In conclusion to the Government’s thematic meeting on law-building on the afternoon of August 24, Prime Minister Pham Minh Chinh directed that ministers and heads of ministerial agencies take charge of directing and guiding the work of building and perfecting laws and institutions. This will help remove obstacles and mobilize all social resources to promote growth and sustainable development.

The Prime Minister emphasized that in the process of building and perfecting draft laws, it is essential to ensure practicality and effectiveness so that they can be implemented smoothly without causing further complications. Along with this, thorough decentralization and delegation of power should be implemented, along with cutting and simplifying administrative procedures, eliminating the “asking-giving” mechanism, and reducing intermediary steps to reduce costs for businesses.

Prime Minister Pham Minh Chinh concludes the meeting. Photo: Nhat Bac

Regarding the proposal to build the Law on Public Investment (amended), the Prime Minister stressed the need to truly remove obstacles to unlock public investment resources and maximize their efficiency, avoiding situations where “there is money but it cannot be spent” and preventing prolonged projects. He also called for a firm reduction in unnecessary red tape, creating an unhealthy environment.

Concerning the request to build the Law on Amending and Supplementing a Number of Articles of the Law on Planning, Investment, Public-Private Partnership Investment, and Bidding Law, the Prime Minister noted that the implementation of public-private partnership projects currently faces many obstacles. He suggested studying policies to remove these obstacles, unblocking and mobilizing all social resources for development, expanding cooperation areas, and encouraging investment in fields such as green, digital, and circular economies.

For the draft Law on Special Consumption Tax (amended), the Prime Minister requested a thorough review of taxable items to balance the goals of promoting production and business and socio-economic development with limiting the negative impacts of consuming taxable items, protecting people’s health, and safeguarding the environment.

Regarding the draft Law on Enterprise Income Tax (amended), the Prime Minister emphasized the viewpoint of “harmonious interests and shared risks” among the State, citizens, and enterprises. He also stressed the importance of promoting production and business, creating livelihoods for the people, meeting international economic integration requirements, and enhancing international cooperation on taxation.

The Prime Minister advised creating a uniform and coherent legal environment, overcoming the limitations and inadequacies of the current law, ensuring the correctness, fullness, and timeliness of tax collection, and combating tax losses in line with international practices. He also suggested reducing administrative procedures to facilitate tax collection and payment, raising awareness of tax obligations, and enhancing the sense of responsibility among taxpayers…

The Power of Lizen: Consistently Winning Massive Bids

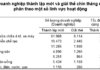

Lizen has achieved a significant milestone by successfully deploying and implementing major high-speed construction projects in 2023. The company’s revenue has reached 2,030.5 billion VND, which is twice the amount compared to 2022. However, the post-tax profit has reached its lowest point in the past 6 years, dropping down to only 118.3 billion VND.

Supplemental Funding of Nearly 30.7 Trillion VND for Mid-Term Public Investment Plan

Deputy Prime Minister Le Minh Khai has assigned a budget of 30.683,441 billion dong to supplement the medium-term public investment plan for the 2021-2025 period from the central budget. This source of funding will be used to support infrastructure development and promote economic growth. The goal is to ensure that the investment projects are implemented effectively and contribute to the overall development of the country. With this additional funding, Vietnam aims to improve its transportation system, upgrade its public facilities, and enhance the quality of life for its citizens. The government believes that investing in infrastructure is crucial for sustainable development and will create favorable conditions for attracting domestic and foreign investments. The Deputy Prime Minister emphasized the importance of transparency and accountability in the implementation of these projects to ensure the efficient use of public funds. The government also encourages the participation and contribution of the private sector in these initiatives to maximize the benefits for the whole society.