The Ho Chi Minh City Stock Exchange (HOSE) has announced a supplementary list of securities that are ineligible for margin trading.

HOSE has added two stock codes to the list: ABS of Binh Thuan Agriculture Service Joint Stock Company and RAL of Rang Dong Lightbulb and Tubes Joint Stock Company. The reason for their inclusion is that both companies delayed the publication of their reviewed semi-annual financial statements for 2024 beyond the five-day deadline from the date of the information disclosure.

According to ABS’s disclosed semi-annual financial statement for 2024, the company recorded a 69% decrease in revenue compared to the same period last year, amounting to VND 172 billion. Additionally, their pre-tax profit decreased by 52.9% to VND 10.35 billion, and their post-tax profit declined by 66.6% compared to the previous year, reaching VND 4.6 billion.

For the first six months, ABS’s revenue reached VND 208.5 billion, in contrast to a profit of VND 634 billion in the corresponding period. Their post-tax profit stood at over VND 8 billion, compared to a profit of VND 23.6 billion in the same period last year.

On the other hand, RAL’s second-quarter financial statement for 2024 showed a 39% increase in revenue, surpassing VND 2,119 billion. Their profit also rose by 24.4%, exceeding VND 137 billion. For the six-month period, RAL recorded a gross revenue of VND 4,950 billion and a post-tax profit of nearly VND 332 billion. RAL attributed the increase in revenue and profit to their robust implementation of digital transformation during the production process, including the establishment of smart manufacturing, automation, and enhanced automation in various stages of their production line.

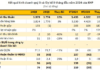

As of August 22, the number of stocks ineligible for margin trading has climbed to 86, including DQC, JVC, HBC, HNG, HAG, HPX, HVN, NVL, OGC, POM, PPC, QCG, SMC, TNA, and TTF. The primary reasons for this status are comprehensive, ranging from audited semi-annual losses in 2023 to semi-annual financial statements for 2023 with opinions from auditing firms. Other reasons include securities subject to warning/control/restricted trading/trading suspension/securities at risk of delisting, less than six months of listing, and more.

Additionally, the list includes several fund certificates due to the net asset value (NAV) calculated per fund certificate being lower than the par value based on the monthly NAV change report for three consecutive months (FUCVREIT, FUEIP100, FUEKIV30) and newly listed fund certificates such as FUEKIVND.

The list also includes TVB, the only securities company stock that has been cut off from margin trading due to control-related issues.

Most recently, HOSE decided to delist 347.2 million HBC shares of Hoa Binh Construction Group Joint Stock Company and over 1.1 billion shares of HAG of Hoang Anh Gia Lai International Agricultural Joint Stock Company, effective from September 6, 2024. The last trading day for these shares on HOSE was September 5, 2024.

The delisting of Hoa Binh Construction Group shares was due to their accumulated losses exceeding their paid-up charter capital, as per their 2023 audited financial statements. This falls under the mandatory delisting cases stipulated in Clause 1, Article 120 of Decree 155/2020/ND-CP, dated December 31, 2020.

Regarding HAGL Agrico, the delisting was a consequence of the company incurring consecutive losses for three years, as evidenced by their audited financial statements for 2021, 2022, and 2023. This scenario also aligns with the mandatory delisting provisions outlined in Clause 1, Article 120 of Decree 155/2020/ND-CP, dated December 31, 2020.

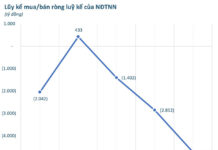

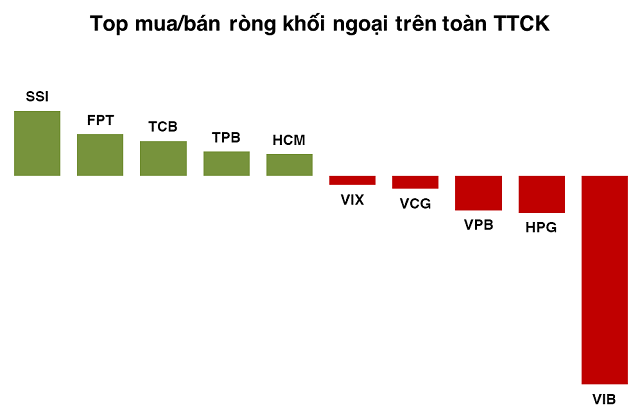

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.