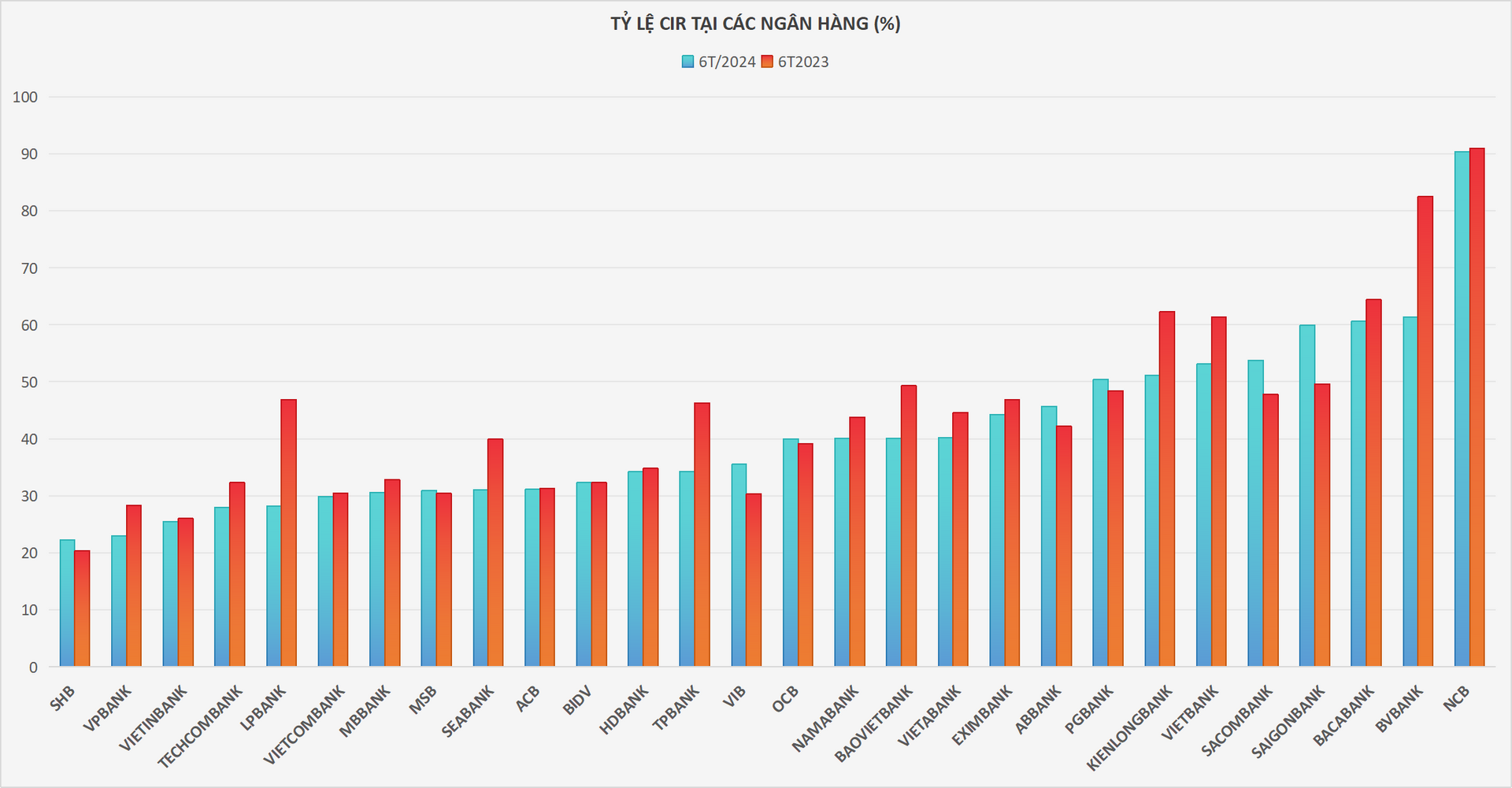

The Cost to Income Ratio (CIR) is a key metric in evaluating a bank’s operational efficiency. It indicates the percentage of a bank’s total operating costs in relation to its total revenue, with a lower CIR ratio being preferable.

Financial reports from 29 banks for the first half of 2024 revealed significant improvements in CIR for most institutions, with 20 out of 29 members recording lower CIR compared to the same period last year. The average CIR for this group stood at 31.7%, a 1.5-percentage-point decrease from the first half of 2023.

SHB maintained its position as the bank with the lowest CIR, registering a slight increase to 22.9%, up by 1.9 percentage points from 2023.

VPBank climbed to second place with a CIR of 23%, a notable reduction of 5.2 percentage points compared to the previous year. This improvement was driven by a 17.5% increase in total operating income and a 4.28% decrease in total operating costs.

VietinBank ranked third with a CIR of 25.5%, a 0.5-percentage-point decrease from the previous year.

Techcombank retained its fourth position, recording a CIR of 28%, a significant improvement of 4.2 percentage points.

LPBank surpassed Vietcombank to enter the top 5 banks with the lowest CIR in the industry. LPBank’s CIR decreased by a substantial 18.7 percentage points to 28.2%, the second-highest reduction in the industry for the first half of the year.

The remaining banks in the top 10 lowest CIR included Vietcombank (29.9%), MB (30.6%), MSB (30.9%), SeABank (31%), and ACB (31.1%).

BVBank led the industry with the most significant CIR reduction of 21.1%. Other banks that showed notable improvements included TPBank (down 12.1%), KienlongBank (down 11.2%), BaoVietBank (down 9.2%), SeABank (down 9%), VietBank (down 8.2%), and VPBank (down 5.2%).

Conversely, banks such as VIB, OCB, ABBank, PGBank, and Sacombank experienced increases in their CIR for the first half of the year. Notably, Saigonbank’s CIR rose by a significant 10.3%.

In a recently published report on the banking sector, Vietcombank Securities (VCBS) forecasted that operational cost optimization would be one of the main drivers of the industry’s profit growth, estimated at around 10% for 2024, along with capital cost optimization and growth in non-interest income.

Specifically, banks are expected to continue their focus on digital transformation and enhanced governance efficiency while managing operating costs to maintain profitability.

However, the report also highlighted that investment costs for technology are currently in a cycle of significant increase as banks strive to enhance their competitiveness and comply with stricter regulations regarding security and safety in payment activities.

Regarding capital cost optimization, VCBS suggested that private banks have an advantage due to their higher proportion of non-term deposits (CASA) and flexibility in capital mobilization, allowing them to optimize capital costs and improve profitability.

In terms of non-interest income, VCBS anticipated that some banks might record extraordinary income from upfront fees in cross-selling insurance (bancassurance), profits from the sale of subsidiaries, or recovery of previously written-off bad debts.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

![VPBank Proudly Presents G-DRAGON 2025 WORLD TOUR [Übermensch] IN HANOI as Title Sponsor](https://xe.today/wp-content/uploads/2025/10/screen-sho-2-100x70.png)