In the ever-changing investment landscape of the Vietnamese stock market, it’s almost impossible for investors to always come out on top. As noted by Ms. Pham Minh Huong, Chairwoman of VNDirect’s Board of Directors at the 2023 Annual General Meeting, “90% of transactions in the stock market incur losses.”

In reality, individual investors, who account for about 80-85% of the trading value in Vietnam’s stock market, are often significantly influenced by their emotions. However, the desire to pursue quick profits through “market surfing” or attempting to time the market by “buying low and selling high” rarely leads to sustainable outcomes.

According to numerous stock market experts, it is highly challenging for individual investors who engage in market surfing to retain their profits over the long term. The majority of non-professional investors who may be fortunate enough to reap gains from market surfing on one occasion are likely to lose those profits in subsequent losing trades.

On the other hand, accurately predicting whether the market will go up or down is incredibly difficult, even for the most experienced investors. Even when a correct prediction is made, there is no guarantee of profits due to the risk of selecting the wrong business.

The legendary investor Warren Buffett has also advised investors against closely monitoring the market and instead recommended adopting a long-term perspective. He further suggested investing in index funds, as they automatically diversify and hold all the stocks included in that index.

Consistent Investing is the Key to Success

In reality, successful investors in the market opt for long-term strategies characterized by patience and a long-term vision. For instance, Warren Buffett might not have the best investment performance every year, but he remains one of the wealthiest investors due to his consistently growing investment returns over the years.

Therefore, instead of attempting to predict the market’s ups and downs, implementing a consistent investment strategy in stock funds with a long-term perspective can yield better results for investors.

During the Q2 2024 Investor Day event, Mr. Vo Nguyen Khoa Tuan, Senior Business Director of Dragon Capital’s Securities Division, acknowledged that investors’ desire to buy and sell continuously based on market movements to optimize profits is legitimate. However, he pointed out that this strategy often yields suboptimal results.

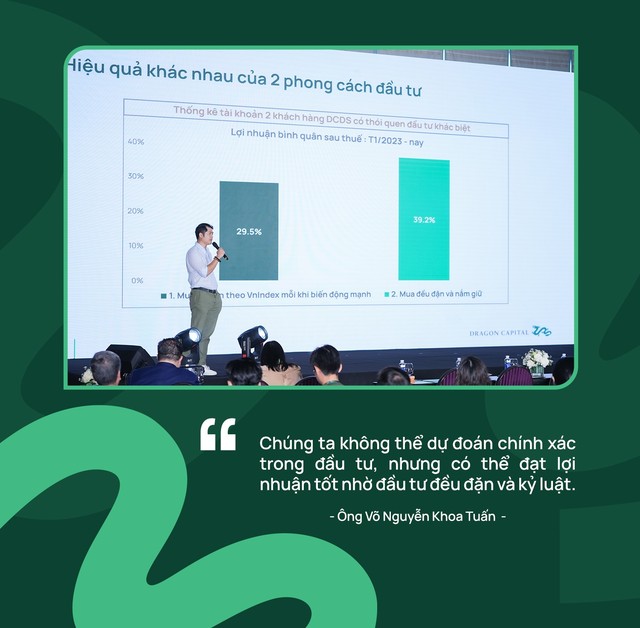

Analyzing the performance of two DCDS fund clients from the beginning of 2023 until now, investors who traded based on the fluctuations of the VN-Index achieved a performance of 29.5%, while those who invested regularly and held on to their investments saw a performance of 39.2%. While the latter group of investors easily achieved higher profits, the former group had to exert significant effort in monitoring the market, conducting analyses and predictions, and engaging in frequent transactions that incurred various costs, all while achieving lower returns.

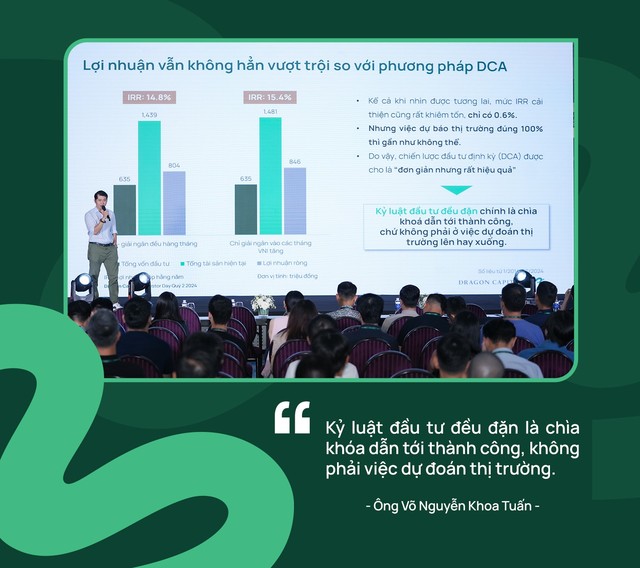

The Dragon Capital team also presented a different scenario involving a “prophet investor” who could always accurately predict market trends, only buying when the market rose and refraining from buying before corrections, and a “disciplined investor” who employed a dollar-cost averaging (DCA) strategy, investing a fixed amount regularly instead of a lump sum.

The results showed that the annual profit rates of these two investors did not differ significantly. Specifically, the prophet investor, who only invested during months when the VN-Index increased, achieved an IRR (internal rate of return) of 15.4%, while the disciplined investor who invested a fixed amount monthly recorded an IRR of approximately 14.8%.

Therefore, even with the ability to foresee the future, timing the market does not yield significantly superior returns, and the effort required is considerable. Moreover, accurately predicting the market 100% of the time is impossible, even for top experts. Consequently, the periodic investment strategy is considered “simple yet highly effective in the long run.”

