Mrs. Dorsati Madani – World Bank’s Senior Country Economist

|

At the launch of the World Bank’s report, “August 2024 Review: Reaching New Heights in the Capital Market”, on the morning of August 26, 2024, Mrs. Dorsati Madani, World Bank’s Senior Country Economist, answered investors’ questions. She shared that the government’s policies are gradually reducing support measures. Firstly, tax exemption and reduction policies, such as lowering the VAT tax rate and providing tax breaks for businesses, have improved liquidity for production and business operations. Secondly, there has been a 1.8% of GDP increase in public investment, with efforts to introduce more public investment projects to support aggregate demand, economic activities, and employment.

“The World Bank observes that the government is returning to previous tax rates and that this year’s public investment does not include the large-scale packages of 2023 but rather a regular budget. This means that fiscal policy will be tightened for this year and the next, and the supportive policies of the past years will be scaled back. However, this does not imply a significant impact on the economy.” Mrs. Madani added.

She further projected, “The economy is anticipated to grow by 6.5% next year, and with the economy performing well, there is no necessity to loosen the fiscal stance as it may create more issues. A more prudent fiscal policy is preferable, and unless there are further economic shocks, there shouldn’t be pressure on monetary policy either.“

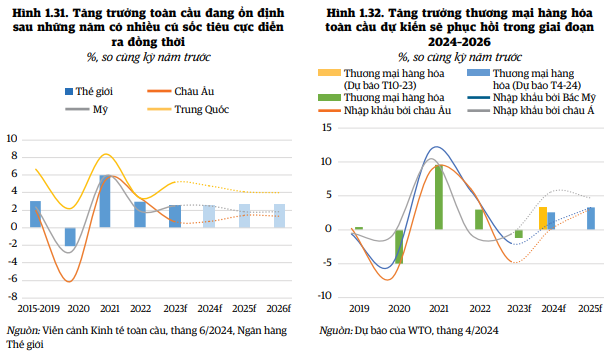

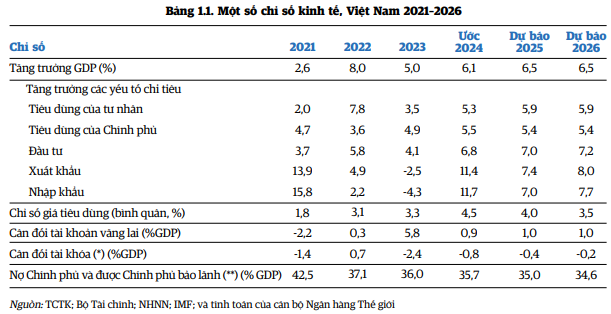

Positive Outlook for Vietnam’s Economic Growth

According to the World Bank report, Vietnam’s economy is projected to grow by 6.1% in 2024 and accelerate to 6.5% in 2025-2026. This forecast is based on the assumption that the growth in exports of manufactured goods will slow down in the second half of 2024, following a recovery of 16.9% (year-on-year) in the first half of 2024, and a predicted global demand slowdown in 2024, particularly in the US, Vietnam’s largest export market. Export growth is expected to pick up slightly in 2025-2026 as global trade prospects and external demand from major trading partners, such as the US, the Eurozone, and China, improve.

The real estate market is showing signs of recovery and is expected to turn around by the end of 2024 and early 2025, following the resolution of the corporate bond market freeze and the implementation of the new Land Law in August 2024. With continued export growth and a recovering real estate sector, domestic demand is projected to increase in the second half of 2024 as investor and consumer confidence improves. Comparatively, total investment and private consumption growth are expected to reach 5.8% and 5.6%, respectively, in 2024.

Inflation, according to the World Bank, is expected to continue rising in 2024, reaching 4.5% from 3.2% in the previous year, driven by persistently high food prices. This forecast reflects the recent surge in food prices, which contributed the most to new inflation in the first half of 2024, and the situation is expected to worsen due to the outbreak of African Swine Fever across the country, despite enhanced prevention measures. While conflicts in Ukraine and the Middle East persist, inflation in oil and commodity prices is projected to ease in 2024. The public sector salary increase and pension adjustments in July 2024 are expected to have a minor impact on inflation due to the small size of the public sector workforce relative to total employment (approximately 2 million public servants and employees, equivalent to 3.8% of total employment).

