Oil prices slip further as US job data disappoints investors.

Oil prices slipped by $1 per barrel on Friday, following the US government’s downward revision of several key employment statistics closely watched by investors. Brent crude fell by $1.15, or 1.49%, to $76.05 per barrel, while WTI crude dropped by $1.24, or 1.69%, to $71.93 per barrel, by the end of the trading session on August 21st.

The US Department of Labor revealed that employers had created fewer jobs than initially reported in the year up to March 2024. The total number of jobs created from April 2023 to March 2024 was revised down by 818,000.

Natural Gas Prices in the US Dip by 1%

Natural gas prices in the US fell by 1% due to excess gas supply and warmer weather forecasts for the next two weeks than previously expected. The price of natural gas for September 2024 delivery on the New York Mercantile Exchange (NYMEX) dipped by 2.1 US cents, or 1%, to $2.177 per million British thermal units (mmBTU).

Gold Prices Fluctuate Near Record Highs, Palladium Reaches One-Month Peak

Gold prices dipped but remained near record highs following the release of the latest Federal Reserve meeting minutes, indicating that officials are leaning towards cutting interest rates at the upcoming policy meeting in September 2024. Spot gold on the London Bullion Market Association’s (LBMA) spot market rose by 0.1% to $2,516.01 an ounce, after hitting a record high of $2,531.60 in the previous session. Meanwhile, gold futures for December 2024 delivery on the New York Mercantile Exchange (COMEX) dipped by 0.1% to $2,547.50 an ounce.

Following the Fed’s meeting minutes, the US dollar fell to its lowest level in over seven months, and the yield on the 10-year US Treasury note dropped to its lowest level in more than two weeks. Palladium prices rose by 2.7% to $951 an ounce, its highest level in over a month.

Aluminum Prices Dip as Investors Cash In Profits, Lead Reaches Three-Week Peak

Aluminum prices dipped as investors cashed in on recent gains, with three-month aluminum on the London Metal Exchange (LME) falling by 1% to $2,478 a ton after plunging as much as 2% to $2,452.50 a ton earlier in the session. The US dollar came under pressure after data revealed that US employers had created fewer jobs than initially reported in the year up to March 2024, raising concerns about the health of the labor market ahead of the expected interest rate cut in September 2024.

Lead prices on the LME rose by 1.5% to $2,085 a ton after touching a three-week high of $2,089.50 a ton, supported by a 21% drop in inventories in Asia to 185,500 tons since the beginning of August 2024.

Iron Ore Prices Reach One-Week High, Steel Prices Climb

Iron ore prices on the Dalian Commodity Exchange rose to a one-week high as supportive measures for the property sector in China, the top consumer, raised hopes for improved demand in the coming months. The most-traded January 2025 iron ore contract on the Dalian Commodity Exchange ended daytime trading 4.58% higher at 742 Chinese yuan ($104.01) a ton, its strongest level since August 13th, 2024.

The September 2024 iron ore contract on the Singapore Exchange climbed 3.66% to $99 a ton, its highest since August 14th, 2024. On the Shanghai Futures Exchange, steel rebar rose by 2.5%, hot-rolled coil by 3.79%, wire rod by 1.76%, and stainless steel by 0.88%.

Rubber Prices in Japan Hit Eight-Week High

Rubber prices in Japan climbed to an eight-week high, boosted by gains in synthetic rubber prices. The rubber contract for January 2025 delivery on the Osaka Stock Exchange (OSE) rose by 8.1 Japanese yen, or 2.45%, to 339.1 Japanese yen per kilogram. During the session, it touched 339.4 Japanese yen, its highest since June 14th, 2024.

The January 2025 rubber contract on the Shanghai Futures Exchange rose by 135 Chinese yuan, or 0.84%, to 16,290 Chinese yuan ($2,284.46) per ton. Butadiene rubber futures for October 2024 delivery on the Shanghai Futures Exchange climbed by 145 Chinese yuan, or 1%, to 14,610 Chinese yuan ($2,048.60) per ton. Rubber prices for September 2024 delivery on the Singapore Exchange rose by 0.7% to 176.3 US cents per kg.

Robusta Coffee Prices Climb

Robusta coffee prices for November 2024 delivery on the London ICE Futures Europe exchange rose by $13, or 0.3%, to $4,632 a ton after hitting a one-month peak of $4,658 a ton earlier in the session. Arabica coffee for December 2024 delivery on the ICE Futures US exchange climbed by 0.3% to $2,492.50 per pound.

Sugar Prices on the Rise

Sugar prices climbed, with raw sugar for October 2024 delivery on ICE Futures US up by 0.08 US cent, or 0.5%, to 17.65 US cents per lb, after falling to 17.52 US cents in the previous session, its lowest since October 2022. White sugar for October 2024 delivery on ICE Futures Europe rose by 0.6% to $505.60 a ton.

