Foreign Exchange Losses

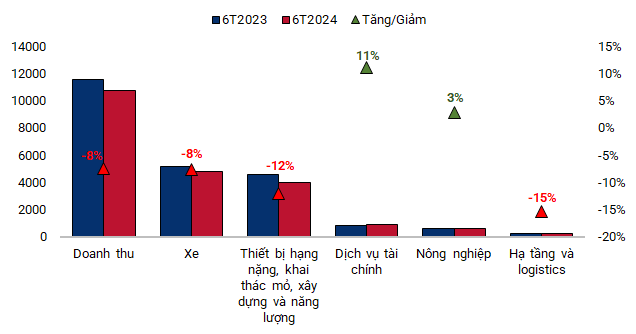

JC&C’s revenue for the first six months reached $10.7 billion, an 8% decrease due to losses in various segments. The automotive business brought in $4.8 billion in revenue, a nearly 8% drop. Heavy equipment, mining, construction, and energy contributed $4 billion, an 11% fall. Agriculture, infrastructure, and logistics didn’t fare much better, with respective contributions of $643 million and $228 million, reflecting decreases of 2.6% and 15%. The sole bright spot was the financial services segment, which improved by 11% to reach $941 billion.

While the cost of goods sold decreased proportionally, financial expenses of $167 million, a 55% surge due to increased borrowing in the heavy equipment and mining business, negatively impacted the period. This resulted in higher interest payments.

|

JC&C’s revenue structure for the first half of 2024 (in millions of USD)

Source: Author’s compilation

|

JC&C’s net income was $1.24 billion, a 22% decline, but only $483 million belonged to the parent company’s shareholders, representing a 25% retreat. However, when considering the impact of other factors, mainly foreign exchange rates, the parent company’s shareholders were left with just $77 million, a significant decrease compared to the $915 million in the same period last year.

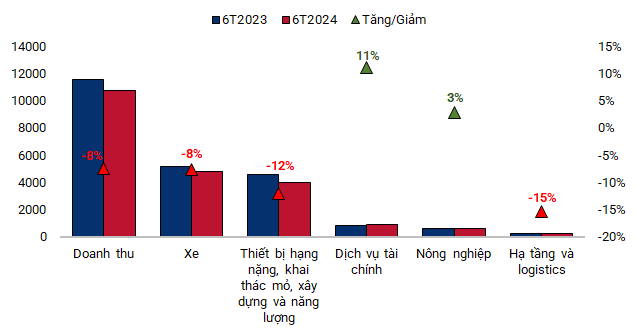

Astra International (Astra), in which JC&C holds a 50.1% stake, remained the group’s profit center, contributing $497 million, an 8% drop. Astra’s automotive segment posted a net profit of $345 million, a 3% decline, reflecting the low consumption in the market. Automobile sales volume decreased by 17%, reaching only 232,000 units, but market share increased from 55% to 57%. Motorcycle sales fell by 4% to 2.4 million units, and market share dropped from 80% to 77%.

The net profit from the heavy equipment, mining, construction, and energy segment decreased by 15% to $365 million. This was due to lower sales of heavy equipment and a decline in mining activity, caused by the drop in coal prices.

Financial services contributed $257 million, an improvement of 8%, thanks to the growth in the loan portfolio of Astra’s consumer finance businesses. The infrastructure and logistics division reported a 24% increase to $39 million, mainly due to improved traffic flow, which led to higher toll revenues. Astra operates 396 kilometers of toll roads along the Trans-Java network and the Outer Ring Road in Jakarta.

The agricultural segment was the most promising, bringing in $25 million, a remarkable 36% increase, attributed to higher sales and prices of crude palm oil and related extracted products.

Additionally, Tunas Ridean, in which JC&C holds a 49.9% stake, contributed $16 million, an 18% drop, due to lower profits from automobile operations and the impact of exchange rates. Motorcycle sales decreased by 16% to 123,000 units, while automobile sales fell by 4% to 22,000 units.

Profit by segment for Astra. Source: JC&C

|

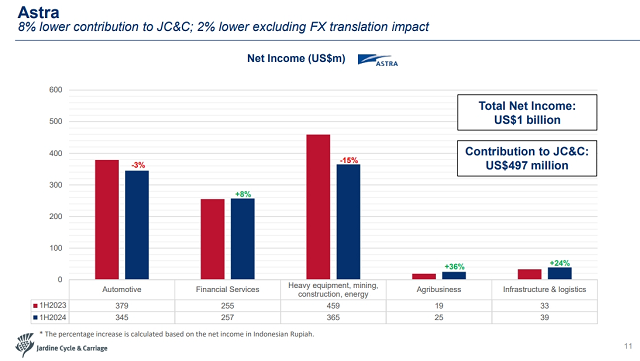

Contributions from REE and VNM declined

The three Vietnamese companies in this period contributed $31 million to JC&C’s profit, a 12% decrease compared to the same period last year. The most significant reduction came from Refrigeration Electrical Engineering Corporation (HOSE: REE), which contributed only $6.7 million, a 39% drop. Vinamilk (HOSE: VNM) contributed $8.4 million, a decrease of nearly $0.6 million. Meanwhile, the contribution from Thaco increased by 5% to reach $15.4 million.

