MARKET REVIEW FOR THE WEEK OF 19-23/08/2024

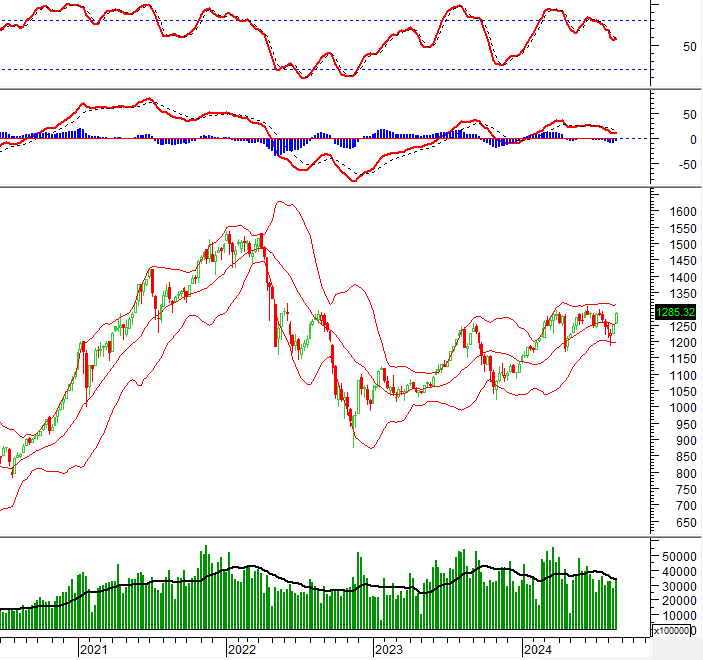

For the week of August 19-23, 2024, the VN-Index had a brilliant performance, surging over 33 points and continuing its upward trajectory from the previous week. However, to solidify this upward trend, the trading volume needs to surpass the 20-week average.

Additionally, the index has climbed above the Middle line of the Bollinger Bands. Should it maintain its position above this line, the short-term outlook will become even more optimistic.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Closely Following the Upper Bollinger Band

On August 23, 2024, the VN-Index rose and continued to closely follow the upper band (Upper Band) while the Bollinger Bands expanded, accompanied by trading volume exceeding the 20-day average. These indicators suggest a persistent short-term positive outlook.

Furthermore, the MACD indicator continues to ascend and remains above zero, providing a buy signal that reinforces the ongoing recovery.

However, the VN-Index is approaching the June-July 2024 peak zone (around 1,290-1,310 points), while the Stochastic Oscillator has ventured deep into overbought territory. If this indicator triggers a sell signal and falls below this zone, the risk of a downturn will increase in the coming period.

HNX-Index – Long-Legged Doji Candlestick Pattern Emerges

On August 23, 2024, the HNX-Index climbed, marking its sixth consecutive gaining session, and a Long-Legged Doji candlestick pattern emerged, accompanied by trading volume surpassing the 20-session average. These factors reflect the continued optimism among investors.

Additionally, the MACD indicator has crossed above zero and is trending upward, issuing a buy signal. This reinforces the potential for a mid-term recovery for the HNX-Index.

Moreover, the index successfully surpassed the 61.8% Fibonacci Retracement level (approximately 236-239 points), which also coincides with the support zone formed by the SMA 50-day and SMA 100-day moving averages. As a result, the positive mid-term outlook remains intact.

Money Flow Analysis

Smart Money Flow Variation: The Negative Volume Index for the VN-Index has crossed above the EMA 20-day. If this status persists in the next session, the risk of a sudden downturn (thrust down) will diminish.

Foreign Capital Flow Variation: Foreign investors continued to offload Vietnamese stocks on August 23, 2024. If this trend persists in the upcoming sessions, the market sentiment may turn less optimistic.

Technical Analysis Department, Vietstock Consulting

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.