Illustrative image

Prudential Vietnam Life Insurance Company Limited (Prudential Vietnam) has announced its semi-annual financial report for 2024, with total assets reaching nearly VND 182,282 billion by the end of June, up 3.2% from the end of 2023.

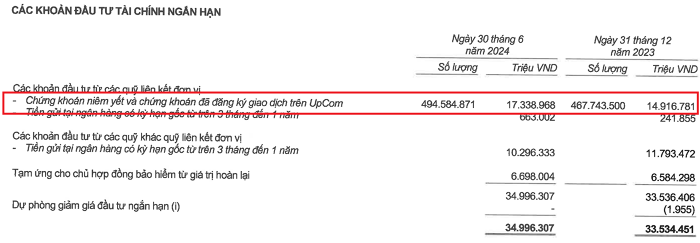

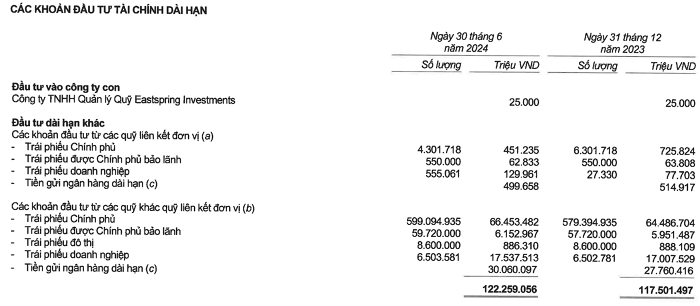

Of which, Prudential continues to expand its financial investment portfolio to over VND 157,300 billion, accounting for more than 86% of total assets. Specifically, short-term financial investments reached VND 34,996 billion, and long-term financial investments were VND 122,259 billion, up 4.4% and 4%, respectively.

With these figures, the scale of Prudential Vietnam’s investment portfolio is second only to Bao Viet Holdings and is one of the life insurance companies investing the most in the stock market.

Specifically, as of the end of June, the company held over 494.5 million listed securities and securities traded on the UPCoM system, worth more than VND 17,300 billion, up VND 2,400 billion compared to the end of 2023, equivalent to nearly half of the value of short-term financial investment portfolios. The rest is mainly in the form of bank deposits and prepayments to policyholders from the surrender value.

Prudential Vietnam did not disclose the details of its securities investment portfolio, but according to the information disclosed by banks, Prudential holds about 57.6 million CTG shares of VietinBank, 69.46 million shares in ACB, and 65.72 million shares in MBB. Referring to the prices on the stock market, these shares are worth about VND 5,000 billion.

Source: Prudential Vietnam’s Financial Statements

In terms of long-term financial investments, government bonds and bank deposits are the two largest investment items, amounting to nearly VND 67,000 billion and over VND 30,500 billion, respectively. In addition, Prudential Vietnam also holds more than VND 17,600 billion in corporate bonds and VND 6,200 billion in government-guaranteed bonds.

Source: Prudential Vietnam’s Financial Statements

With a huge investment portfolio, revenue from financial activities is the most important source of income for Prudential Vietnam and continues to show positive results in the first half of 2024. Specifically, net income from financial activities reached VND 6,187 billion, up 16.8% over the same period.

According to the explanation, Prudential Vietnam’s net income from financial activities increased due to the recognition of a gain of over VND 719 billion from the sale of investment securities, a significant improvement compared to the loss of VND 449 billion in the same period in 2023. Interest income from bonds, deposits, etc., remained stable compared to the previous year, at over VND 4,200 billion.

Meanwhile, the insurance business in the first half of the year lost VND 1,672 billion, while in the same period last year, Prudential Vietnam made a profit of VND 322 billion. This was due to a 13% decrease in net revenue from insurance business while operating expenses increased by 2.6%.

In the first half of 2024, Prudential’s sales expenses decreased by 22.7% to VND 2,117 billion, mainly due to a reduction in bonus and other benefit payments to insurance agents, as well as a decrease in customer workshop and promotion expenses. Administrative expenses increased slightly to VND 1,304 billion.

After deducting expenses, Prudential Vietnam’s pre-tax profit in the first half reached VND 1,092 billion, down nearly 32% over the same period last year.

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.