According to the group, Thaco experienced a 10% increase in sales to 36,600 vehicles, and its market share rose from 21% to 23%, despite the impact of weak consumer demand. However, profits declined due to lower profit margins as a result of intensifying competition.

The investment in Refrigeration Electrical Engineering Corporation yielded lower contributions due to reduced demand for hydropower, which affected income from electricity production. The decrease in contribution from Vinamilk was purely due to exchange rate fluctuations.

According to JC&C, their businesses in Indonesia and Vietnam have faced weak consumer demand and lower commodity prices compared to previous highs. Additionally, the depreciation of local currencies in these countries has impacted the profit contributions recorded in US dollars.

Furthermore, JC&C’s other investments in Cycle & Carriage, Siam City Cement (holding 25.5%), and Toyota Motor Corporation (holding 0.09%) contributed a total of $25 million, a 13% decrease. This was mainly due to the decline in revenue from Cycle & Carriage, which distributes vehicles in Singapore, Malaysia, and Myanmar. Their contribution fell by almost half.

Profit contributions from the Vietnamese market. Source: JC&C

|

As of the end of the second quarter of 2024, JC&C’s total assets amounted to approximately $31.8 billion, remaining relatively stable compared to the beginning of the year, with two-thirds comprising long-term assets.

The value of investments in associates and joint ventures was slightly over $5.4 billion, a minor decrease from the previous $5.6 billion. The investment value in Thaco and REE at the end of the second quarter was $661 million and $276 million, respectively, reflecting decreases of approximately $8 million and $12 million.

The group’s total liabilities were about $14.6 billion. Short-term borrowings of non-financial services companies stood at $697 million, a significant reduction of half.

In addition to Astra, JC&C’s management also considers their investments in REE and Thaco (with current holdings of 34.9% and 26.6%, respectively) to be significant, based on the size and growth rate of these companies, despite their relatively small contribution to the overall results.

Focusing on the luxury electric vehicle market

When asked about the group’s strategy to counter competition from Chinese electric vehicle manufacturers and their plans for the next five years during the 2024 Annual General Meeting, JC&C’s management stated that the team is focusing on both the opportunities and threats presented by the development of electric vehicles.

Cycle & Carriage Singapore has recently become the distributor for the electric vehicle brand Ora and will be launching smart electric vehicles in the latter part of the year. JC&C also represents Mercedes-Benz and Kia, both of which have electric vehicle strategies within their portfolios.

According to the group, in Indonesia, Toyota and Astra are the market leaders in hybrid vehicles, accounting for approximately 80% of new electric vehicle sales in 2023.

Regarding the growth potential of Mercedes-Benz electric vehicles in the Asian market, the company’s management stated that they “will continue to lead the market in the luxury electric vehicle segment in Singapore and Malaysia through Mercedes-Benz.” They added that “even the cars of the senior management are gradually being replaced with electric vehicles.”

In terms of investments, JC&C recently signed an agreement to sell its entire 25.54% stake in Siam City Cement (SCCC) to Sunrise Equity Co., Ltd., a current shareholder of SCCC and part of the Ratanarak Group, which controls a total of 46.35% of SCCC’s shares.

Previously, through the Platinum Victory Pte. Ltd. fund, JC&C had filed for a public offering to acquire additional shares of REE and successfully increased its ownership to 34.93%. In July, the group registered to purchase an additional 4 million shares, aiming to own 35.7%, but this is still pending approval from the regulatory body due to ownership exceeding the 35% threshold.

Similarly, through United Tractors, JC&C invested $81 million in PT Supreme Energy Rantau Dedap, a company that owns a geothermal project in Sumatera, Indonesia.

JC&C targets the luxury electric vehicle segment through Mercedes-Benz

|

Largest taxi company in Nghệ An cancels car purchase contract with Toyota to switch to VinFast

Mr. Ho Chuong, CEO of Son Nam International Transport Co., has recently disclosed that he had previously signed contracts to purchase gasoline-powered vehicles from a Japanese car manufacturer. However, he has since diversified his investment portfolio by also venturing into VinFast electric vehicles, in order to embrace long-term and sustainable development.

Drivers only need to pay a deposit of over 2 million VND to buy Selex Motors electric motorcycles

Selex Motors has partnered with the United Nations Development Programme (UNDP) in two projects to provide smart financial support packages for drivers of delivery companies when purchasing the Selex Camel electric motorcycles in Hue and Ho Chi Minh City.