Last week (January 10, 2024), the U.S. Securities and Exchange Commission (SEC) approved trading on 11 bitcoin exchange-traded funds (ETFs). While bitcoin ETFs are already available in other markets, and there are already bitcoin ETFs in the U.S., the approval of bitcoin spot ETFs by the SEC is considered to be a “new era” for cryptocurrency (although the specific reasons for this are not clear).

What are bitcoin spot ETFs? And why did the SEC wait a decade to approve bitcoin spot ETFs?

Bloomberg has tried to explain it simply: “The new bitcoin ETFs, directly or through a third party, buy and hold enough tokens (bitcoin units) to support the number of shares they issue. The price of these shares will track as closely as possible the spot price of bitcoin, calculated using indices provided by companies such as CF Benchmarks. This allows investors to be exposed to cryptocurrencies without having to buy and store bitcoin themselves, either in a wallet or through an exchange. Issuers work with authorized participants (APs), such as market-making firms or large banks, to create and redeem shares in the ETF as market demand requires. Meanwhile, market makers stand ready to buy and sell ETF shares to keep the fund’s price as closely aligned as possible with the fluctuations in bitcoin.”

|

The introduction of bitcoin spot ETFs is not an acknowledgment or endorsement of bitcoin by the SEC, as some misleading information suggests. Instead, in his social media post and in the approval notice for the 11 bitcoin spot ETFs, Gary Gensler emphasized in many ways that the SEC granting approval for these ETFs does not mean they approve or support bitcoin. |

In essence, this is an investment tool for bitcoin for investors through stock exchanges. The SEC has denied approval for bitcoin ETFs for the past decade, citing various reasons related to lack of sustainability, unclear price movements, lack of corresponding market makers, etc. However, after recent lawsuits, one of which was filed by Grayscale against the SEC, the wind has changed. In August 2023, Grayscale won the appeal in its lawsuit against the SEC over the rejection of their bitcoin spot ETF proposal in 2022. The company then resubmitted the proposal to the SEC in October 2023.

An alliance of investment fund providers including Grayscale, BlackRock, and Fidelity, with the presence of Coinbase cryptocurrency exchange, created some reference prices and custodial services for bitcoin. The SEC didn’t have many reasons to reject the ETF applications because the alliance had found ways to meet the requirements. Essentially, the SEC was stuck. Even on the day of the ETF vote, the vote was tied 2-2, and SEC Chairman Gary Gensler, who is skeptical about bitcoin, had to vote in favor to break the deadlock among the commissioners.

This shows that the introduction of bitcoin spot ETFs is not an acknowledgment or endorsement of bitcoin by the SEC, as some misleading information suggests. Instead, in his social media post and in the approval notice for the 11 bitcoin spot ETFs, Gary Gensler emphasized in many ways that the SEC granting approval for these ETFs does not mean they approve or support bitcoin. A longtime finance professional in the U.S., who is a friend of the author, commented that there may now be people within the SEC who are starting to open monitoring files to find opportunities to delist bitcoin spot ETFs if possible. Note that the 3-2 vote is delicate and divided.

Some questions about bitcoin spot ETFs:

1. Is this the first bitcoin ETF? No.

Bitcoin ETFs have existed for several years, but they were bitcoin futures ETFs, not spot ETFs. They are also different from futures contracts on bitcoin exchanges like Binance (where leverage of 100x or more can be used), as they are regulated ETFs. This is the first time the SEC has allowed bitcoin spot ETFs.

|

The first bitcoin ETF was ProShares’ BITO, launched in 2021, which reached $2 billion in assets under management (AUM) before the SEC approved trading on 11 bitcoin spot ETFs on January 10. January 11 was the first trading day for the bitcoin spot ETFs.

In addition to bitcoin futures ETFs, there have been other indirect ways for retail and institutional investors to invest in bitcoin, such as Grayscale’s GBTC and MicroStrategy’s stock. Some still believe that MicroStrategy is a cheaper and more liquid investment vehicle for bitcoin, just like Bill Miller of Miller Value.

In other words, for those who want to invest in bitcoin, they have been able to directly or indirectly “hold” it, and there have been many options for the past decade.

