On August 23, 2024, based on investigation results, the Investigation Police Agency of Ha Giang Provincial Police decided to initiate legal proceedings and arrest and temporarily detain Nguyen Lan Huong (born in 1973, permanent residence: CT 4 Vimeco, Trung Hoa, Cau Giay, Hanoi) – Chairman of the Board of Directors of Bao Chau Pharmaceutical Group Joint Stock Company, located in Group 12, Vi Xuyen town, Vi Xuyen district, Ha Giang province.

Huong was arrested for the act of “Illegally printing, issuing, buying and selling invoices and documents for payment to the State budget”, as prescribed in Clause 2, Article 203 of the 2015 Penal Code.

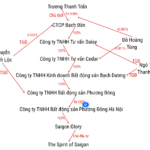

The investigation results showed that Nguyen Lan Huong, Chairman of the Board of Directors of Bao Chau Pharmaceutical Group Joint Stock Company, took advantage of the State’s regulations on enterprise registration conditions, the mechanism of self-declaration and tax payment, and self-printing, issuance, management, and use of invoices to establish many “shell companies.”

Ha Giang Provincial Police reads the arrest warrant for Huong. Photo: Ha Giang Provincial Police

Huong then used these companies to establish fictitious economic contracts and issue illegal value-added invoices to legalize input and output materials and goods and enjoy value-added tax deductions for Bao Chau Pharmaceutical Group Joint Stock Company.

This behavior helped increase the value of the company’s production and business results to meet the conditions for participating in the stock market and issuing shares to attract investment capital.

In 2022 and 2023, Nguyen Lan Huong directly performed and instructed the accountant of Bao Chau Pharmaceutical Group Joint Stock Company to set up fake economic contracts and illegally issue 368 electronic invoices with a total value of VND 367 billion to serve the business accounting activities of Bao Chau Pharmaceutical Group Joint Stock Company.

The case is being actively investigated and clarified by the Investigation Police Agency of Ha Giang Provincial Police.

Investigation into Tax Evasion Suspected in the Case of Fraudulent Real Estate Project in Binh Thuan

As the investigation into the TP Holding case, accused of fraudulent sale of a ‘ghost’ project in Binh Thuan province, is still ongoing, authorities are now also looking into possible tax evasion by this company.

Proposal to prosecute 4 corporate directors for causing a loss of over 16 billion VND in tax revenue

During the process of importing goods for business purposes, Mr. Doan Manh Duong (Director of Tan Dai Duong Company) has been accused of directing the misdeclaration of categories, names, and codes of the goods on the customs declaration in order to reduce the taxes payable. Additionally, he has been involved in facilitating illegal transactions between two other companies in terms of value-added tax invoices.

Legal lessons from ‘under-declaring property transfers’

The real estate market in Vietnam has faced significant challenges from 2020 until now. Besides objective factors leading to difficulties in real estate transactions, there have been numerous cases of lack of transparency, fraudulent activities, and deception during the transaction process. This has resulted in unpredictable legal consequences for both sellers and buyers.