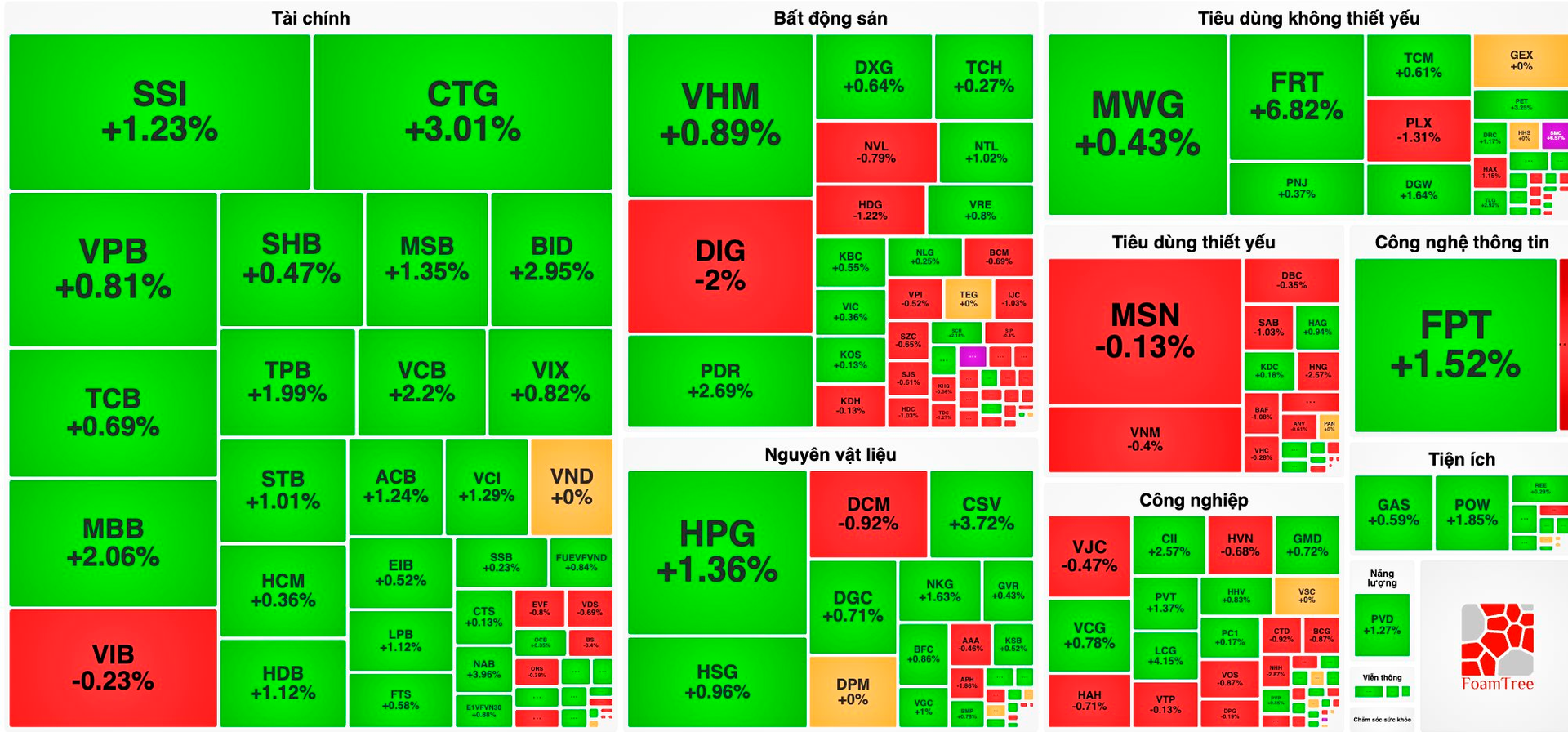

Turning to another member of the “FPT family,” FPT Corporation’s shares (ticker: FPT) climbed 1.52% to VND 133,500 per share, with a trading volume of over 6.1 million, nearly doubling the previous session’s volume.

However, FPT’s share price is still shy of its early July peak of nearly VND 140,000 per share.

VN-Index Surges for the Fourth Consecutive Session, Breaching the 1,280-Point Threshold

Riding the wave of market enthusiasm, buyers overwhelmed sellers, propelling the benchmark VN-Index to its fourth straight gain, with a remarkable advance of over 50 points, decisively surpassing the 1,280-point level.

At the close, the VN-Index climbed 11.5 points to 1,284.05. The HNX-Index advanced 1.11 points to 238.42, while the UPCoM-Index rose 0.38 points to 94.48.

Market liquidity continued to improve, with total trading value across the three exchanges surpassing VND 23,100, and HoSE alone witnessing a turnover of over VND 20,650 billion.

Buyer momentum overwhelms sellers, driving the VN-Index higher for the fourth straight day.

In addition to the two aforementioned FPT-related stocks, bank stocks continued to steer the market. Notably, six out of the top ten stocks influencing the VN-Index were from this sector: VCB (+2.2%), BID (+2.95%), CTG (+3.01%), MBB (+2.06%), ACB (+1.24%), and VPB (+0.81%).

Moreover, numerous other bank stocks witnessed price increases during the session, including STB (+1.01%), TPB (+1.99%), MSB (+1.35%), HDB (+1.12%), NAB (+3.96%), and others.

In the real estate sector, the scoreboard was split between gainers and losers. While stocks like VHM, VRE, VIC, PDR, DXG, TCH, KBC, KOS, NLG, NTL, and NHA remained in the green, DIG, NVL, KDH, HDG, BCM, VPI, KHG, HDC, SZC, and SJC dipped into the red.

Foreign investors turned net sellers on the HoSE, offloading a net value of nearly VND 220 billion. HPG of Hoa Phat Group topped the selling list, with a net sell value of over VND 151 billion. This was followed by MWG (VND 112.01 billion), VPB (VND 77.08 billion), and MSN (VND 74.51 billion), among others.