Soybean and Corn Prices Advance, Wheat Retreats

Wheat prices on the Chicago Board of Trade (CBOT) fell due to ample global supplies and competitive exports from the Black Sea region. Soybean futures on the CBOT rose by 5-1/2 cents to $9.81-1/2 per bushel, corn futures gained 1/4 cent to $3.98-1/4 a bushel, while wheat futures dropped by 13-1/2 cents to $5.19-3/4 a bushel.

Palm Oil Prices Reach Two-Week High

Palm oil prices in Malaysia climbed to a two-week high, supported by expectations of lower output from Indonesia, the world’s top producer, although weaker export data capped gains. The benchmark palm oil contract for November 2024 delivery on the Bursa Malaysia Derivatives Exchange rose by 39 ringgit, or 1.05%, to 3,754 ringgit ($858.06) a ton. It touched 3,776 ringgit earlier in the session, its highest since August 6th, 2024.

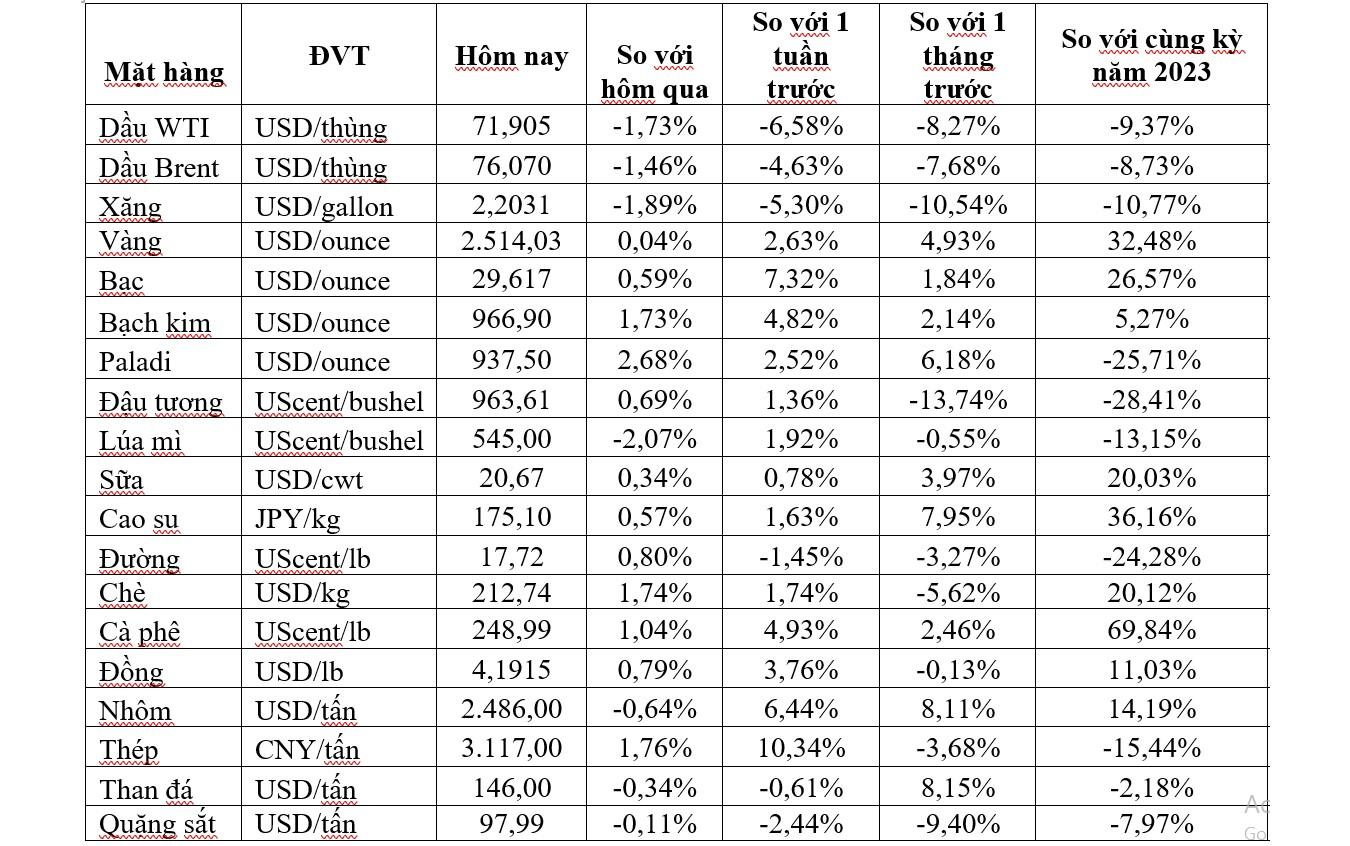

Prices of Key Commodities on August 22nd, 2024

Key commodity prices as of August 22nd, 2024.

Weekend Ending Sees Significant Gold SJC Price Drop

After surging to nearly 79 million dong per tael on February 2nd, the price of SJC gold is now plummeting towards the 78 million dong per tael mark this weekend.