MayCha made its appearance on the Nasdaq Tower’s LED screen in Times Square, New York City in November 2023.

“MayCha was established in 2018 by me and a co-founder. Our first store was only 15 square meters with a capital of 50 million VND. Although we studied digital marketing and finance and banking, which are unrelated fields, we shared a passion for bubble tea and had the opportunity to go to Taiwan to learn from a master in the industry,” said Mr. Phung Anh The – Founder of the MayCha bubble tea brand at the Vietnam F&B Summit 2024 organized by iPOS.vn.

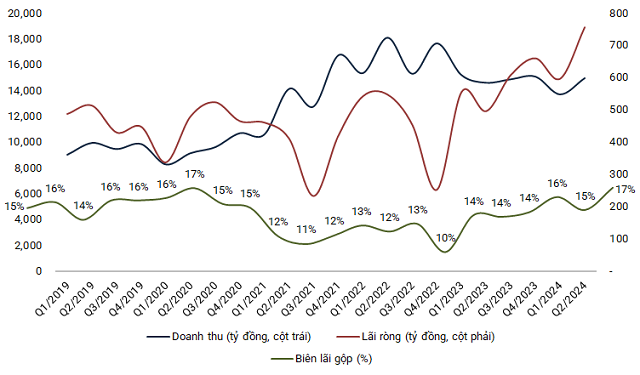

There was a time when they sold 4,000 cups of bubble tea a day at one store, with an annual revenue of over 550 billion VND

When MayCha joined the market, it was also the year of the “boom” in the F&B industry. From Mr. The’s perspective, big players such as Phuc Long and Highlands Coffee were spending a lot of money to attract middle and high-end customers, while the majority of popular customers were not targeted much. MayCha’s founder saw the opportunity and decided to invest seriously.

According to the menu posted on MayCha’s Facebook fanpage, the cheapest product is green leaf tea in size M for only 15,000 VND, and traditional bubble tea in size M for 17,000 VND. All products on the menu are under 45,000 VND (excluding additional toppings).

Although the stores mainly focus on take-out sales, Mr. The does not consider this a spontaneous model, leaving employees to “fend for themselves”. Instead, each store is optimized down to the smallest metrics. The company invests in a professional training room to thoroughly guide all 1,700 employees.

“MayCha does not franchise. All stores are under the management of the company. We have grown strongest from last year to now. In March 2023, I only had 30 stores, and now I have 80.

All stores achieve a profit margin of 18-23%. Previously, at the peak, with about 30 stores, some MayCha outlets sold 3,000 cups, even 4,000 cups a day, with 12-13 employees working tirelessly from morning to night,” said Mr. The.

Regarding the experience of expanding the number of stores, the founder of MayCha said that from the beginning, it is necessary to determine the construction of a central kitchen. MayCha has invested more than 20 billion VND in a central kitchen, which “truly cooks everything here”. Currently, more than 90% of the ingredients for the stores are processed in this central kitchen.

Mr. The revealed that the total annual revenue of all 80 MayCha stores is about 555 billion VND.

MayCha’s founder shared his experience at the Vietnam F&B Summit 2024.

Focus on physical stores before expanding to food-app platforms

One of MayCha’s notable achievements is its appearance on the LED screen of the Nasdaq Tower in Times Square, New York City in November 2023. This was part of a campaign by GrabFood to honor its restaurant partners in Southeast Asia.

However, when asked about his experience selling on food-app platforms, Mr. The advised focusing on physical stores first.

“Somehow, physical stores still bring better profits. Food delivery apps are a secondary tool. Everything must operate in this way. First and foremost, your product and service must be truly unique, making customers talk and remember you,” said Mr. The.

The founder of MayCha views food-app platforms as a “hypermarket” where there are already many customers. The task of the restaurant owners is to make their stalls stand out. For example, the images must be neat, and the menu must be well-organized and concise.

“At the beginning, you don’t need to sell too many dishes on the app, because then customers may have to think a lot, resulting in aimless scrolling for 2-3 minutes and then leaving. The menu should be simple but focused, with clear images and pricing.

We must also have leading products. These products have to be delicious, and the cost of making them must be low so that we can sell them together with the products we want to promote, bringing higher profits.

Not every customer who visits your stall will place an order. The average conversion rate in the F&B industry is just over 2-3%, which means out of 100 people who visit your store, only 2-3 people will make a purchase. 3% is the highest rate, and at MayCha, it’s about 2.5-2.7%,” said Mr. The.

Another piece of advice from the founder of MayCha for new brands is to target niche markets, serving a smaller group of customers but avoiding direct competition with the big players.

“Vietnam’s Top 5 Coffee Shops Set to Make Waves in Singapore: Luckin Coffee, Watch Out!”

In Singapore, the Chinese brand Luckin Coffee has quickly gained dominance through its franchise model, compact spaces, and affordable prices. Meanwhile, Founder …Ka Coffee – a coffee chain that has opened 5 branches in Hanoi and Ho Chi Minh City – has announced that their franchise stores in Singapore will have spacious premises, despite the high rent costs of 200-300 million VND for 80 square meters spread across two floors.

Unstoppable beverage trends, who can keep up with the wave?

(KTSG Online) – The F&B market is set to see a wave of new products in the bubble tea and beverage industry by 2023, making it the focal point of each season. While some items have established themselves as brand staples, there are also those that quickly rise and fall. In addition, there is a growing number of “local and international” beverage chains entering the market with substantial investments, indicating that competition goes beyond just following trends.