Illustration

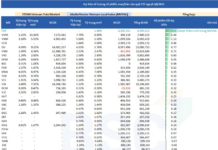

As per the plan announced by Orient Commercial Joint Stock Bank (OCB – Code: OCB), August 30 is the record date for shareholders to be eligible for a 20% stock dividend (shareholders owning 5 shares at the record date will receive 1 new share).

Specifically, the bank will issue nearly 411 million shares to pay dividends to shareholders. The source of issuance is the undistributed post-tax profit accumulated up to the end of 2023. After the issuance, OCB’s charter capital is expected to increase to nearly VND 24,658 billion.

A day before OCB, Vietnam Maritime Commercial Joint Stock Bank (MSB – Code: MSB) will also finalize the list of shareholders eligible for 2023 dividends in shares on August 29.

Accordingly, MSB will issue shares to pay dividends from profits retained as of the audited financial statements at December 31, 2023, after deducting funds as prescribed by law. The issuance ratio is 30% of the total outstanding shares (shareholders owning 100 shares will receive 30 new shares), equivalent to the issuance of 600 million shares. With this ratio, MSB is the bank with the highest dividend payout ratio this year.

After the capital increase, the total number of MSB shares in circulation will be 2.6 billion shares, corresponding to a new charter capital of VND 26,000 billion.

The Board of Directors of Southeast Asia Commercial Joint Stock Bank (SeABank – Code: SSB) has also approved the record date for implementing the right to receive dividends in shares and receive shares issued to increase capital from owned capital in 2024 as August 26, 2024.

Specifically, SeABank will issue 329 million shares to pay dividends to shareholders, equivalent to an issuance ratio of 13.18%. At the same time, the bank will issue an additional 10.3 million shares to increase capital from owned capital, equivalent to a ratio of 0.4127%. Thus, the total ratio of the above two methods is 13.6%.

Previously, Vietnam International Commercial Joint Stock Bank (VIB – Code: VIB) also finalized the list of shareholders eligible to receive bonus shares on August 23, 2024, with a ratio of 17%.

Bi-Weekly Scrip Dividend Lock-In Concluded, Ratio Set at 14%

Biwase to issue over 27 million shares for 2023 dividend, representing a 14% distribution ratio (shareholders with 100 shares will get an additional 14 new shares).