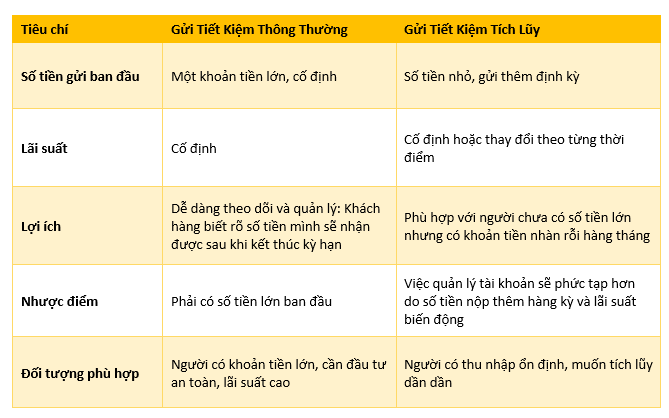

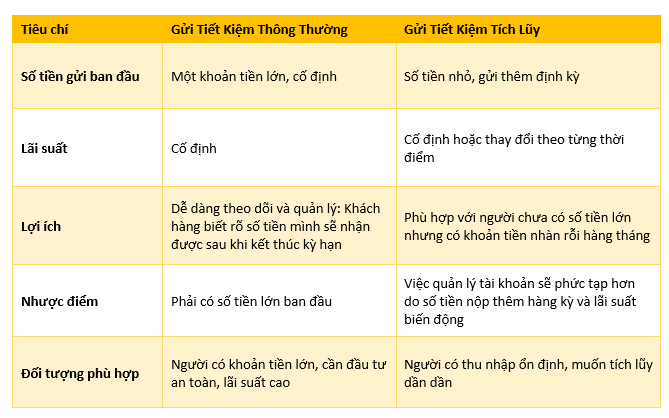

Regular Savings

Regular savings involve depositing a fixed amount of money at regular intervals, such as monthly, quarterly, or annually. With this type of account, account holders can deposit a specified amount at each interval, with no limit on the number of deposits. Interest is calculated on the increasing principal amount with each additional deposit.

Similar to other bank savings products, regular savings accounts also allow for early withdrawals. However, customers may not enjoy the same interest rate as initially agreed upon if they choose to withdraw their money before the maturity date.

One unique feature of regular savings is the low minimum deposit requirement. This varies across banks; for instance, Techcombank requires a minimum initial deposit of 100,000 VND, while Vietcombank requires 3 million VND for the initial deposit and 1 million VND for subsequent periodic deposits.

Interest rates for regular savings accounts are adjusted by the bank based on the prevailing interest rates at any given time.

This type of savings is generally suitable for customers who may not have a large balance but have a stable monthly income or disposable funds that they wish to save regularly to achieve financial goals such as buying a house, a car, or planning for vacations.

Most banks offer regular savings accounts, and customers can choose to deposit money directly at a bank branch, via ATM deposits, electronic bank transfers, or automatic deductions from their payment accounts.

Traditional Savings

Traditional savings involve depositing a lump sum of money, with the interest rate fixed for a specified period. Each additional deposit requires opening a new account, which can result in managing multiple savings accounts.

Traditional savings are commonly used for long-term financial goals such as retirement planning, daily expenses, or investments.

Depending on your financial needs and capabilities, you can choose between regular savings and traditional savings to suit your preferences.

For example, if you find the current interest rates attractive and have a substantial amount of money to deposit, traditional savings would be a good option to lock in the fixed interest rate for the entire term. This approach is particularly beneficial if you anticipate interest rates to decrease in the future.

On the other hand, if you don’t have a large sum of money readily available but expect to have a stable income and disposable funds in the future, regular savings would be a better choice. With interest rates adjusted periodically by the bank, regular savings can be advantageous in a rising interest rate environment.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.