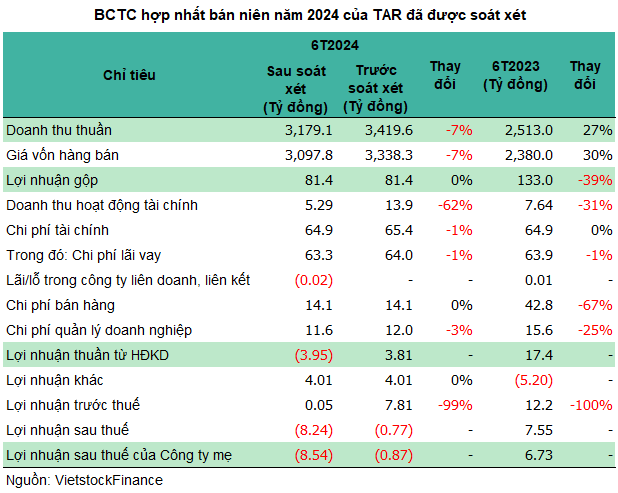

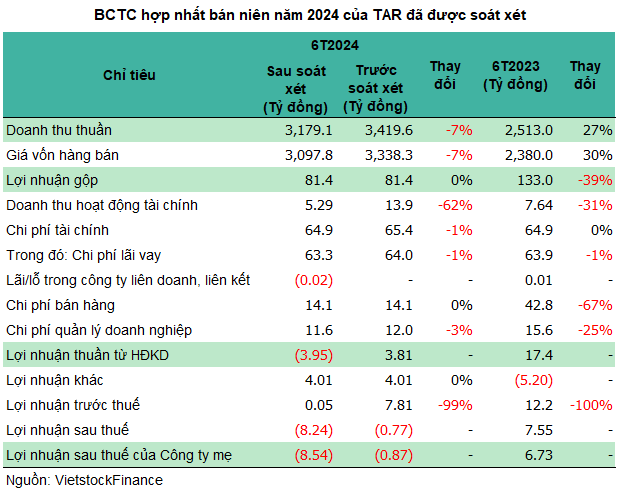

According to the consolidated semi-annual financial statements for 2024, TAR recorded a 7% decrease in net revenue compared to the self-prepared report, reaching nearly VND 3.2 trillion. The corresponding decrease in cost of goods sold kept gross profit unchanged at over VND 81 billion, with a thin gross profit margin of just 2.6%.

A notable point is the 62% drop in financial revenue compared to the self-prepared report, decreasing from nearly VND 14 billion to over VND 5 billion. As a result, TAR incurred a net loss of over VND 8.5 billion, an increase of nearly VND 900 million compared to the self-prepared report.

The company attributed this discrepancy to adjustments made by the auditor related to accrued interest income from fixed-term bank deposits and exchange rate differences arising from the revaluation of foreign currency-denominated bank loans.

Compared to the same period in 2023, TAR’s revenue for the first half of 2024 was 27% higher, but fell short of the net profit of VND 6.7 billion achieved in the previous year.

For the full year 2024, the company set a target of VND 3,100 billion in consolidated net revenue and VND 31 billion in after-tax profit. In the first six months, TAR has exceeded the full-year revenue target but has not yet turned a profit.

Notably, AASCS, a financial accounting and auditing consultancy firm, has once again declined to express an opinion on TAR’s semi-annual financial statements for 2024. The auditors are awaiting the results of an investigation by relevant authorities into issues raised in the Conclusion of Inspection of the State Securities Commission of Vietnam (SSC) dated September 13, 2023, including the ownership of 15 million TAR shares from the company’s private placement offering; the preparation of the private placement registration dossier in 2021; and information related to inventory data disclosed in the 2022 audited financial statements, valued at over VND 1,255 billion.

Due to the significance of these matters, the auditors were unable to assess and quantify their impact on TAR’s financial statements for the first six months of 2024, and therefore could not render an opinion.

On May 31, the Hanoi Stock Exchange (HNX) decided to place TAR on a restricted trading list, allowing trading only on Fridays, due to the auditor’s inability to express an opinion on the company’s 2023 financial statements. This was also the first day of trading for more than 78.3 million TAR shares on the UPCoM market. Since then, the share price of TAR has gradually declined and is currently trading at around VND 5,500 per share, representing a drop of over 25% in the past quarter.

| TAR share price movement since resuming trading on UPCoM |

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.