2. So what are the advantages of bitcoin spot ETFs compared to existing products?

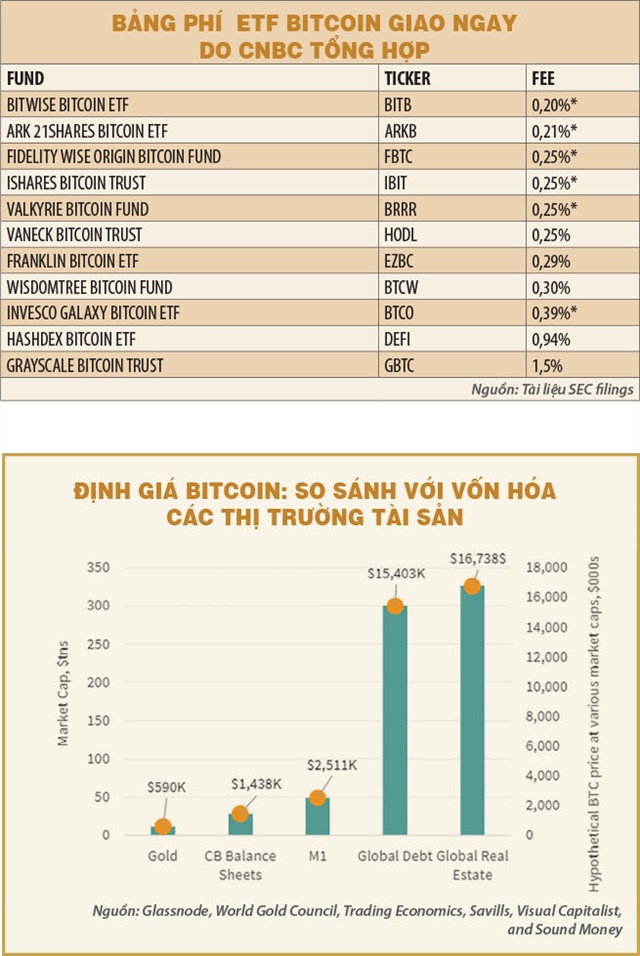

They have lower fees compared to some existing options like GBTC. Some bitcoin spot ETFs have fees below 0.3%, compared to the 2% fee (reduced to 1.5%) of GBTC. The 0.3% fee is still considered “expensive” compared to some stock ETFs with fees around 0.08%. With over $4.5 billion in trading volume on the first day, the assets managed by these ETFs are in the hundreds of millions. This means we are talking about multi-million dollar fees this year and possibly even higher in the following years, whether investors in bitcoin through ETFs make a profit or loss. It’s not hard to understand why Grayscale teamed up with other asset management companies to confront the SEC, as there is a significant amount of money involved.

The second advantage is that because ETFs or related parties have to directly buy and sell bitcoin, there will be a more direct inflow of money into the bitcoin market compared to the previous mechanisms of bitcoin futures ETFs. This means that people can participate in “pushing or depressing” the price of bitcoin more directly through their ETF trades.

|

Everyone has their own beliefs about bitcoin, just as they have beliefs in diamonds, luxury watches (which have seen large price drops in 2023), or gold (which has seen large price increases). But if you’re waiting for money from investment funds, be aware that investors have more options. They have ETF investment funds in vague concepts like space exploration, self-driving cars, AI-generated drugs, which promise high returns (which Cathie Wood’s ARK is also promoting). |

The most important thing: bitcoin spot ETFs open up marketing opportunities for retirement funds to buy bitcoin. Not every retirement plan provider allows it, for example, Vanguard still doesn’t allow customers to buy bitcoin spot ETFs with retirement accounts. But other providers like VanEck and Fidelity are more comfortable. This is no longer for “hardcore” fans, but it’s now possible to play with…retirement money.

3. So, will bitcoin go up in the future?

No one can say for sure, not even…fortune tellers. There are certain opportunities and risks. Opportunities for bitcoin: there are still many “games” this year, such as rumors about ETFs for Ethereum (ETH) tokens, the possibility of introducing derivatives for cryptocurrencies on mainstream U.S. derivatives exchanges, bitcoin halving (when the rate of new bitcoin issuance is halved), social media payments like Elon Musk’s X (of course, just rumors). Another expectation is that when U.S. dollar interest rates go down, cryptocurrency startups will emerge again and there will be new money flows. 2023 was a particularly difficult year for startups in general and cryptocurrency startups in particular. When times are tough, they tend to get better.

If all these favorable conditions occur, how high can bitcoin go? It depends on whom you believe. Thomas (Tom) Lee, Managing Partner and Head of Research at Fundstrat, believes bitcoin will rise to $150,000 per bitcoin in the next 12 months. Meanwhile, longtime bitcoin enthusiast Cathie Wood is still committed to long-term predictions of over $1 million per bitcoin. Her ARK fund has experienced significant outflows in 2022 and the first half of 2023, but it has rebounded strongly in the second half of 2023, drawing attention to her “high-risk, high-reward” predictions.

So, are there any milestones to watch out for? There have been some analyses comparing the market capitalization of bitcoin and gold (as some discussions suggest that bitcoin is “digital gold”). If bitcoin’s market capitalization is on par with the gold market, which is estimated to be over $11 trillion according to the World Gold Council, then Glassnode’s calculation of “on par” indicates a price of $590,000 per bitcoin. If you believe it’s only one-tenth of the gold market capitalization, then the price of bitcoin would be around $59,000 per bitcoin (not far from the current price). An article in CFA calculated that if the market value of bitcoin is on par with the global real estate market, then the price of bitcoin would be… $16 million per bitcoin.

Everyone has their own beliefs about bitcoin, just as they have beliefs in diamonds, luxury watches (which have seen large price drops in 2023), or gold (which has seen large price increases). But if you’re waiting for money from investment funds, be aware that investors have more options. They have ETF investment funds in vague concepts like space exploration, self-driving cars, AI-generated drugs, which promise high returns (which Cathie Wood’s ARK is also promoting).

When interest rates go low enough and people want to try something that offers higher returns and quick riches, bitcoin is one of the options, but not the only one. Betting on a few small-cap Chinese industrial stocks (which have declined by over 90%) is forecasted to potentially increase tenfold with just a few billion U.S. dollars in capital, much lower than what bitcoin currently requires.