“We cannot be prophets in investing, but we can be disciplined investors to achieve good profits through consistent investing. Consistent investing is the key to success, not market prediction,” said Mr. Tuan.

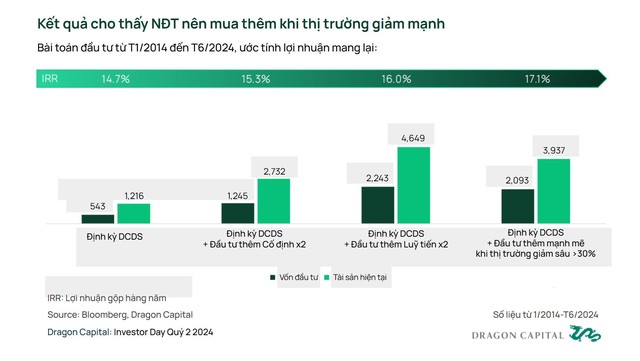

Regarding simple and effective investment methods, in addition to periodic investing (DCA), investors should be steadfast in increasing their investments when the market experiences significant corrections. If one invests 1 million VND weekly in DCDS and invests additional savings during significant dips from the latest peak of the VN-Index from January 2014 to June 2024, the annual profit rate can increase from 14.7% to 17.1%.

The consistent investment strategy is highly regarded by Dragon Capital experts, given the positive recovery of Vietnam’s economy, which lays a solid foundation for the stock market in the long term. According to Dr. Le Anh Tuan, Director of Dragon Capital’s Investment Division, Vietnam’s economy exhibited several bright spots in the first half of the year, with positive profit growth and attractive valuations, enabling the stock market to maintain stability despite the headwinds of net foreign selling.

Looking ahead to the second half of the year, Dr. Le Anh Tuan expressed optimism about the stock market’s prospects due to the stability of the macroeconomic environment and supportive monetary policies, with expectations of an early Fed rate cut. Additionally, revenue and profit growth are expected to continue improving, and the market’s valuation remains reasonable, presenting good accumulation opportunities.

Therefore, investors should remain steadfast in their long-term holding strategy and implement periodic investments to achieve positive results in the future.

Comprehensive Investment Solution for Non-Professional Individual Investors

With 30 years of experience, Dragon Capital has become a leading fund management company, currently managing over $5.5 billion in assets and serving as a trusted partner for Vietnamese investors. To support non-professional individual investors in confidently navigating their investment journey and striving towards their financial goals, Dragon Capital offers the “Dragon Investment Solution,” which revolves around three main pillars: products, technology platform, and people.

In terms of products, Dragon Capital is a pioneer in providing a diverse ecosystem of funds catering to different investor preferences, ranging from daily trading to long-term investing, wealth accumulation to retirement planning. The company’s open-ended stock and bond funds are managed by experienced professionals and consistently outperform the overall market. Notably, investors can switch between these open-ended funds without incurring any fees, a highly beneficial mechanism that enables investors to proactively allocate their capital across funds according to market conditions and investment objectives.

A notable example is DCDS, a growth stock fund with over 20 years of presence in the market, suitable for long-term investors, which achieved an impressive 19.8% return, outperforming the market by 9% in the first seven months of the year. Similarly, DCDE, Vietnam’s first dividend-focused fund targeting investors seeking long-term profit optimization, outperformed the VN-Index with a return of 13.9% in the same period (the fund distributed a 13% cash dividend in June 2024).

With a mid- to long-term investment objective, DCBF is a bond fund with a long history of over 15 years, delivering an average investment return of 11.6%/year over the past decade. In the first seven months of 2024, DCBF grew by 4%, outperforming the average 12-month deposit interest rate of the four state-owned banks. Lastly, DCIP, a money market fund suitable for short-term investors, achieved a return of 3.09% in the same period, outpacing the average 3-month deposit interest rate of banks by 1.93%.

In addition, Dragon Capital boasts a range of leading ETFs, including ETF DCVFM, VN30 ETF, DCVFM Dimond ETF, DCVFM VN Midcap ETF, and the Retirement ETF.

The technology platform is another forte of Vietnam’s longest-running fund management company. The launch of the DragonX fund investment application in 2021 marked a breakthrough for Dragon Capital in enhancing the investment experience for its clients. Just a year after its introduction, DragonX has rapidly grown its user base to 100,000 investors. However, Dragon Capital doesn’t rest on its laurels; instead, it has a clear roadmap to continuously maintain and upgrade the platform with additional features and utilities to create a cutting-edge investment platform that caters to the masses.

Regarding the people pillar, Dragon Capital boasts a dedicated customer support team ready to assist and address investors’ queries, along with a vibrant community of over 40,000 members on Facebook, where investors actively engage and support each other. Moreover, the Dragon Edu program provides valuable investment and financial planning knowledge through social media platforms, and the Investor Day event, a quarterly gathering hosted by Dragon Capital, fosters direct connections and exchanges between investors and the fund’s management team, completing the investment experience with Dragon Capital.

In essence, by embracing the Dragon Investment Solution, investors gain access to Dragon Capital’s comprehensive ecosystem, empowering them with the confidence to grow their wealth through a well-rounded approach rather than relying solely on individual fund choices.

Once a formidable competitor in the stock market, the total market capitalization of the entire real estate industry is now less than the combined market capitalization of three banks.

If you combine the market cap of Vietcombank and BIDV, along with the market cap of Vietinbank (which is approximately 960 trillion VND), it already surpasses the market cap of the top 30 largest real estate enterprises (which is around 788 trillion VND).