Illustrative Image

|

According to statistics from the Ministry of Agriculture and Rural Development, the export of wood and forest products in the first seven months of 2024 is estimated to reach $9.36 billion, a 20.5% increase compared to the same period last year. Of this, the export of wood and wood products reached $8.78 billion, a nearly 22% increase year-on-year.

In most major markets, the export of wood and wood products has increased. The United States remains the largest market, with a value of over $5 billion, a 24.5% increase compared to the previous year. This is followed by China, which achieved $1.22 billion, a nearly 38% increase.

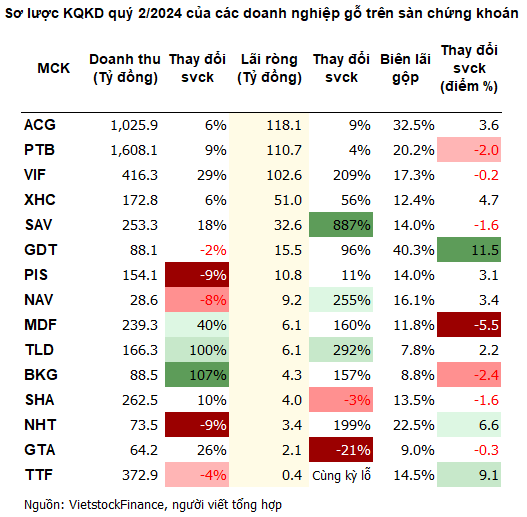

This positive export picture is reflected in the financial results of the businesses. Data from VietstockFinance shows that, among the 15 wood and wood product exporters on the stock exchange that announced their second-quarter 2024 financial statements, 12 companies increased profits, two companies decreased profits, and one company returned to profitability.

The total revenue of these companies exceeded VND 5,000 billion, and their net profit was nearly VND 477 billion, respectively increasing by 12% and 64% compared to the same period in 2023. In particular, the gross profit margin improved from 19% in the same period last year to over 20%.

Adding More Bright Spots

Savimex (SAV) led in terms of profit growth rate in the second quarter, with a nearly tenfold increase compared to the same period last year, reaching nearly VND 33 billion. The company attributed this performance to a 20% increase in furniture sales, which accounted for nearly 98% of its total revenue. Another highlight was the reversal of over VND 32 billion in allowance for impairment of investment securities in TCM.

Investment Construction and Urban Development Corporation (TLD), Navifico (NAV), and Vinafor (VIF) were also positive standouts in the industry, with profit growth rates of three to four times compared to the previous year, reaching over VND 6 billion, VND 9 billion, and VND 103 billion, respectively.

TLD and Vinafor both attributed their performance to increased production and sales volume against the backdrop of a recovering market, which led to higher revenue and profits. Meanwhile, Navifico benefited from dividends received from its associate company, Saigon Development Joint Stock Company.

In the second quarter, Duc Thanh Wood (GDT) achieved a gross profit margin of over 40%, an 11.5 percentage point increase compared to the same period last year and higher than the full-year 2023 margin of 29%. This contributed to a net profit margin of nearly 15.5%, the highest in the past two years and a 96% increase year-on-year.

These favorable results were also supported by the consolidation of two factories into one, which not only reduced management, personnel, and transportation costs but also generated additional profit from leasing the vacated factory premises.

Truong Thanh Wood (TTF) improved its core business with a gross profit margin of 14.5%, a 9 percentage point increase compared to 2023. Along with increased financial revenue from exchange rate differences, the company reported a net profit of over VND 360 million, while in the same period last year, it had incurred a loss of nearly VND 39 billion.

The profit champion for the second quarter of 2024 was An Cuong Wood (ACG), with a profit of over VND 118 billion, a 9% increase compared to the same period and accounting for nearly 25% of the total profit of the group. The company attributed its performance to its focus on product lines with good profit margins and its efforts to increase productivity and reduce costs amid a thriving export market.

Phu Tai reported a profit of nearly VND 111 billion, the highest in the past seven quarters and a 4% increase compared to the same period. The company also led in terms of quarterly revenue, with over VND 1,600 billion in the second quarter, a 6% increase, and accounted for more than 32% of the group’s total revenue, including VND 890 billion from the sale of wood products.