In the medium term, inflation is forecast to return to its historical average of around 3.5% in the following year. The current account balance is predicted to remain in surplus in 2024, mainly due to the merchandise trade surplus. The balance of payments is expected to show a small surplus in 2025-2026, supported by continued growth in merchandise exports and contributions from transportation and tourism services. Foreign direct investment (FDI) inflows are projected to remain stable in the short and medium term as foreign investors maintain their interest in Vietnam.

As the economy returns to its high-growth trajectory, the government is expected to refocus on fiscal consolidation. The budget deficit is projected to narrow to 0.8% of GDP in 2024 and further decrease to 0.5% and 0.1% of GDP in 2025 and 2026, respectively, as the government aims to strengthen fiscal consolidation through expenditure and tax revenue measures in 2024. In the next two years, recurrent spending will continue to be aligned with the ongoing five-year financial plan. Improved domestic revenue collection, along with a broader tax base and amendments to major tax laws (VAT and CIT), as well as enhanced tax administration, are expected to support fiscal consolidation.

Balanced Outlook: Opportunities and Risks

The positive outlook is subject to both external and internal risks. Given Vietnam’s high level of economic openness, the main source of uncertainty stems from lower-than-expected global growth, particularly in major trading partners such as the US, the European Union, and China. These developments could impact exports of manufactured goods and industrial production, as Vietnam’s growth model relies heavily on exports. Escalating geopolitical tensions may further affect export performance.

On the domestic front, a weakening of macroeconomic stability and a decline in consumer confidence could affect consumption and investment. The real estate market recovery may take longer than expected, adversely impacting private sector investment, a crucial contributor to economic growth. If asset quality in the financial sector continues to deteriorate, banks’ lending capacity may be impaired. As a country highly vulnerable to climate change, the increased intensity of natural disasters could elevate risks to the economy. Energy supply shortages may hinder the growth of exports of manufactured goods, as Vietnam remains susceptible to heatwaves affecting hydropower plants in the northern region, although the completion of the 500 KV transmission line across the country by the end of 2024 could mitigate this risk.

The outlook may also benefit from more positive developments. Higher-than-expected global economic growth could boost Vietnam’s export recovery sustainably. More accommodative monetary policies in major developed economies, initiated by the European Central Bank and the Bank of England, coupled with signals from the US Federal Reserve regarding a possible interest rate cut in September, could further stimulate aggregate demand in advanced economies and boost Vietnam’s exports. This may also contribute to lowering financial sector borrowing costs globally and narrowing the interest rate differential between the VND and the USD, positively impacting Vietnam’s banking and financial sector.

Supporting Policies for Growth

As the economy has not yet returned to its pre-pandemic growth trajectory, accelerating public investment disbursement could support aggregate demand in the short term and help address emerging infrastructure gaps. Even a 1% increase in public investment relative to GDP could result in a 0.1% increase in GDP. On the other hand, Vietnam continues to face limitations in its ability to further cut interest rates due to the large interest rate differential between the domestic and international markets, along with exchange rate pressures.

Building on past reforms, it remains crucial to take further steps to mitigate vulnerabilities and risks in the banking sector. The authorities could encourage banks to improve their capital adequacy ratios and strengthen the institutional framework for safety supervision (including early detection and handling of issues arising from interconnectedness between banks and corporate groups) and early intervention (early problem identification and crisis prevention). While the Law on Credit Institutions has been strengthened through recent amendments, there are still gaps, including consolidated supervision of conglomerates, especially those with links to the real estate sector. Other areas for improvement include the resolution of weak banks and crisis management, as well as legal protection for supervisors.

Propose adding a bad scenario script to “shock” the economy

In addition to the positive economic growth scenarios for 2024, Vietnam needs to prepare for negative scenarios to enhance its ability to cope with unexpected shocks.