The real estate market in Ho Chi Minh City has experienced a slowdown recently, with fewer people engaging in property purchases and sales. A staff member from a notary office in the former District 9 (now Thu Duc City) shared that their office has seen a decrease in customers due to the “ghost month” (the seventh month of the lunar calendar) and the implementation of the new Land Law, effective August 1, 2024. This has resulted in a backlog of tax-related documents and land use fee calculations, causing a decrease in the number of notarized documents as well.

A similar situation is observed in a notary office in District 5, where customer traffic has been low. This is not an isolated incident, as notary offices in districts 5 and 3, as well as Hoc Mon and Cu Chi counties, tend to be less busy compared to those in the eastern part of the city. According to a notary staff member in District 5, the number of documents and customers varies from day to day, but there has been a significant decrease compared to the beginning of 2022.

Notary offices in Ho Chi Minh City seeing fewer customers. Photo: Tieu Bao

The new Land Law of 2024 and Decree No. 103, which regulate land use fees and land rent, have introduced changes in the way these fees are calculated, leading to a backlog of land-related documents in the city. The Tax Department of Ho Chi Minh City has recently submitted a report to the city’s People’s Committee regarding the resolution of land-related documents since August 1, 2024.

According to the Tax Department, the Decision No. 02/2020 of the Ho Chi Minh City People’s Committee, which sets the land price framework for the period of 2020-2024, will remain in effect until December 31, 2025. However, there are some discrepancies when applying this decision to cases where the land price is determined by the land price table as stipulated in Article 159 of the Land Law 2024.

One of the issues pertains to the calculation of land use fees and land rent. Specifically, the Land Law 2024 applies the land price from the land price table to calculate these fees when the state recognizes land use rights or changes the land use purpose for households and individuals, regardless of whether it is within or outside the land allocation limit for households and individuals.

In contrast, the previous Land Law of 2013 only applied the land price from the land price table to calculate land use fees when the state recognized land use rights for households and individuals for areas within the allocation limit. For areas exceeding the limit, a specific land price was applied, which was determined by multiplying the land price in the 2020-2024 land price table by a coefficient (K) for 2024.

Another discrepancy pointed out by the Tax Department relates to the calculation of personal income tax from real estate transfers. According to Article 247 of the Land Law 2024, taxable income from real estate transfers is determined by the transfer price for each transaction. In the case of land-use right transfers, the taxable income is calculated based on the land price in the land price table. Previously, the taxable income for personal income tax calculation from land-use right transfers was not allowed to be lower than the land price announced by the Ho Chi Minh City People’s Committee.

Due to these discrepancies, tax offices in Ho Chi Minh City have temporarily halted the processing of land-related documents received after August 1, 2024, causing a slowdown in real estate transactions and notary services.

New Land Use Fee Regulation Proposed for Certificate Granting

The Ministry of Finance is seeking comments on the draft Government’s Decree on land use fees and land rents in accordance with the Land Law 2024, which proposes new regulations on exemptions and reductions in land rents, and the calculation of land use fees when granting land use right certificates…

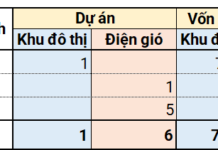

Numerous irregularities in the ecological urban area project on both sides of the Da River of the HUD4 Company

The Thanh Hoa Provincial Inspectorate has pointed out numerous irregularities and violations at the Eco-Urban Area project along the two banks of the Do River, invested by HUD4 Investment and Construction Corporation. Thereby, the Thanh Hoa Provincial Inspectorate identified the need to collect nearly 100 billion VND in land use fees.

“Vice Premier Requests Incorporation of Feedback to Ensure Quality of Two Crucial Land-Related Decrees”

On July 1st, Deputy Prime Minister Tran Hong Ha chaired a meeting with government ministries, experts, and real estate association representatives to review and finalize two draft decrees. The decrees pertain to land use and rental fees and detailed regulations for implementing the Land Law.