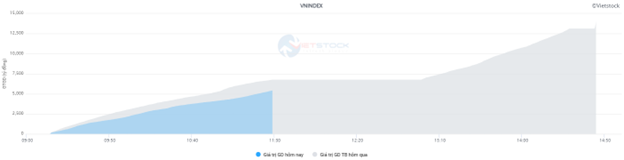

Cautious sentiment kept liquidity low in the morning session, with the trading volume of the VN-Index reaching nearly 247 million units, equivalent to a value of over 5.4 trillion VND. The HNX-Index recorded a trading volume of over 29 million units, with a value of nearly 470 billion VND.

Source: VietstockFinance

|

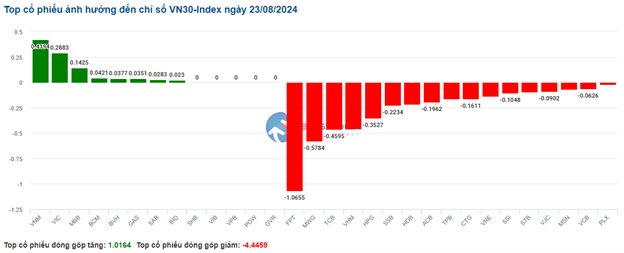

The VN30-Index closed the morning session down 6.19 points, or 0.47%, to 1,312.38. The stocks VHM (-1.1%), HPG (-1.2%), FPT (-0.9%) and CTG (-0.9%) were the biggest drags on the VN-Index, causing the index to lose nearly 2 points.

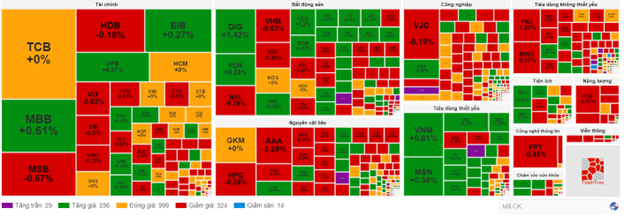

The red color is temporarily dominating across all sectors. Among them, the telecommunications services group ranked last with a decrease of 1.67%, with the main pressure coming from large-cap stocks such as VGI (-1.87%), FOX (-2.44%), and CTR (-0.16%). Meanwhile, many stocks rose strongly, such as CAB (+13.71%), GLT (+9.84%), VIE (+7.14%), SGT (+3.7%), and DST (+3.33%), but their small market capitalization meant they had little impact on the overall index.

The energy and information technology groups are also facing selling pressure, falling by around 1%. Many stocks declined by over 1%, including BSR (-1.24%), PVS (-1.23%), PVC (-1.47%); CMT (-2.58%), CMG (-1.83%), HPT (-1.41%), and so on.

Essential consumer goods and utilities services were the two sectors that saw the least decline and were mostly unchanged, supported mainly by large-cap stocks such as VNM (+0.54%), QNS (+0.21%), VHC (+2.37%); GAS (+0.12%), REE (+1%), HND (+1.48%), and more.

10:35 am: Cautious sentiment prevails as the VN-Index hovers around the reference level

Investors were relatively cautious, and trading volume did not improve much. As of 10:30 am, the VN-Index gained 0.44 points, trading around the 1,283 level. The HNX-Index increased by 0.15 points, trading around 238.

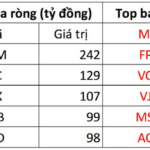

Stocks in the VN30 basket were mixed, but the sellers had a slight edge. Specifically, FPT, MWG, TCB, and VHM respectively subtracted 1.07 points, 0.58 points, 0.46 points, and 0.45 points from the overall index. On the other hand, VNM, VIC, MBB, and BCM remained in positive territory, contributing almost 1 point to the VN30-Index.

Source: VietstockFinance

|

The telecommunications services sector was the worst-performing group, falling by 1.17%. This decline was mainly driven by selling pressure in VGI (-1.44%), ELC (-1.02%), YEG (-2.06%), and FOX (-1.17%)…

The financial sector witnessed a mixed performance, with red stocks slightly outnumbering the green ones and exerting the most significant pressure on the overall index. Specifically, on the selling side, we saw TCB (-0.22%), MSB (-0.67%), HDB (-0.37%), and TPB (-0.83%). Conversely, some stocks maintained their upward momentum, including MBB (+0.61%), EIB (+0.27%), and LPB (+0.16%)…

On a more positive note, the essential consumer goods and utilities services sectors were the only two groups that managed to stay in positive territory since the beginning of the trading session, with gains of 0.16% and 0.14%, respectively. The consumer goods sector stood out with the presence of two giants, VNM (+0.67%) and MSN (+0.13%). Meanwhile, in the utilities sector, GAS (+0.47%), POW (+0.37%), and REE (+0.14%) contributed to the upward momentum.

Compared to the opening, the sellers have taken a more dominant position. There were 324 declining stocks versus 236 advancing stocks.

Source: VietstockFinance

|

Opening: Maintaining a slight gain

At the start of the August 23 trading session, as of 9:40 am, the VN-Index rose over 2 points to 1,285.6. Meanwhile, the HNX-Index also edged higher to 238.88.

The VN30 basket saw a slight majority of gainers, with 12 declining stocks, 13 advancing stocks, and 5 stocks remaining unchanged. Notably, some large-cap stocks, including BCM (+1.81%), VNM (+1.21%), MBB (+0.61%), and MSN (+0.51%), started the day on a positive note.

Stocks like VNM, GAS, and BCM were the main drivers of the market, contributing almost 1.5 points to the index. On the other hand, VCB, FPT, and DGC led the negative influences, but their impact was limited, with losses of less than 0.5 points.

![[On Seat 47] ‘EC40 Wants to Win, Volvo Vietnam Needs to Educate Customers: Using Electric Cars Without Public Charging Stations is Normal’](https://xe.today/wp-content/uploads/2024/12/v-quote-te-100x70.jpg)