On September 6, 2024, FTSE is expected to announce the constituent stocks of the FTSE Vietnam All-Share and FTSE Vietnam Index. On September 13, 2024, MarketVector will announce the MarketVector Vietnam Local Index.

September 20, 2024, is expected to be the completion date for the restructuring of the portfolios of ETFs referencing these indices. The official closing date for the two indices is August 30, 2024.

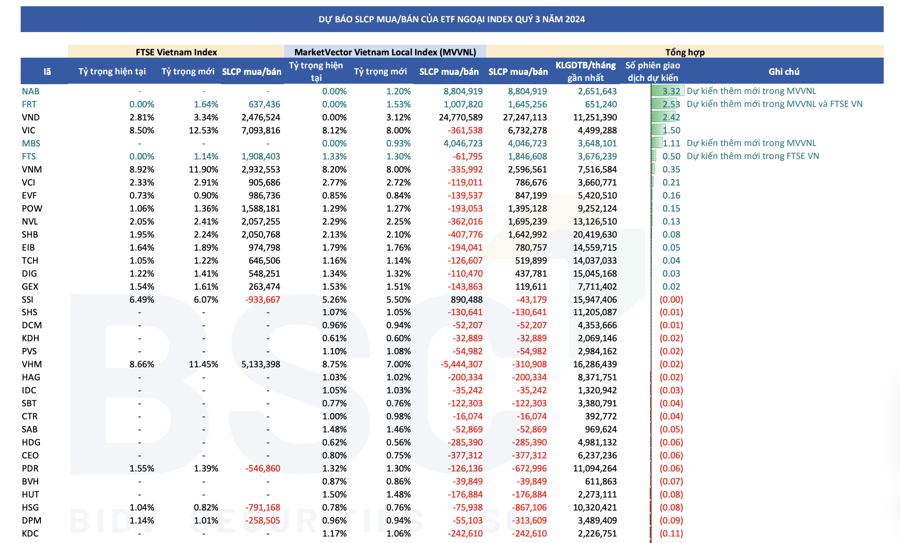

BSC forecasts the constituent stocks and the number of stocks to be bought/sold for ETFs referencing these indices. Accordingly, for the FTSE Vietnam Index (referenced by the FTSE ETF), the FTSE Vietnam Index is expected to add FRT and FTS stocks and not remove any stocks. Values may be skewed due to data application date, free-float ratio, and investment weights.

The FTSE ETF will buy 637,000 new FRT stocks, increasing its weight to 1.64%, and purchase 1.9 million new FTS stocks, raising its weight to 1.14%. Many other stocks will also be bought additionally, such as 2.47 million VND stocks, 7.09 million VIC stocks, 2.9 million VNM stocks, and over 2 million stocks each of NVL and SHB.

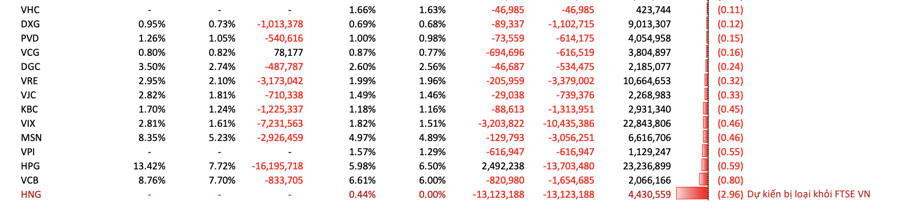

On the other hand, the fund will sell up to 16.2 million HPG stocks, offload 7.2 million VIX stocks, 3.1 million VRE stocks, 2.9 million MSN stocks, 1 million DXG stocks, and 1.25 million KBC stocks.

Regarding the MarketVector Vietnam Local Index (referenced by VanEck Vectors Vietnam ETF), the MarketVector Vietnam Local Index is expected to remove HNG and add NAB, FRT, and MBS, as they are in the top 85% of the accumulated free-float market cap of eligible stocks. Values may be skewed due to the data application date, free-float ratio, and investment weights.

Bitcoin Hype

Last week, the crypto community in Vietnam was buzzing with an event that some media channels and social networks called a “new era” for cryptocurrencies. Some fund managers predict that from here, Bitcoin will rise to $100,000, $150,000, or even $1.5 million per bitcoin as predicted by fund manager Cathie Wood. So what’s all the fuss about?