Meanwhile, Go Thuan An (GTA) and Son Ha Saigon (SHA) were among the few companies in the industry to report lower profits, with VND 2 billion and VND 4 billion, respectively, representing decreases of 21% and 3% compared to the second quarter of 2023.

On Track to Meet Annual Profit Targets

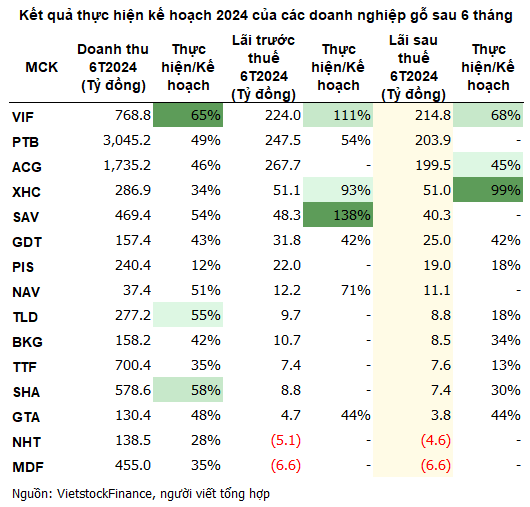

According to statistics, in the first six months of the year, the 15 wood industry companies’ pre-tax and post-tax profits reached over VND 934 billion and VND 789.5 billion, respectively. Notably, five wood industry companies achieved more than 50% of their annual profit targets, effectively completing their semi-annual plans.

In fact, two companies, Savimex and Vinafor, surpassed their annual plans in just six months. Specifically, Savimex achieved an early victory, with a pre-tax profit of over VND 48 billion in the first six months, the highest semi-annual profit in its operating history and 38% higher than its annual plan. On the other hand, Vinafor’s pre-tax profit for the first six months reached VND 224 billion, a 50% increase compared to the same period last year and 11% higher than its full-year plan.

Similarly, Xuan Hoa nearly reached its target after just six months, with a post-tax profit of VND 51 billion, the highest in the past five years, and achieving 99% of its annual profit target.

On the contrary, TLD and TTF are the two companies in the industry that have not even reached the one-quarter mark of their annual targets. Even more dire, Nam Hoa (NHT) and MDF QR, both suffered losses in the first six months, with net losses of nearly VND 5 billion and VND 7 billion, respectively.

As of the first six months, no wood industry company has accomplished its annual revenue plan for 2024. However, five out of 15 companies have progressed beyond the halfway point, including Vinafor, Savimex, Navifico, TLD, and SHA. Following closely behind, PTB, ACG, GDT, BKD, and GTA have achieved 42-49% of their annual revenue targets.

Challenges and Obstacles Remain

At the quarterly conference of the wood processing industry for export and forest products, held on August 9 in Binh Duong, Mr. Do Xuan Lap, Chairman of the Vietnam Timber and Forest Product Association (VIFOREST), stated that the industry still faces challenges in the remaining months of 2024. These include the complex and unpredictable impacts of geopolitical competition among major powers, as well as increasing commercial fraud and the complexity of trade competition.

Additionally, sea freight rates remain high, and VAT refunds for businesses are still slow. Achieving the export target of $15.2 billion for the year will be challenging without determination, effort, and proactive problem-solving.

Based on the positive results of the first seven months, the conference identified three key tasks for the wood processing and forest product industry: First, continue to improve and effectively implement existing policies to attract all economic sectors to participate in the development of planted forests and the processing of wood and forest products.

Second, enhance propaganda, organize exhibitions and investment promotion activities, and proactively seek and expand consumption markets for wood and forest products. Third, closely monitor and promptly address difficulties and obstacles related to mechanisms and policies for wood processing and exporting enterprises.

Te Manh

Profit from Sugarcane, Durian, and Leafy Vegetables with the Lunar New Year approaching

Good news for farmers in the Mekong Delta provinces as the prices of sugarcane, durian, and vegetables… have skyrocketed during the days leading up to the Lunar New Year, providing them with attractive sources of income.