In the international market, the DXY index plunged 1.72 points over a week to 100.68. This was also the lowest level for the US dollar since mid-July last year.

At the much-anticipated speech at the annual economic conference in Jackson Hole, Federal Reserve Chairman Jerome Powell referred to the possibility of easing monetary policy in the coming time.

“It’s time to adjust the policy. The direction is clear, but the timing and pace of interest rate cuts will depend on upcoming data, as well as economic prospects and risk balance calculations,” Mr. Powell declared.

After recalling the causes of inflation and the Fed’s strong interest rate hike moves from March 2022 to July 2023, Mr. Jerome Powell emphasized that inflation has cooled down and the US central bank can now focus on its dual mandate.

“Inflation has come down significantly. The labor market is no longer too hot, and conditions are now less tense than before the pandemic,” Mr. Powell added, committing that the Fed will do everything possible to ensure a strong labor market and a quick return to 2% inflation.

The Fed Chairman’s comments further reinforced expectations that the Fed will cut interest rates in the coming period, causing the US dollar to depreciate heavily in the international market.

Source: SBV

|

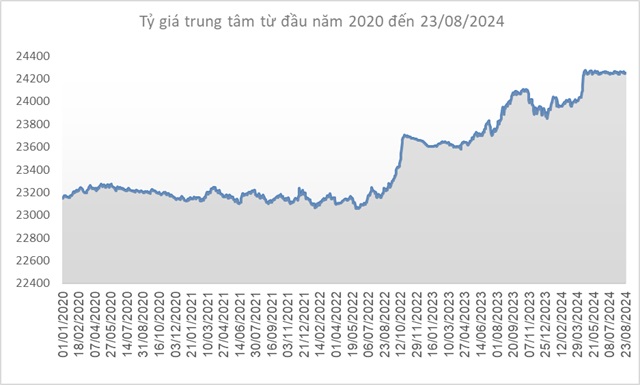

Domestically, the central exchange rate of the Vietnamese dong to the USD decreased by VND 4 per USD compared to the previous week (session of August 16), to VND 24,250 per USD in the session of August 23, 2024.

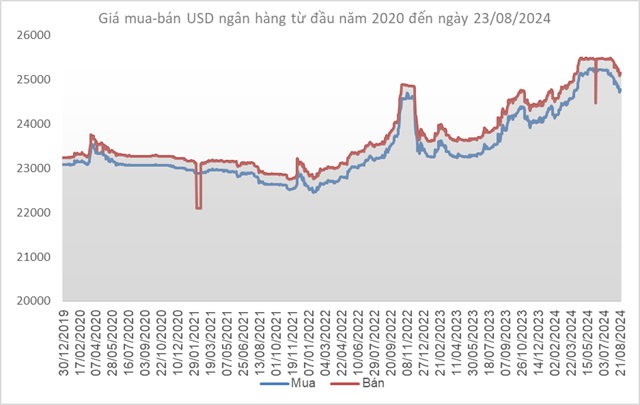

The State Bank of Vietnam (SBV) kept the immediate buying price unchanged at VND 23,400 per USD. In addition, the regulator maintained the immediate selling price at VND 25,450 per USD since April 19. This is the intervention selling price that SBV announces to sell USD to banks with a negative foreign currency status to bring the foreign currency status back to zero.

Source: VCB

|

The exchange rate listed at Vietcombank was VND 24,780-25,150 per USD (buying – selling), down VND 80 per USD in both directions. This is the fourth consecutive week of the USD bank rate decline, with a total decrease of VND 311 per USD in both directions.

Source: VietstockFinance

|

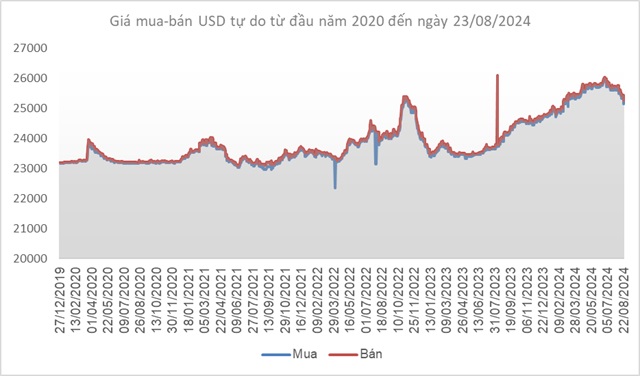

Declining USD Prices: Banks and Free Market Suffer Declines

Approaching Tet holidays, the USD price in banks and the free market dropped significantly, despite the international USD index maintaining a high level.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…