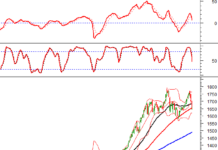

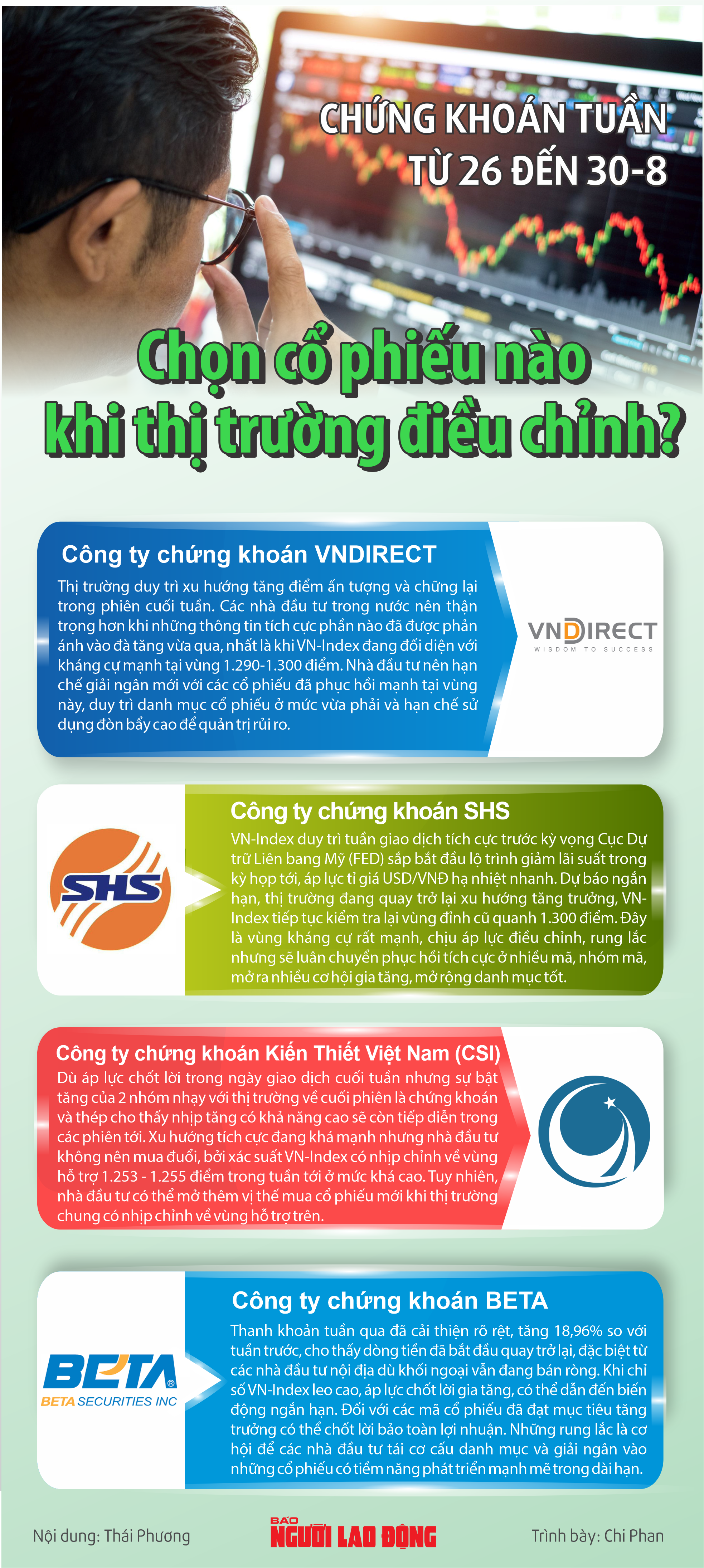

Vietnam’s stock market witnessed a vibrant trading week as the VN-Index sustained its robust growth trajectory following the explosive session last week (August 16).

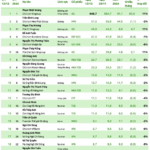

At the week’s close, the VN-Index climbed 2.6% to 1,285.3 points, while the HNX-Index and Upcom Index rose 2.1% and 1% to 240.1 and 94.4 points, respectively. VCB, BID, and CTG were the key stocks driving the market’s upward momentum.

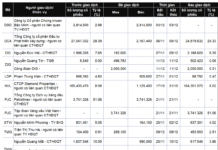

Weekly liquidity surged 19%, averaging VND 17,756 billion per session. Foreign investors net sold VND 963.9 billion across all three exchanges, but this did not dampen the overall market sentiment. Domestic funds are pouring in, despite the selling pressure from foreign investors.

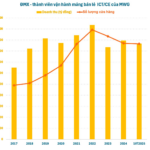

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.