Vietnam’s stock market experienced significant volatility during the August 22 session. The VN-Index fluctuated between gains and losses, briefly turning positive, but ultimately closed in negative territory, down nearly 1.27 points to 1,283. Foreign investors’ net selling put pressure on the market, with a net sell value of nearly VND 545 billion across all exchanges.

In this context, securities companies’ proprietary trading bought a net VND 114 billion on the three exchanges.

On the HoSE exchange, securities companies’ proprietary trading bought a net VND 109 billion, including a net buy of VND 174 billion on the matching order channel but a net sell of VND 66 billion on the negotiated deal channel.

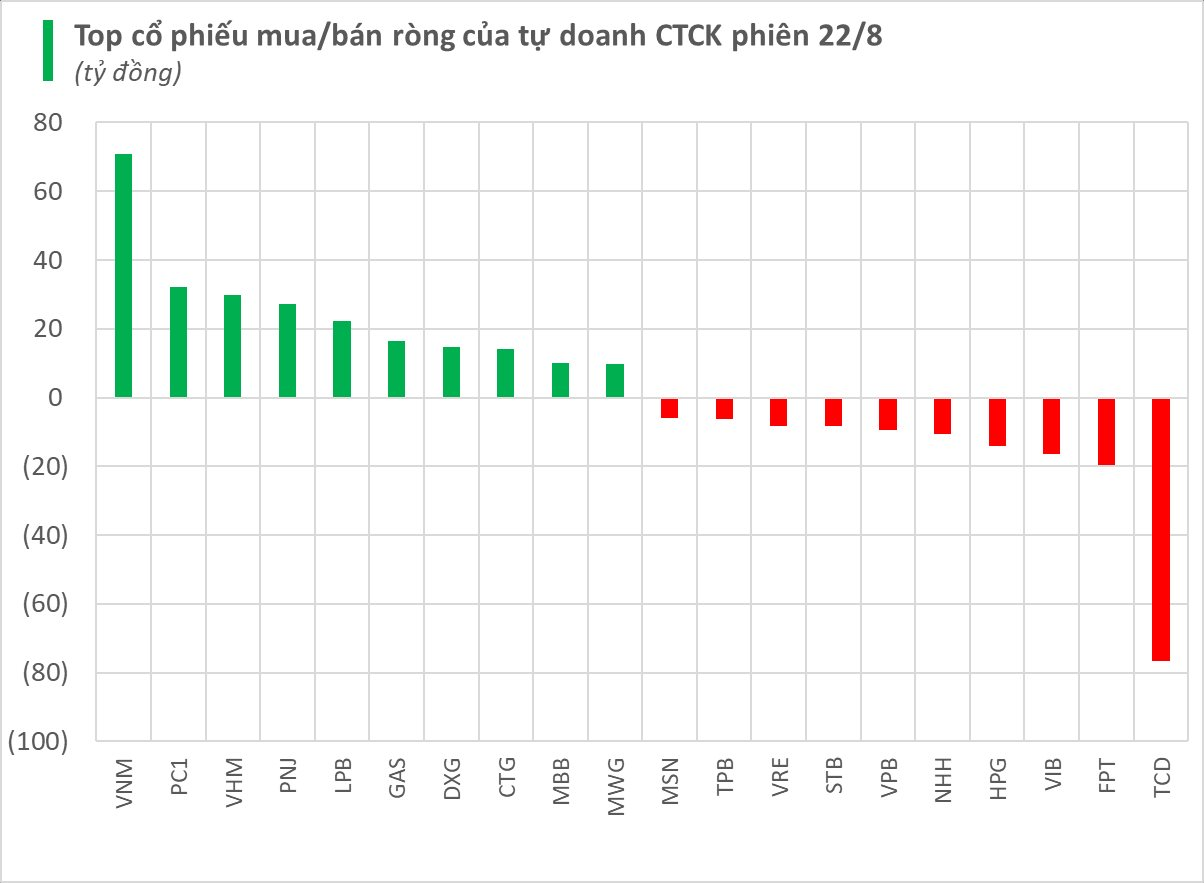

Specifically, the most net-bought securities by brokerage firms were VNM and PC1, with values of VND 71 billion and VND 32 billion, respectively. Additionally, securities such as VHM, PNJ, LPB, and GAS were also net bought during the session.

Conversely, the most net-sold securities by brokerage firms were TCD, FPT, and VIB, with net sell values of VND 77 billion, VND 20 billion, and VND 16 billion, respectively. HPG, NHH, VPB, and other securities were also among the net sells for the day.

On the HNX exchange, securities companies’ proprietary trading bought a net VND 5 billion, with PVS being the most net-bought security at VND 4 billion.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.