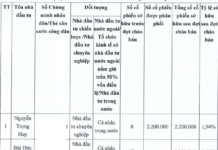

In particular, FIT intends to transfer 6 million shares issued by FC at a price of 9,000 VND/share to Can Tho Agricultural Technical Supplies JSC (HOSE: TSC). The purpose of the transfer is to restructure its investment portfolio. The corresponding value of the transfer is VND 54 billion.

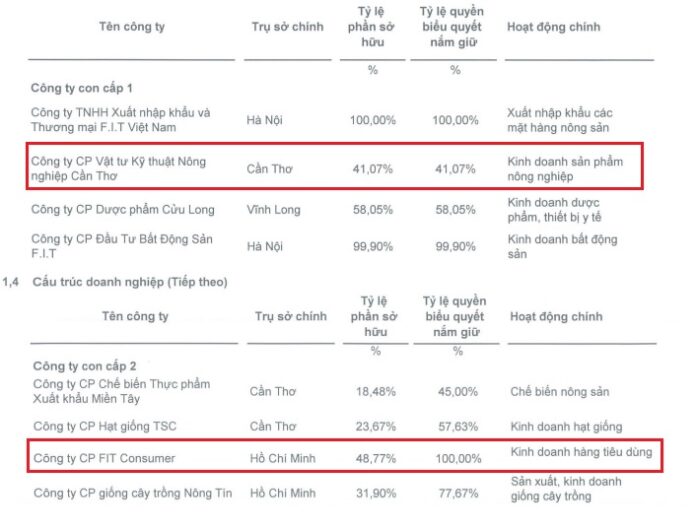

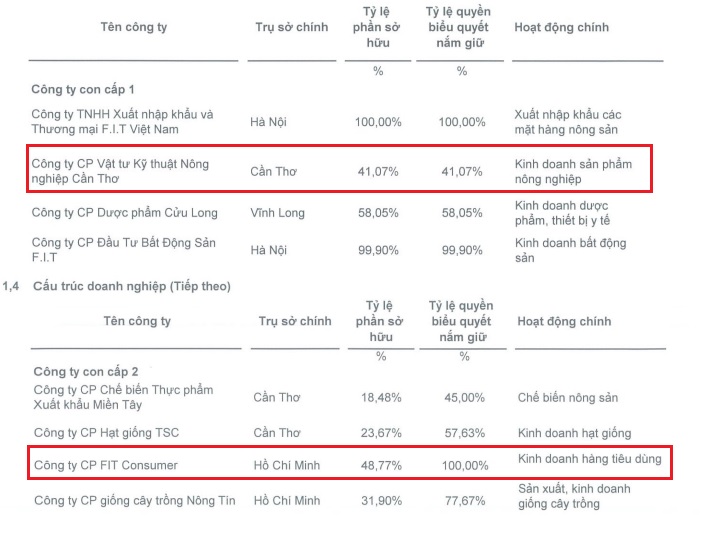

According to the resolution, the number of shares owned by FIT in FC prior to the transfer is 21.76 million, representing 16.27% of the total shares. However, according to the Q2/2024 financial statements, as of June 30, FIT held 48.77% with 100% voting rights, thus considering FC as a second-tier subsidiary of the Company. It is unclear why FIT’s percentage in the new resolution has decreased and whether this reduction affects its voting rights.

Following the completion of the transaction, FIT’s share ownership in FC further decreased to approximately 17.8 million, equivalent to 12.16% of the total shares.

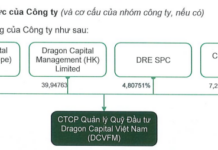

Also, according to the Q2/2024 financial statements, FIT holds only 41.07% of the shares in TSC, with an equivalent voting percentage, but classifies it as a first-tier subsidiary. In TSC’s Q2 financial statements, FIT is also recognized as the parent company. Therefore, this transaction can be considered as FIT transferring shares between its two subsidiaries.

|

Both FC and TSC are recognized as subsidiaries of FIT despite ownership percentages below 50%

Source: FIT

|

In terms of business performance, FIT has just experienced Q2 with a strong profit recovery compared to the same period last year. Specifically, revenue reached VND 468 billion, up 21%; net profit was VND 36 billion (compared to a loss of VND 204 billion in the same period last year). The main reason for this improvement was the adjustment of accounting entries in the previous period, recognizing the investment in Cap Padaran Mui Dinh JSC as an associate of FIT.

FIT’s Explanation for the 87% Drop in Reviewed Half-year Profit