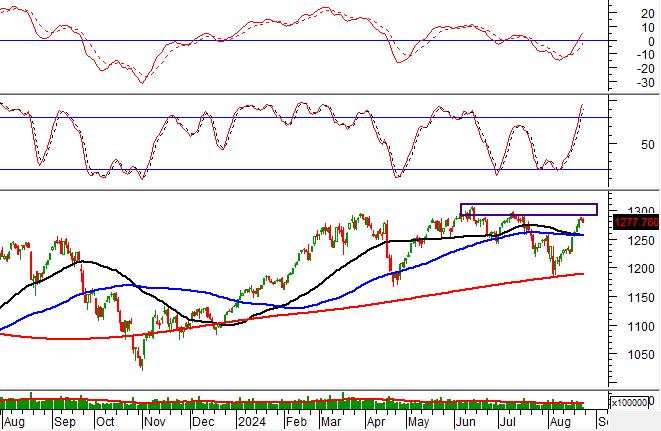

Technical Signals for VN-Index

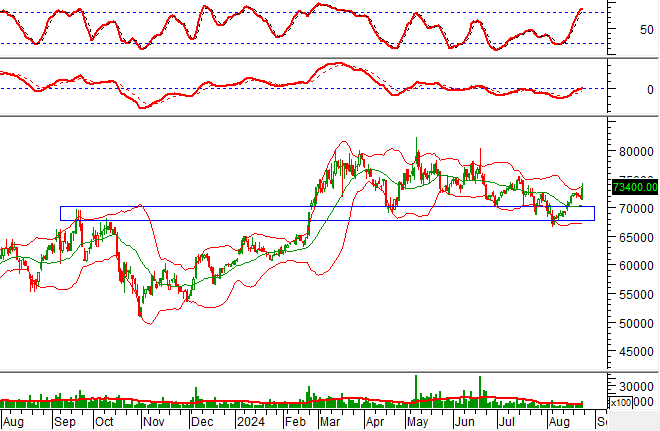

In the trading session on the morning of August 23, 2024, the VN-Index declined, along with a slight drop in trading volume in the morning session, indicating investors’ cautious sentiment.

Currently, the VN-Index remains above the 50-day and 100-day SMA lines, as the MACD indicator continues to rise, giving a previous buy signal. If the recovery momentum is maintained, the medium-term optimistic outlook will be further reinforced.

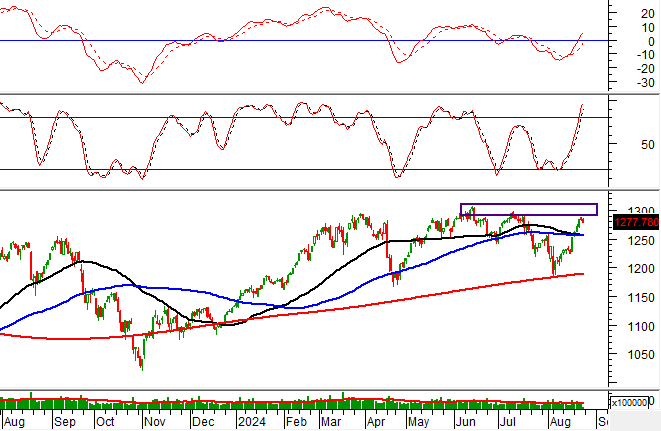

Technical Signals for HNX-Index

In the trading session of August 23, 2024, the HNX-Index witnessed a slight decline, with no significant improvement in liquidity, reflecting investors’ indecision.

Additionally, the HNX-Index is retesting the old bottom from June 2024 (corresponding to the 235-240 point range) as the Stochastic Oscillator indicator continues to rise, delving deeper into the overbought zone. Should a sell signal emerge again, and the index fails to retest this resistance level, the risk of a downward adjustment will heighten in the upcoming sessions.

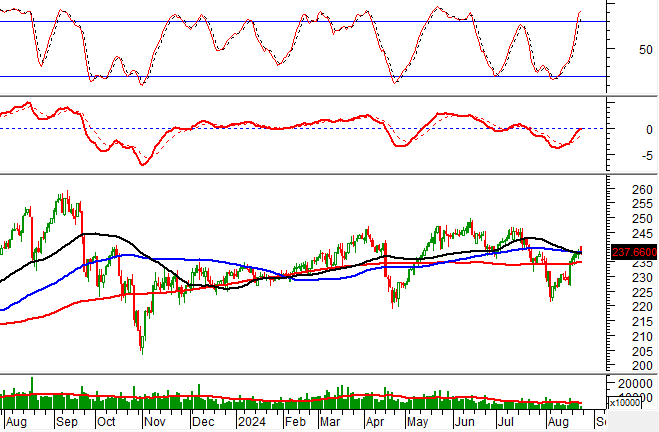

DIG – Investment and Construction Development Joint Stock Corporation

On the morning of August 23, 2024, DIG’s share price increased, along with a slight rise in trading volume, indicating investors’ optimism.

Additionally, the share price is testing the 50-day SMA line, as the MACD indicator continues to rise, giving a previous buy signal. If it successfully surpasses this resistance level, the medium-term optimistic outlook will return in the upcoming sessions.

VHC – Vinh Hoan Corporation

In the morning session of August 23, 2024, VHC’s share price rose, along with trading liquidity surpassing the 20-session average, indicating active trading among investors.

Additionally, the share price surged after breaking above the Middle line of the Bollinger Bands, as the Stochastic Oscillator indicator continues to rise, delving deeper into the overbought zone. Should a sell signal emerge again, potential volatility may occur in the upcoming sessions.

Technical Analysis Department, Vietstock Consulting