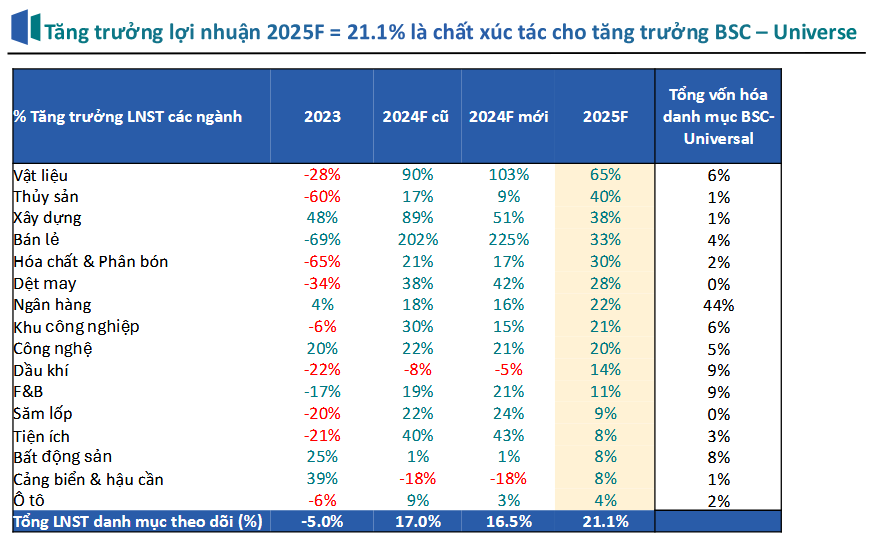

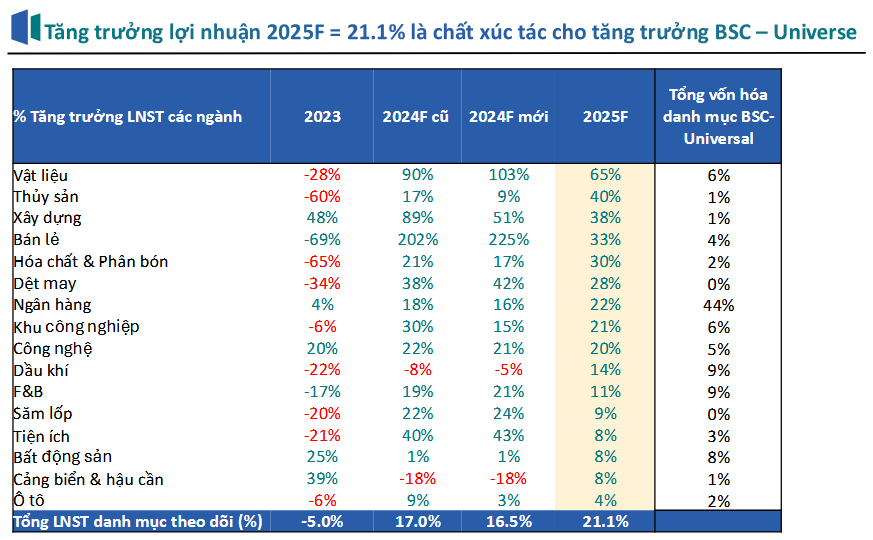

In their H2 2024 industry outlook report, BSC Securities assesses that with the expected easing of exchange rate pressure as the Fed cuts interest rates, the profit growth of enterprises in the latter half of 2024 will continue to be supported mainly by reduced borrowing costs, lower foreign exchange losses, and curtailed sales and management expenses, along with the low base of Q3 2023.

According to BSC, the non-financial sector will continue to lead, indicating the economic recovery trend and serving as the primary driver for market profit growth in the second half. BSC anticipates an improvement in the financial sector’s profit recovery as the economy rebounds, particularly for banks, which have seen three consecutive quarters of positive growth.

Additionally, BSC maintains a positive outlook for 2025 for the following sectors: Information Technology, Industrial Parks, Seafood, F&B Retail, Construction Materials, Textiles and Garments, Utilities, Banking, Chemicals and Fertilizers, Oil and Gas, and Marine Transportation.

Information Technology Sector: BSC anticipates that the performance of IT enterprises will remain positive in the second half of 2024, driven mainly by strong digital transformation demands in the Japanese and APAC markets and expected recovery in the US following the Fed’s rate cut in September 2024. This is coupled with trends in intelligent transportation system (ITS) investments and the development of 4G and 5G networks in Vietnam.

Real Estate – Industrial Parks Sector: BSC observes a slowing trend in FDI growth, attributed to political tensions and the global minimum tax policy implemented since 2024, while Vietnam lacks supportive policies, deterring large enterprises from expanding their production to Vietnam.

Decision 227/QD-TTg dated March 12, 2024, unlocked land use quotas, mainly in northern provinces such as Bac Ninh (+780 ha), Thai Binh (+700 ha), and Hung Yen (+360 ha). BSC expects this to facilitate the delivery of existing industrial park land (such as KBC’s Nam Son Hap Linh project) and expedite legal procedures for new industrial park projects (like DPR’s Bac Dong Phu Expanded project) in the latter half of 2024 and into 2025.

Textiles and Garments Sector: BSC foresees positive export order prospects for garment enterprises in the second half of 2024, driven by recovering demand in the US, low inventory levels, and improved orders and unit prices.

Seafood Sector: Regarding the outlook for the latter half of 2024 and 2025, BSC believes that tra fish export volume will continue its recovery trend, but export prices will not rebound as quickly and robustly as in the previous tra fish cycle (2021-2022).

Marine Transportation Sector: According to BSC, new fixed-term ship leasing contract rates will significantly improve compared to the same period in the second half of 2024, and self-exploited output and prices will recover.

Consumer – Retail Sector: BSC expects the performance of leading consumer and retail enterprises to maintain a positive trend in the second half of 2024 due to domestic economic stimulus policies driving the recovery of consumer demand, including maintaining the 8% VAT rate until the end of 2024 and increasing the basic salary from July 2024. These enterprises also leverage their competitive advantages to expand their customer base and market share, initially recording growth in business volume as demand has not improved significantly in 2024, and sustaining growth through anticipated increases in average unit prices in 2025.

Oil and Gas Sector: BSC holds a neutral view of the oil and gas sector in the second half of 2024 as the B – O Mon Lot has not yet officially received FID. However, BSC anticipates a more favorable situation in 2025, expecting oil and gas enterprises to achieve profit growth compared to 2024 due to a low base in 2024 (BSR) without comprehensive maintenance, recognizing revenue and profits related to the B – O Mon Lot project (PVS, PVB, PVD), and growth in LNG and LPG offsetting the decline in traditional gas as the Nhon Trach 3 plant comes online (GAS).

Fertilizer Sector: The fertilizer sector is expected to benefit from the VAT policy but faces rising production costs. Fertilizer prices are under pressure due to increased fertilizer imports, yet BSC maintains a positive outlook for fertilizer prices to recover in the latter half of the year due to improved demand for the winter-spring crop and sustained high agricultural produce prices.

Chemicals Sector: BSC anticipates a recovery in chemical consumption driven by rebounding chemical exports and increased demand for chemicals in electronic component manufacturing.

Deposit Interest Rate Reaches 40.1% by 2023, MB Holds Top Spot in CASA for 2nd Consecutive Year

Thanks to our pioneering efforts in digital banking, 2023 marks the third consecutive year that MB has attracted over 6 million new customers annually, bringing the total number of customers served to 27 million.