On August 14, 2024, the company announced the issuance of the BCMH2427004 bond series, with a value of VND 300 billion and a 3-year maturity.

Specifically, the BCMH2427004 bond series was issued in the domestic market, with a volume of 3,000 bonds, a face value of VND 100 million per bond, and a corresponding issuance value of VND 300 billion.

The bond issuance and completion took place on the same day, August 14, 2024, making the maturity date August 14, 2027.

The bonds are secured by land-use rights in an urban area, specifically Lot No. 138, Map Sheet No. 78, Hoa Phu Ward, Thu Dau Mot City, Binh Duong Province. The land area measures 15,004.7 square meters, as per the Land Use Right Certificate No. CY 375734, issued by the Binh Duong Department of Natural Resources and Environment on February 8, 2021.

In terms of interest rates, the BCMH2427004 bond series offers a combined interest rate, with a six-month interest payment period. The interest rate for the first interest payment period is set at 10.5% per annum, while subsequent periods will be based on the Reference Rate plus a margin of 4.0% per annum, but not less than 10.0% per annum.

The bond underwriter is the Bank for Investment and Development of Vietnam (BIDV), and the related organization is BIDV Securities Joint Stock Company (BSC).

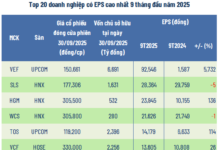

According to data from the Hanoi Stock Exchange (HNX), Becamex has completed the issuance of three bond series since the beginning of the year: BCMH2427001 with a value of VND 800 billion, BCMH2427002 with a value of VND 200 billion, and the aforementioned BCMH2427004.

Thus, Becamex has issued and completed the issuance of three bond series totaling VND 1,300 billion in value since the start of 2024.

Additionally, if we include the BCMH2328003 bond series issued on December 29, 2023, and completed on January 24, 2024, with a value of VND 1,300 billion and a 5-year maturity, Becamex has raised a total of VND 2,600 billion in bond financing since the beginning of the year.

At the recent 2024 Annual General Meeting of Shareholders, Becamex received approval from its shareholders to offer additional shares to the public to increase its charter capital.

The industrial real estate giant aims to raise a minimum of VND 15,000 billion by offering 300 million shares to the public at a minimum price of VND 50,000 per share.

In terms of business plans, Becamex has set targets for 2024, including total revenue of VND 9,000 billion and after-tax profit of VND 2,350 billion, representing a 2% and 3% increase, respectively, compared to the results of 2023. The company also plans to pay a dividend of 10% for 2024.

For the first six months of 2024, Becamex recorded net revenue of over VND 1,973 billion, a 4.7% increase compared to the same period last year. After-tax profit increased by more than 10.5 times year-on-year, reaching VND 513.3 billion. These figures represent 21.9% and 21.8%, respectively, of the company’s annual plan.

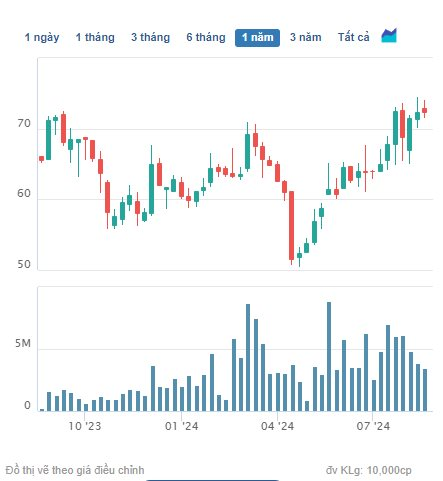

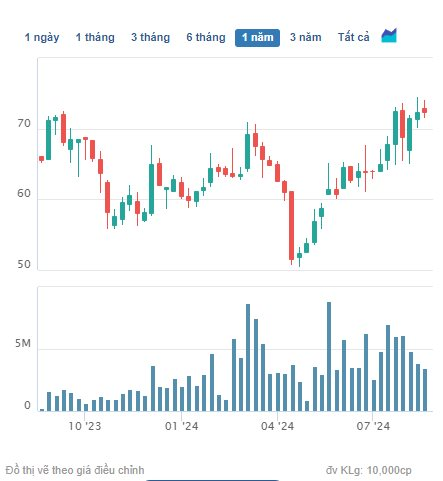

BCM shares are currently trading at their highest level in the past year. (Source: Cafef)

On the stock market, BCM shares closed at VND 72,400 per share on August 23, 2024, up 0.56% from the previous session, with a matched volume of over 750,000 shares.

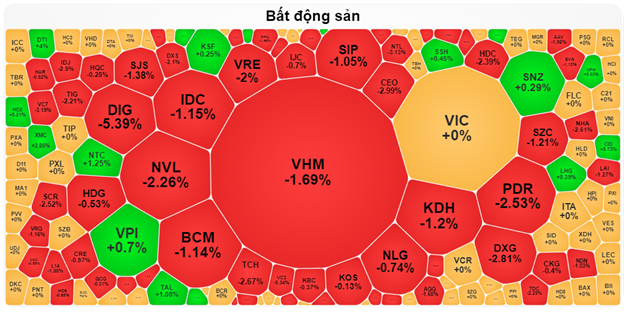

Becamex’s market capitalization currently stands at over VND 74,934 billion, making it the third-largest real estate company in the market, following the “Vin” duo of Vinhomes (VHM) and Vingroup (VIC).

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.